Version 8 – 1 November 2024

We can confirm that we are an Independent Financial Advice provider and have no conflicts or other relationships that may impact our Independence in providing financial advice services to you.

This FSG will help you decide whether to use the services that we offer. It contains information about:

We are authorised to provide general advice, personal advice and

dealing services in the following areas:

When you become a client of Allied Wealth, we act on your behalf.

The objectives and personal circumstances of each client are different. Where we provide personal advice, we will seek to understand your objectives and circumstances for our advice to be in your best interests.

Our initial advice on suitable financial strategies will be provided in the form of a written Statement of Advice (“SoA”) which you can take away and read. The SoA will explain the basis of our advice, the main risks associated with the advice and the cost to you of implementing the advice.

This part of the FSG – about MDA Services – is prepared pursuant to ASIC Corporations (Managed Discretionary Account Services) Instrument 2016/968.

The above outsourcers provide a custodial service and are regulated by ASIC. As an MDA provider we do not provide custodial or depository services related to the MDA services, in accordance with RG179.166(a).

Fees and other costs

The following table shows fees and other costs that you may be charged. These fees and costs may be deducted from your money, from the returns on your investment or from the assets held within the MDA service agreement. You should read all the information about fees and costs because it is important to understand their impact on your investment.

In relation to your portfolio we manage for you we advise the following fees and costs will be incurred in the normal course of business

| Type of fee or cost | Amount | How and when paid |

| Fees when your money moves in or out of the portfolio | $0 | Not applicable |

| Establishment fee The fee to open your portfolio | $0 | Not applicable |

| Contribution fee The fee amount contributed to your portfolio | $0 | Not applicable |

| Withdrawal fee The fee amount you take out of your portfolio | $0 | Not applicable |

| Exit fee The fee to close your portfolio | $0 | Not applicable |

| Management costs | ||

| The fees and costs for managing your portfolio by Allied Wealth | $0 | Not applicable |

| Additional fees and costs for managing the investments in the MDA portion of your portfolio (if applicable) | Assets Under Management rate 0% | Not applicable |

| Admin fees to Platforms for MDA portion on a sliding scale (if applicable) | $0 - $250,000 0.36% - 0.32% Plus $250,001-$500,000 0.20% - 0.22% Plus $500,001-$1,000,000 0.10% - 0.12% Plus $1,000,001-$2,500,000 0.04% - 0.05% Plus $2,500,001 and over 0.00% | The fees are deducted from your platform account. |

In relation to your portfolio we manage for you we advise the following fees and costs will be incurred in the normal course of business

| Type of fee or cost | Amount | How and when paid |

| Account keeping fee to Platforms | $180-$360 per account per annum | |

| Service fees | ||

| Switching fee The fee for changing portfolio options | $0 | Not applicable |

| Extra services you request maybe be at a time cost | $500 + GST per hour | Paid when service requested |

The advice preparation fee includes meeting with you, the time we take to determine our advice and the production of the SoA. It is based on the scope and complexity of advice provided to you. We will agree the fee with you before providing you with advice.

If you decide to proceed with our advice, we may charge an implementation fee for the time we spend assisting you with implementation. We will let you know what the fee will be in the SoA.

Our annual fees depend on the services that we provide to you. We will charge a flat fee for service which is generally paid monthly and agreed with you on an annual basis.

In limited circumstances, we may provide one- off services and charge a fee at an hourly rate. This will be discussed with you prior to engagement.

In some circumstances we may provide services to you as a wholesale client. We will seek your consent before providing services to you as a wholesale client.

We avoid conflicts of interest including the receipt of commissions. Where we receive commissions, we will rebate this to you within a period of not more than 90 days. We do not retain any commissions.

We act only for you as our client and not for any product issuer or financial institution. We have no financial relationship with any product issuer or financial institution.

At all times you are able to contact us and ask questions about our advice and the products we recommend. You can provide instructions to us in writing, via phone or via email. In some cases, we may require you to provide signed instructions.

Where we receive or pass on a referral to another professional we note that there are no referral fees or any other sort of payment made. As noted above we act only for you.

We endeavor to provide you with the best advice and service at all times. If you are not satisfied with our services, then we encourage you to contact us. Please call us or put your complaint in writing to our office.

If you are not satisfied with our response, you can refer it to the Australian Financial Complaints Authority. You can contact AFCA on 1800 931 678 or via their website www.afca.org.au. This service is provided to you free of charge.

We believe we have put in place compensation arrangements (via maintenance of professional indemnity insurance and adequate financial provision for any policy excess) that are adequate having regard to the size, nature and complexity of our business.

We believe that these arrangements are sufficient for the purpose of meeting our compliance obligations under section 912B of the Corporations Act.

We are committed to protecting your privacy.

We have a Privacy Policy which sets out how we collect, hold, use and disclose your personal information. It also sets out how you can access the information we hold about you, how to have it corrected and how to complain where you are not satisfied with how we have handled your personal information.

Our Privacy Policy is available on request and on our website.

As we begin 2024, we want you to know what a privilege it is to serve as your advisor. Hopefully each quarterly newsletter gives you some insights into our thinking and its evolution as we are confronted with new information and ideas in an ever-changing financial landscape. As always, we strive to maintain a balanced approach with awareness of both upside return and downside risks.

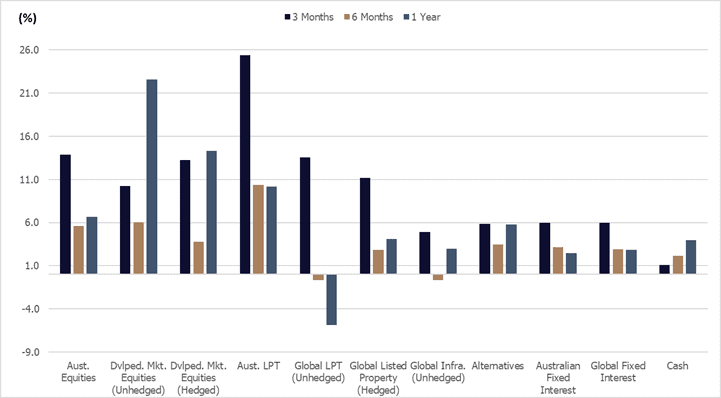

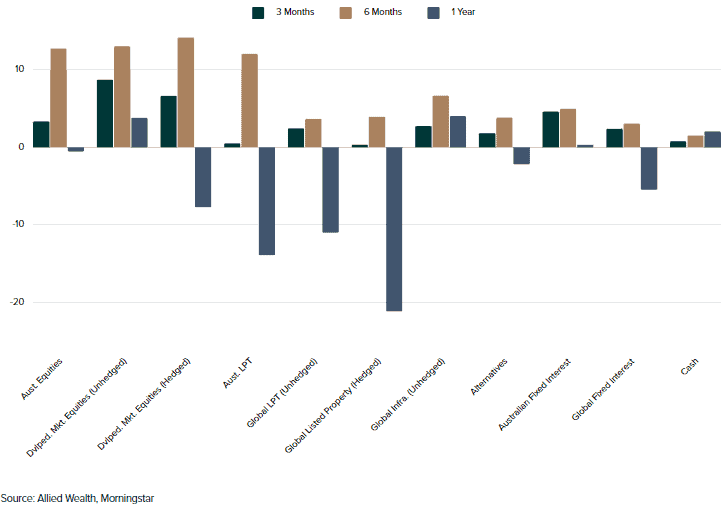

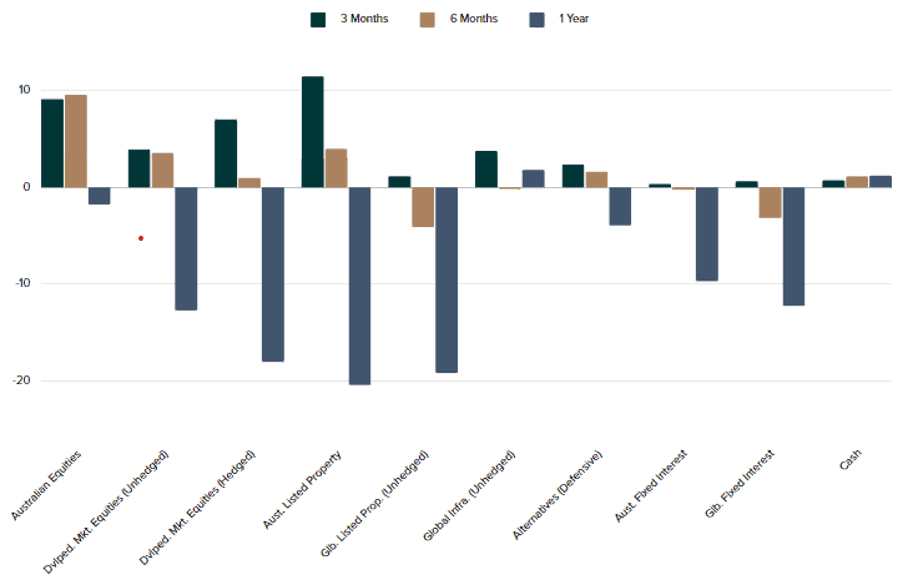

Asset class volatility has continued into 2024, with large return variations observed quarter-on-quarter. Indeed, we have seen correlated asset class performance over 2023 and we think this behaviour will likely continue over the short term. Over the 3-months to January 2024 all asset classes printed positive, driven primarily by market expectations of policy rate cuts over the first half of 2024.

Source: Allied Wealth, Morningstar.

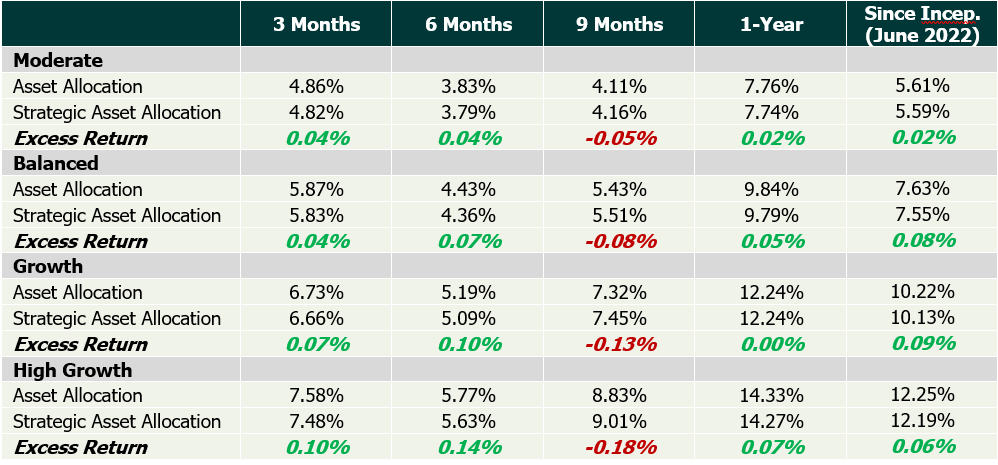

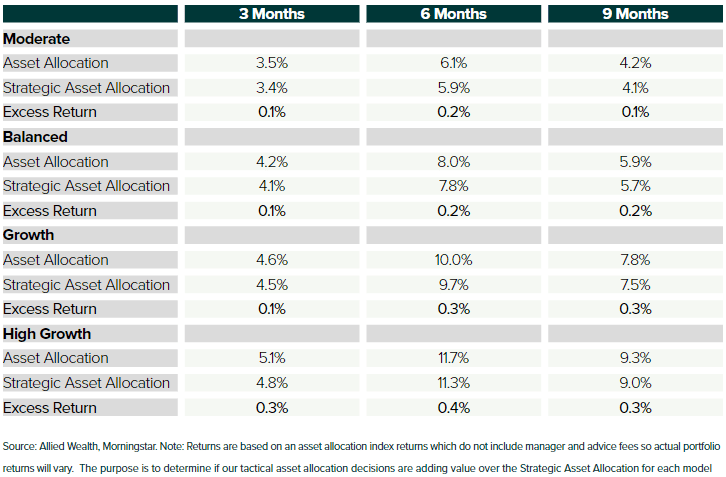

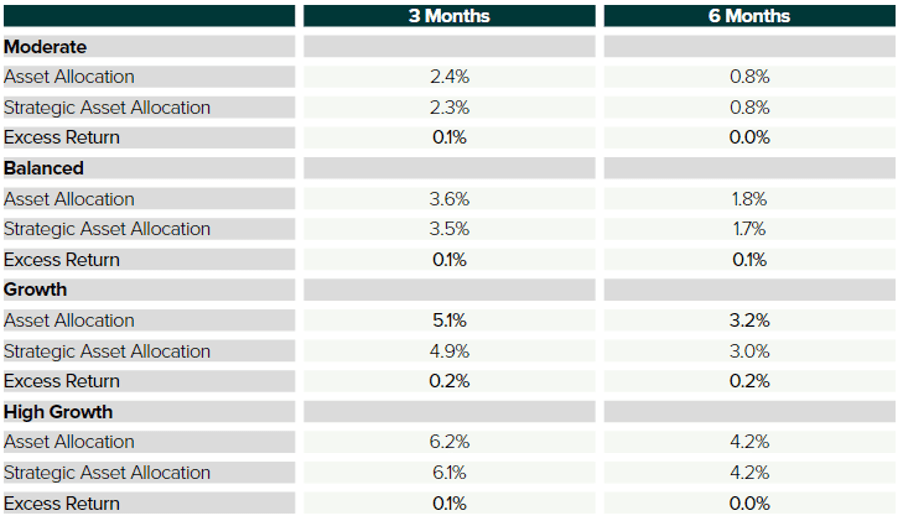

Coming into Q4 2023, we implemented an overweight allocation in hedged international equities relative to the unhedged position. This decision contributed to performance as the Australian Dollar strengthened over the period. Over the quarter, portfolios have maintained a marginal defensive bias expressed as an underweight in growth assets in favour of defensive assets – this position has marginally detracted from relative performance over the quarter. The combined asset allocation decisions are net positive and additive to long-term portfolio returns. While we are pleased with the results, we would emphasize that the asset allocations decisions have been made both from the perspective of risk mitigation as well as alpha generation.

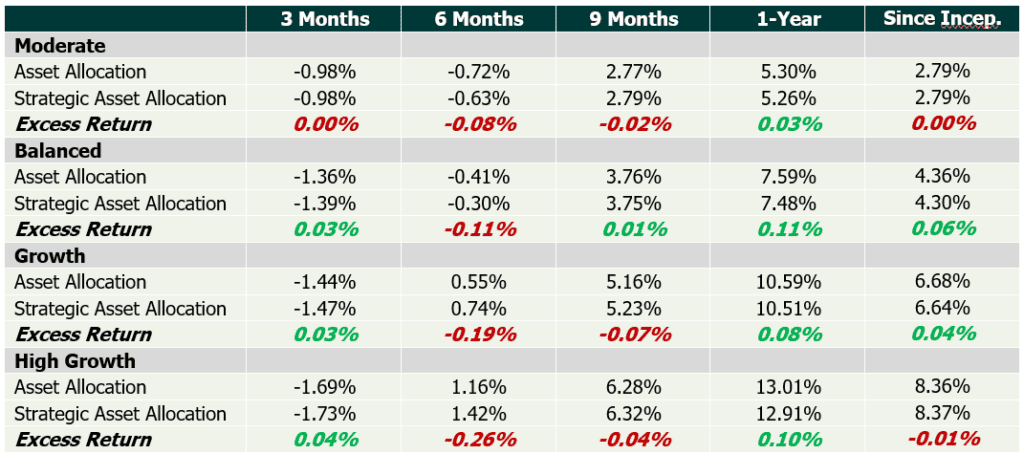

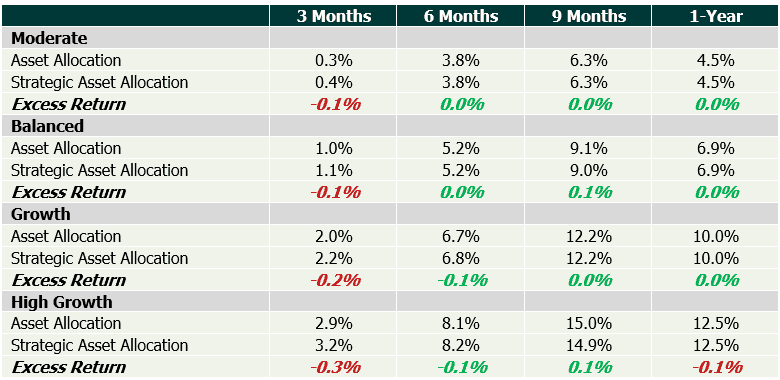

Source: Allied Wealth, Morningstar. Note: Returns are based on an asset allocation index returns which do not include manager and advice fees so actual portfolio returns will vary. The purpose is to determine if our tactical asset allocation decisions are adding value over the Strategic Asset Allocation for each model.

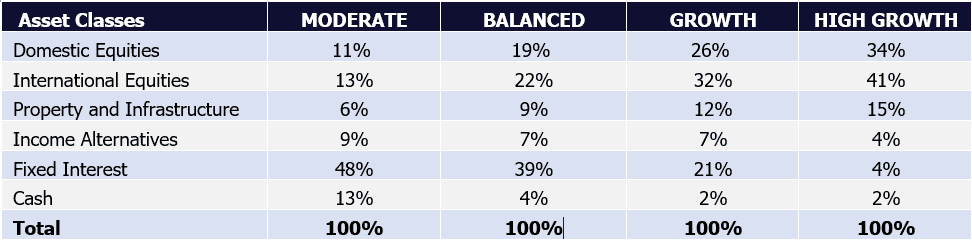

Strategic Asset Allocation Review

In Q4 2023, we conducted a Strategic Asset Allocation (SAA) review of client portfolios across the risk spectrum – Moderate, Balanced, Growth and High Growth. Review includes an assessment of our current Capital Market Assumptions and long-term implications for the baseline SAA.

Our analysis of asset class returns and risks suggests that while there are short-to-medium term market considerations of note, the relative attractiveness of asset classes have not changed over the long-term (20-years forward). Structurally, we see a rise in income yields across asset classes, more so in bonds and credit compared to equities. The attractive level of income has resulted in an increased allocation to Income Alternatives across Moderate, Balanced and Growth portfolios.

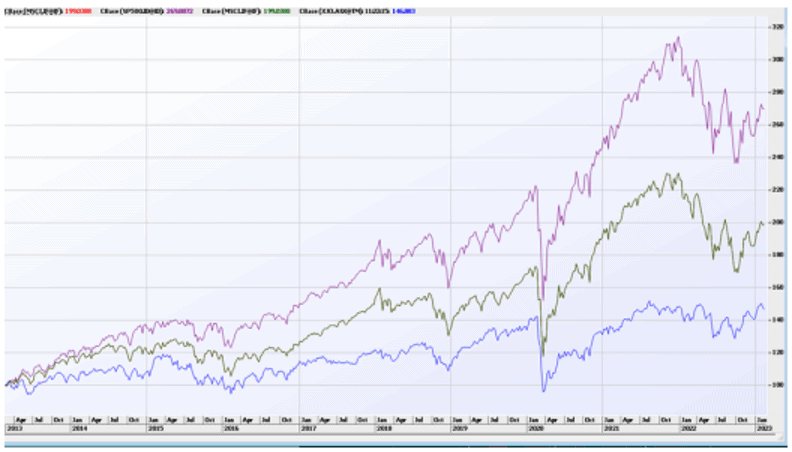

One of the key themes discussed at the Investment Committee was narrow market representation. Looking through the market indices we note that positive performance in international equities was primarily driven by strong performance in a small number of large-cap tech stocks (Microsoft, Google, Nvdia, Meta, Apple and Amazon). While there is an argument to be made that large-cap tech is overvalued, we have seen positive earnings growth which continues to support the lofty valuations. However, we note in most cases (exception being Nvidia) a material contribution to earnings growth have been job cuts in the second half of 2023.

The AI boom remains the gift that keeps on giving. Despite record number of lay-offs in the tech sector, companies continue to invest in AI and data processing which has led to strong demand for both software and hardware. This trend has also percolated across property and infrastructure. We have seen substantial investments in data centres and energy infrastructure, supported by new equity and debt raisings. Investors continue to be extremely bullish on these themes coming into 2024.

We believe that central banks globally are mostly at the tail-end of their hiking cycle. Tight monetary policy has led to softening of economic conditions and moderation in inflationary pressures. Inflation remains on the higher end of the target range at around 3%, and we expect this to continue over the first half of 2024.

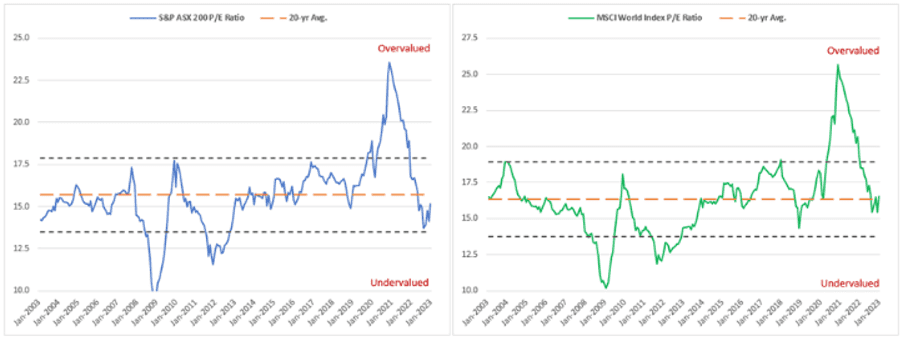

Investor sentiment remains too bullish for our liking. At this point, equity market valuations are expensive but as history indicates, expensive valuations may persist over long-periods of time. Our analysis suggests that equity valuations today include an expectation that interest rate will fall in H1 2024 followed by earnings growth coming into H2 2024. This thesis at current valuation does not leave much room for error and thus we have remained cautious.

Geopolitical conflict continues to be an ongoing theme. With the US presidential elections in November 2024, primaries have already commenced. Polling and voting to date suggest the upcoming election will be a Trump vs Biden showdown. Irrespective of which candidate wins, we expect further escalation of trade conflict between US and China.

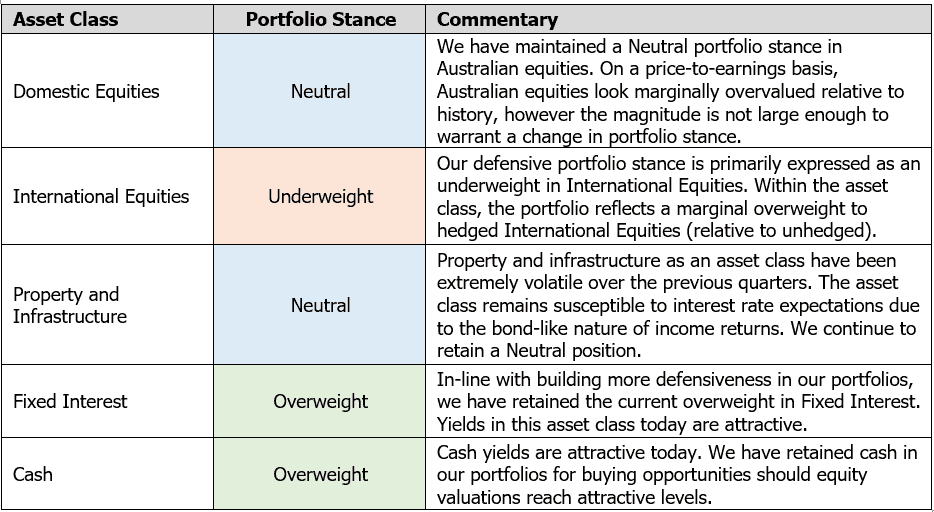

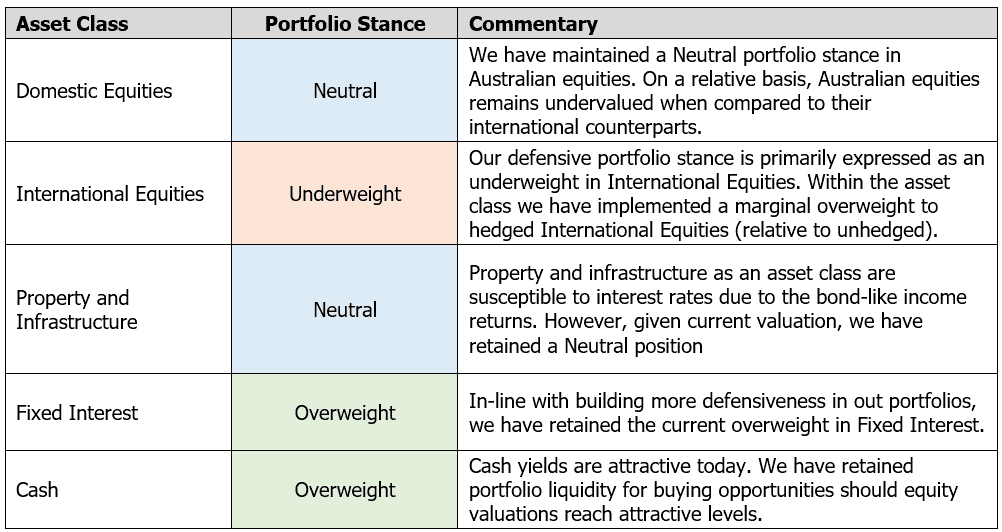

Following the investment committee discussion, members agreed to retain the current asset allocation stance which reflects 1) a marginally defensive stance overweight cash and fixed interest in favour of an underweight in international equities and 2) within international equities, an overweight in hedged international equities relative to unhedged. Despite the appreciation of the Australian Dollar (relative to US Dollar and Euros), current valuations still look cheap relative to history.

In-line with the outlook, the Investment Committee decided to maintain our marginal underweight in growth assets in favour of an overweight to defensive assets; and an overweight to hedged international equities relative to unhedged. Given the current market environment we have thought it appropriate to maintain the cautious stance but will look to reassess our position should it be warranted.

Thank you once again for your continued trust and confidence. We wish you a fruitful and prosperous 2024.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Equity markets rallied over the first half of 2023 but lost steam coming into September and October. Over the 3-months to October, all asset class performance was negative except for Alternatives and Cash. While recent market movements have vindicated the defensive positioning taken in Q2 2023, we remain cautious on both the upside and downside going forward.

Markets have remained volatile over the year and the last few weeks of quarter four have not been an exception. For us this highlights the level of disagreement embedded in the investment views held by both institutional and retail investors.

Source: Allied Wealth, Morningstar.

Please note that asset allocation performance calculations have been conducted as of September 2023.

Portfolios currently maintain a marginally defensive asset allocation stance. As was discussed in the last newsletter, the decision reflects a focus on risk management rather than profit maximisation. This position has proven prescient as growth assets have underperformed defensive assets over the quarter.

Source: Allied Wealth, Morningstar. Note: Returns are based on an asset allocation index returns which do not include manager and advice fees so actual portfolio returns will vary. The purpose is to determine if our tactical asset allocation decisions are adding value over the Strategic Asset Allocation for each model.

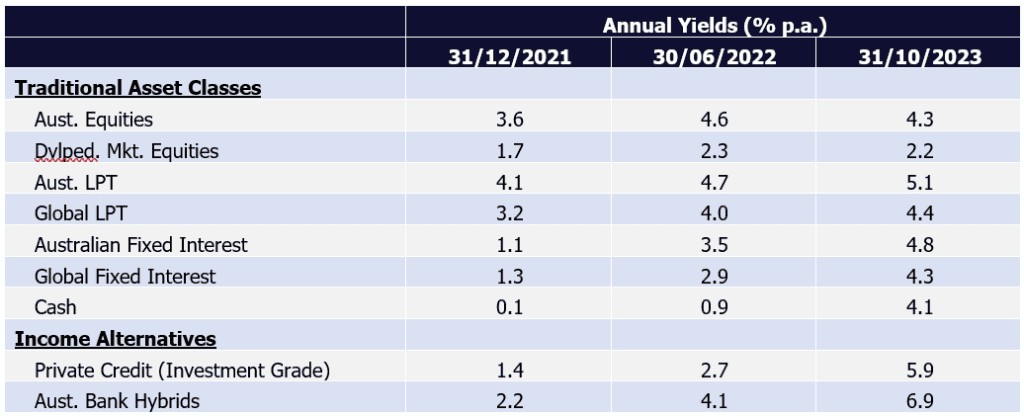

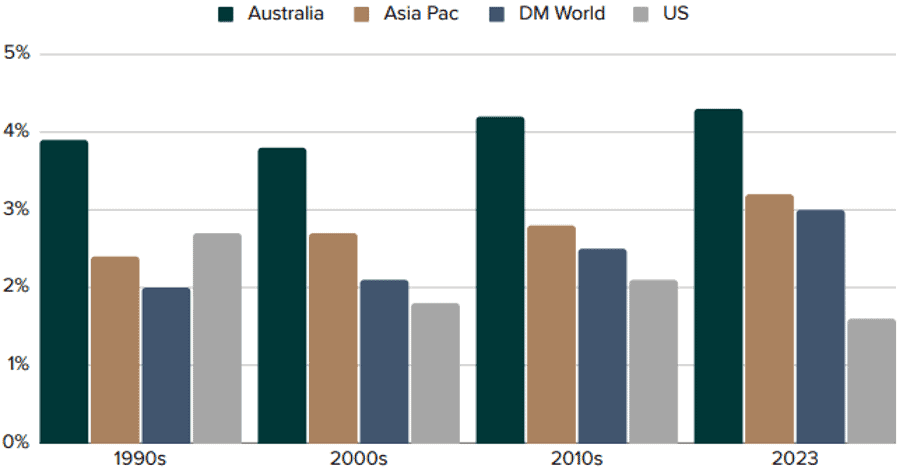

Structural Market Changes – The Returns of Income

Over the past year, rising interest rates have meant a higher income return across defensive asset classes as well as select Alternative asset classes. Where equities have (over the last 10 years) provided a higher income yield compared to bonds, the recent hiking cycle has seen income levels across multiple asset classes rise materially.

Notes:

Dividend yields have been used for equities; yield-to-maturity for bonds

For private credit and Aust. bank hybrids yield have been calculated as a spread plus cash

Comparing yields at the end of October 2023 to December 2021, we see a material increase in yields across Fixed Interest, Cash and Income Alternatives. In some cases, yields exceed dividend yields for equities. Another important point to note is that these asset classes also exhibit lower volatility of capital relative to equities which makes for an attractive investment proposition particularly for investors with lower risk tolerance. As an investment committee, we have begun discussing the implication for client portfolio and expect this to be an important consideration in the upcoming Strategic Asset Allocation review.

Investment Outlook & Strategy Implications

We continue to maintain a cautious asset allocation stance. We see a combination of growth headwinds in the medium-to-near term. The impact of higher interest rates is working through the economy, and we have seen signs of corporate earnings under pressure. Consumers have started to feel the pinch and have adjusted their spending accordingly.

Geopolitical conflict has been a theme well covered in all our publications as well as internal discussions. The escalation of conflict in the middle east represents a grave humanitarian crisis with implications for oil prices. However, the impact of the conflict on global GDP currently remains minimal. It remains too early to tell the secondary or third-order effects and we continue to monitor the situation as it develops.

Market movements across equities and bonds suggest market participants remain glued to central bank commentary. While any indication of a “pause” in policy rates is cheered on by investors and may lead to a short-term equity rally, we believe fundamentals are likely to deteriorate further before improving. Despite falling equity prices in the recent months, we continue to view the asset class as overvalued especially when earnings momentum and economic fundamentals are considered. Based on our current assessment, we would like to see a further 5% to 10% fall in prices before adding back to underweight positions.

Within international equities, we have made some minor allocation changes resulting in a marginal overweight to hedged international equities (relative to unhedged). Over the preceding quarters we have seen the Australian dollar materially weaken relative to the US dollar and Euros. Based on our analysis, the Australian dollar currently trades cheaply when compared to other development market currencies. Our experience with FX suggests that while mean reversion is likely, this can happen over an extended period. Current valuation provides a good entry point, and we expect to hold on to this position over the medium term.

Bottom-up market observations

Reporting Season Scorecard

The last four years have been very eventful for bank shareholders, with each year bringing a new set of worries predicted to bring the banks to their knees. 2020 saw an emergency capital raising from NAB (some of which was used to pay the dividend) and Westpac missing their first dividend since the banking crisis of 1893, as experts forecasted 30% declines in house prices and 12% unemployment! Then, 2021 saw the banks grappling with zero interest rates and APRA warning management teams about the systems issues they may face from zero or negative market interest rates expected to come in 2022. In 2022 and 2023, the concerns have switched to the impact of a 4.25% rise in the cash rate on bad debts and the looming fixed interest rate cliff that would see retail sales and house prices plummet.

In this Allied Wealth quarterly, we will look at the themes in approximately 900 pages of financial results released over the past ten days by the financial intermediaries that grease the wheels of Australian capitalism.

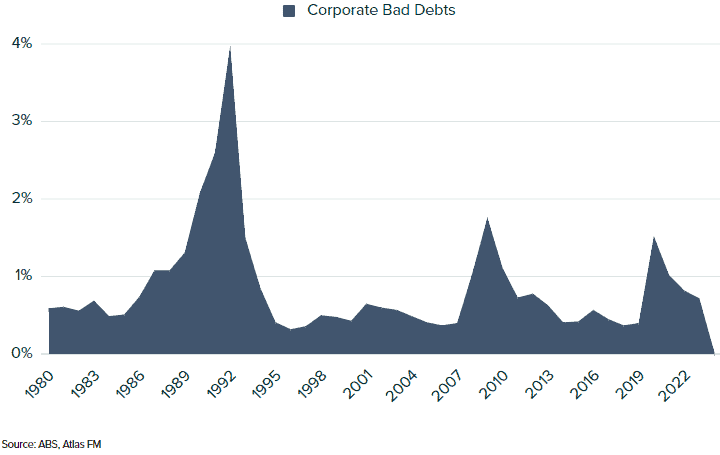

Low Bad Debts

From May 2022, Australia's official cash rate climbed from 0.10% to 4.35% across 13 different rate hikes. Every time we had a cash rate increase, the first question was how it would impact consumers and whether bad debts would rise sharply and house prices would collapse. What we have seen over the last year is that employment in Australia has remained remarkably robust in a tight labour marketplace. This has seen consumers being able to reallocate funds from discretionary or non-necessity spending to being able to fund their home loans. Additionally, we have seen a substantial increase in offset account balances that have risen rather than fallen, with $5 billion being added since March 2023.

Bad debts remained low in 2023, with all banks reporting negligible loan losses; ANZ and Macquarie reported the lowest level, with loan losses of 0.01%. To put this in context, since the implosion in 1991 where, banks grappled with interest rates of 18% and considerable losses to colourful entrepreneurs such as Bond, Skase et al. Since then, loan losses have averaged around 0.3% of outstanding loans, and the banks price loans assuming losses of this magnitude.

The level of loan losses is important for investors as high loan losses reduce profits and, thus, dividends and erode a bank's capital base. Conversely, the very low losses in 2023 have translated into record dividends and billion-dollar share buybacks.

Show Me The Money

While the big Australian banks are sometimes viewed as boring compared with the biotech or IT themes du jour, what is exciting is their ability to deliver profits in a range of market conditions. In 2023, the banks generated $32.7 billion in net profits after tax. This saw dividends per share increase by an average of 15% per share, with all banks except for NAB now paying out higher dividends than they did pre-Covid 19. The star among the banks was ANZ, which raised dividends per share by 19%!

Well Capitalised

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA) has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks. In 2008, US taxpayers were forced to support Citigroup, Goldman Sachs and Bank of America, and British taxpayers dipping into their pockets to stop RBS, Northern Rock and Lloyds Bank going under. The Australian banks were better placed in 2008 and did not require explicit injections of government funds; the optics of bankers in three-thousand-dollar Armani suits asking for taxpayer assistance is not good.

In 2023, the Australian banks are all very well capitalised and have seen their capital build. This allows the banks to return capital to shareholders in the form of on-market buybacks. During the bank reporting season, Macquarie announced a $2 billion dollar on-market buyback, Westpac announced a $1.5 billion share buyback, CBA announced a $1 billion share buyback, and NAB announced they had a remaining $1.2 billion share buyback. For investors, this not only supports the share price in coming months but reduces the amount of shares outstanding to divide next year's profits by!

Our View

Overall, we are happy with the financial results in November from the banks owned by the Concentrated Australian Equity Portfolio. The three main overweight positions, Commonwealth Bank, ANZ and Westpac, all increased their dividends, which is a crucial signal indicating improving prospects and board confidence in the outlook. All banks showed solid net interest margins, low bad debts and good cost control. Profit growth is likely to be tough to find on the ASX over the next few years, with earnings for resources and consumer discretionary likely to retreat; however, Australia's major banks look to be placed in a good position in current turbulent markets.

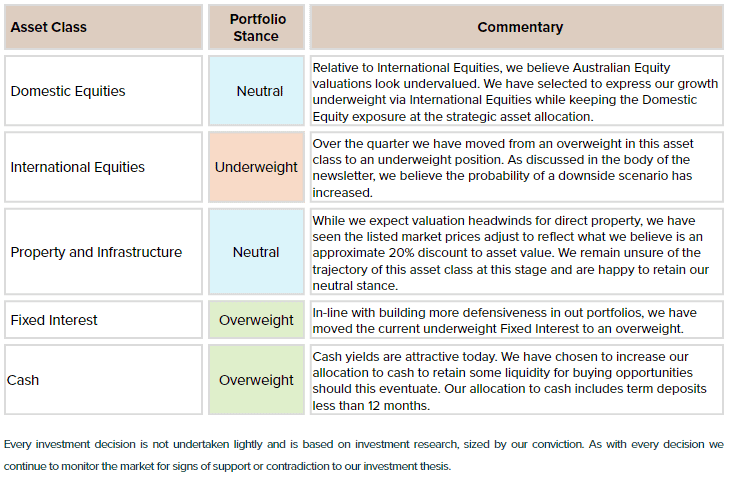

Every investment decision is not undertaken lightly and is based on investment research, sized by our conviction. In-line with the outlook, the Investment Committee has decided to maintain our underweight in growth assets in favour of an overweight to defensive assets. Apart from a marginal overweight in hedged international equities within the asset class, no other allocation changes have been made.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our independent financial advice services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Key Themes

During February and August every year, most Australian listed companies reveal their profit results, and most guide how they expect their businesses to perform in the upcoming year. Whilst we regularly meet with companies between reporting periods to gauge how their businesses are performing, companies open up their books during reporting season to allow investors a detailed look at the company's financials. As company management has been on "blackout" (and prevented from speaking with investors) since mid-June, share prices in the six weeks leading up to the result are often influenced by rumours, theories, and macroeconomic fears rather than actual financials.

The August 2023 company reporting period that concluded last week displayed stronger-than-expected results in a higher inflationary and interest rate environment. The dominant themes of the August reporting season have been higher interest repayments, higher input costs and a weaker Australian dollar. Many companies were able to weather these headwinds and deliver some strong results, and others got caught in the headwinds. In this week's piece, we look at the key themes from the reporting season that finished last week, along with the best and worst results and the corporate result of the season.

Better than expected

Going into the August reporting season, the market expected the profits to fall sharply due to the combination of cost inflation, higher interest costs and slowing retail sales from domestic consumers under pressure from higher mortgage rates. However, the reporting season showed that many companies were able to manage the current economic environment better than expected, with earnings beating expectations outnumbering companies missing expectations by a ratio of 5:3. Looking through the ASX companies that exceeded expectations were in the telco, IT, consumer discretionary and financial sectors. Conversely, disappointments were clustered in the consumer staples and healthcare sectors.

Higher interest rates - Good and bad

One of the main themes over this reporting season was how each company would be able to handle a rising interest rate environment. Since 2008, companies globally have enjoyed declining interest rates, which have seen the interest cost line on the Profit and Loss statement decline, thus boosting earnings. However, since April 2022, the cash rate has increased from 0.1% to 4.1%. August 2023 was going to be the first reporting season, with sharp increases in financing costs taking a bite out of company profits.

Aurizon (nee Queensland Rail), Australia's largest rail freight operator, underwent a large acquisition last year, adding close to $2 billion in additional debt. When combined with an increase in interest rates, the rail company saw its interest expense explode by 84%, dragging earnings down. Similarly, we have seen financing costs increase for the more highly geared listed property trusts such as Charter Hall Long WALE REIT, which saw financing costs increase by 56%. Retailer Harvey Norman is another company that has seen a large increase in financing costs of 76% due to having to take on more debt to fund more capital expenditures.

Conversely, the insurers all reported strong earnings results courtesy of finally earning an income return above zero on their "insurance float". In addition to profits made via underwriting insurance, insurance companies receive premiums upfront and pay claims later, which gives the company a cost-free pool of money that can generate investment profits for the benefit of shareholders. This pool constantly has inflows from premiums and outflows from claims, but the aggregate amount tends to remain constant. For the last several years, with rates close to 0%, insurers were earning close to nothing for their multi-billion-dollar investment floats. However, with rising interest rates, QBE Insurance earned US$662 million on its US$27 billion float in the first half of 2023. Conversely, the company made only US$382 million in all of 2021.

Input cost inflation

Over the past year, wages have risen across many sectors in Australia due to a combination of maintaining real wages in the face of higher inflation and a tight labour market with unemployment the lowest since the early 1970s. In August, cost inflation was seen very clearly in the profit results of the big miners. BHP reported higher production costs for FY2023 with diesel, explosives, machinery, and labour increasing costs by 10% over the year and expects higher costs to remain in FY2024.

Retailers Coles and Woolworths both saw higher costs of doing business in FY2023 due to higher minimum wage awards and cost inflation. Additionally, Coles lost $60 million in "shrinkage" (theft) during the second half, which alarmed investors and saw the company's share price fall. To combat this, Coles plans to add additional personnel in 2024 to watch self-checkouts, which will add to the cost of doing business.

Building products company Boral noted that input materials inflation surged over the past year, with higher transport, energy and labour costs. Despite these input cost increases, Boral increased profits by passing these on to customers, increasing the price of concrete and cement by 12 and 8 per cent, respectively.

Inflation is negative for consumers as it erodes their purchasing power, but it benefits those with existing assets with revenues linked to inflation. The best examples of companies with this characteristic are the toll road operators Transurban and Atlas Arteria, which saw strong increases in revenue from both inflation-linked tolls and higher traffic volumes. Their largest cost of interest repayments barely increased as these companies fixed their interest costs during periods of low-interest rates for a long duration.

Weaker Australian dollar

While the falling Australian dollar is a negative for Australians looking for a winter holiday in the south of France or Qantas buying jet fuel in US dollars on the world market, it is positive for Australian companies earning profits offshore. Over the past year, we have seen the Australian dollar trend downwards compared to most large currencies but most significantly against the USD. The weakening Australian dollar has provided a tailwind for companies that earn revenues in foreign currencies. Once earnings and dividends are translated into weaker Australian dollars, local investors enjoy elevated earnings per share and dividend per share growth. Some companies that benefitted from this tailwind in August were CSL, which saw dividends increase by +18%, and Amcor, where dividends rose by +13% once converted into Australian dollars.

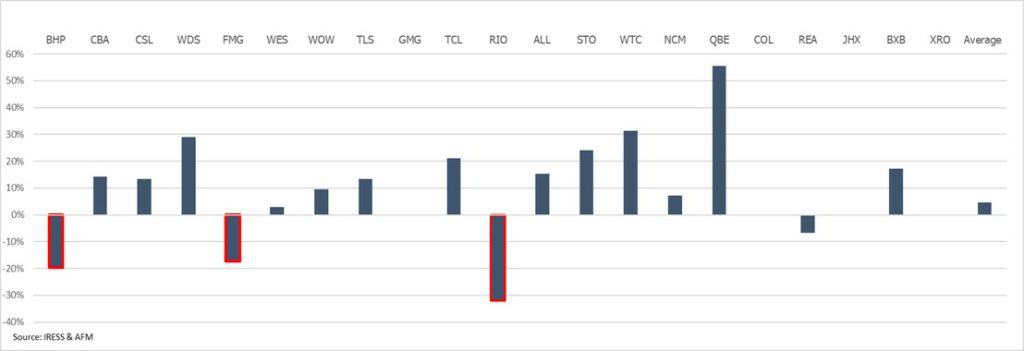

Show me the money

Unlike the previous few reporting seasons, August 2023 saw companies cut dividends, and share buy-backs were not a feature outside of Commonwealth Bank, Qantas and Computershare. Across the ASX Top 25 stocks (that reported - the other banks have a different financial year-end), the weighted average increase in dividends was 4%. The three miners, BHP, RIO and Fortescue, cut their dividends on weaker profits, higher costs and an uncertain outlook, with Xero not paying a dividend and James Hardie replacing their dividend with a buy-back. On the positive side of the ledger, QBE, Transurban and Woodside offset the cuts, posting strong increases in cash flows to their shareholders.

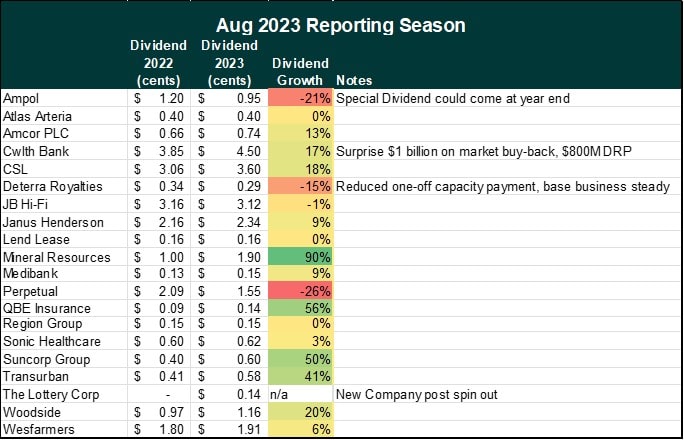

Figure 1: Dividend growth per share – ASX Top 25 August 2023

Best and worst

Over the month, Altium Limited, Inghams Group, GUD Holdings, Johns Lyng Group, Life 360 and Wesfarmers delivered the best results over the month. Despite the uncertain economic environment, especially around higher interest rates, these companies were able to combat these costs by lowering their gearing and leverage ratios whilst still being able to grow the business, in some cases lower losses, along with optimistic outlooks for 2024.

Looking at the negative side of the ledger, Chalice Mining, Core Lithium, Alumina Limited, Fletcher Building, Costa Group Holdings reported poorly received results by the markets. The common themes amongst this group are a delay or cancellation of dividends due to a potential takeover (Costa Group) or due to a lower earnings environment (Alumina) combined with lower profit guidance moving forward. Additionally, high price-to-earnings (PE) companies such ResMed, WiseTech and Ramsay that delivered profits below expectations or gave weak guidance saw their share prices sell off.

Result of the season

Before the August 2023 reporting season, conglomerate Wesfarmers would not have been many investors pick (including ours despite holding it in our portfolio) for the result of the season. Many in the market expected Wesfarmers’ earnings to contract based on a weaker domestic consumer, however the company grew profits on a strong rebound in Kmart, as well as growth in Bunnings, Officeworks and chemicals. Record Kmart earnings indicates consumers switching to the company’s low-price offer. Additionally, management provided upbeat guidance for 2024 which will see the first earnings from the Mt Holland lithium mine with the share price rallying by +11% in August.

Our Take:

Overall, we were reasonably pleased with the results from the reporting season with most of our portfolio companies able to increase earnings and dividends with some reporting record profits in a tougher economic environment.

Figure 2: How did the portfolio fare?

As a long-term investor focused on delivering income to investors, we look closely at the dividends paid out by the companies that we own and whether they are growing. After every reporting season, we look to "weigh" the dividends that our investors will receive. Our view is that talk and guidance from management are often cheap, and that company CFOs can use accounting tricks to manipulate earnings, but actually paying out higher dividends is a far better indicator that a business is performing well. Additionally, global macroeconomic events and market emotions can temporarily cause the share prices of companies performing well to fall.

Using a weighted average across the portfolio, our investors' dividends will be +15% greater than for the previous period in 2022, and every company held in the portfolio was both profitable and paid a dividend.

On this measure, we are pleased with the results of the August 2023 reporting season.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Asset Class and Economic Themes

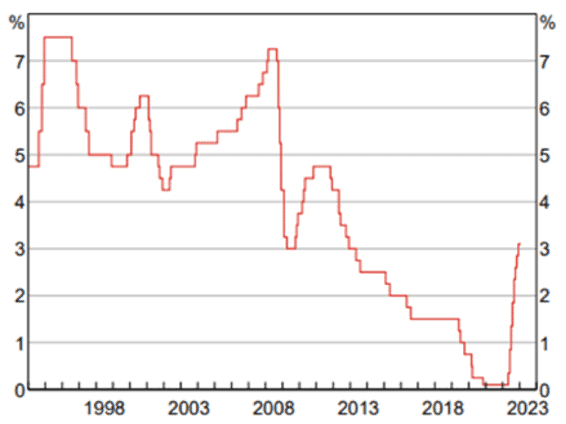

In our last newsletter we highlighted a volatile market environment which has continued unabated. As the year has progressed, we have become resigned to the fact that volatility is here to stay. RBA cash rates are currently at 4.1% and this means that bonds once again produce yield. The impact of higher debt costs, combined with higher than target inflation prints, does introduce an increased level of future uncertainty – thus reflected in the volatile environment.

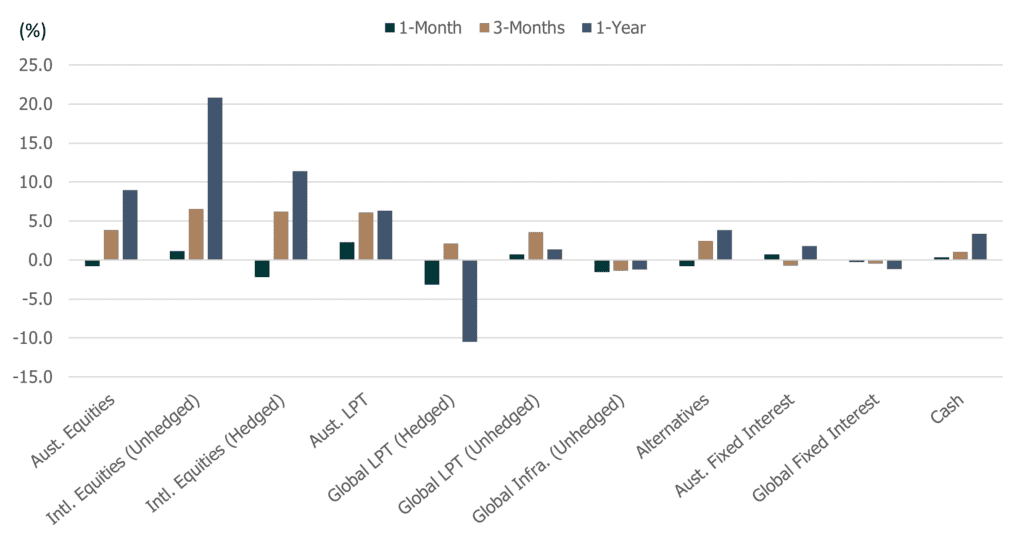

Whilst growth assets posted positive returns over the 3-month and 1-year periods, performance over the August month has been negative. The exception has been unhedged international equities which has benefitted from the depreciation of the Australian dollar, offsetting the negative equity returns.

Figure 1: Asset Class Performance as at 30 June 2023

Source: Allied Wealth, Morningstar.

Please note that asset allocation performance calculations have been conducted as of June 2023 and we will provide a further update to performance by the end of September 2023.

Portfolios currently maintain a marginally defensive asset allocation stance. As discussed in the last newsletter, the decision reflects a focus on risk management rather than profit maximisation. Whilst total return outcomes for clients are positive, our relative to SAA attribution indicates that this defensive position has detracted value over the June quarter as equity markets rallied.

Figure 2: Asset Allocation Performance as at 30 June 2023

Source: Allied Wealth, Morningstar. Note: Returns are based on an asset allocation index returns which do not include manager and advice fees so actual portfolio returns will vary. The purpose is to determine if our tactical asset allocation decisions are adding value over the Strategic Asset Allocation for each model.

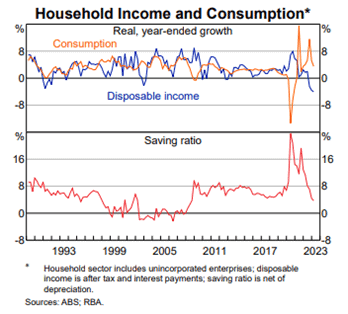

What is Our Current Investment Outlook?

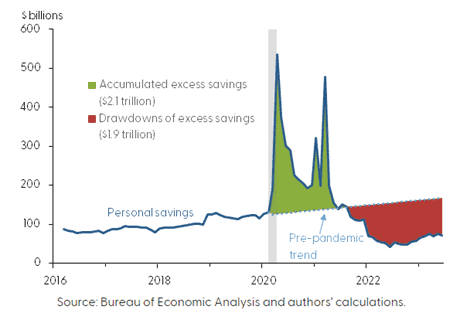

At the time of writing, the Reserve Bank of Australia (RBA) cash rate stands at 4.1% p.a. and represents an increase in interest rates by a whopping 4% since May 2022. The impact of higher interest rates has been felt by consumers; more so on the lower-income end of the spectrum. Higher mortgage payments and material increase in rents have eaten into the excess savings accumulated through the Covid19 pandemic and resulted in negative disposable income.

Figure 2: RBA Measure of Australian Household Income and Consumption

Obviously, this is not just a localised phenomenon. The same consumer impact is also observed in the United States (US). Despite tighter labour markets, wage growth has not outpaced the combined impact of higher inflation and mortgage rates.

Figure 3: Consumers Aggregate Personal Savings versus the Pre-Pandemic Trend

Source: Federal Reserve Bank of San Francisco

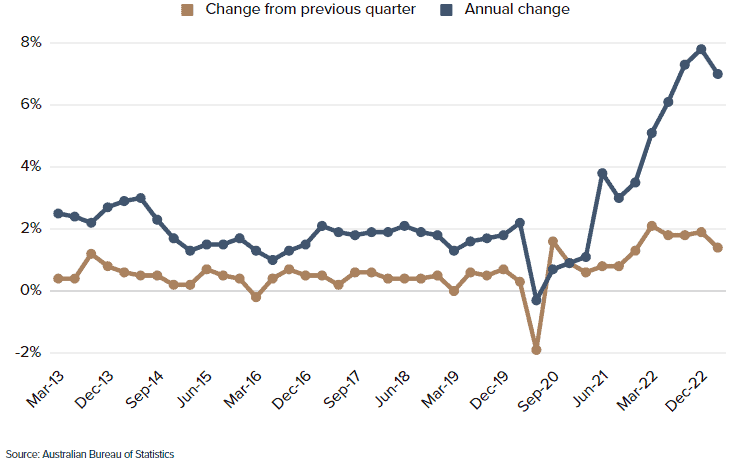

From an inflation management standpoint, the sharp interest rate hiking cycle saw inflation ease over the last 6 months. In Australia, inflation peaked at 8% in December 2022, but since moderated to 6% in June 2023. Since the last rate hike in June this year, the RBA remained on pause but left the door open to further interest rate hikes if required. At 6%, inflation remains materially above the 2% to 3% targeted by the RBA.

Across July and August, companies domestically and globally reported on Q2 2023 earnings. Data suggests that earnings to date have remained resilient, but the forward outlook has been revised downwards. Costs management remains problematic for companies particularly as it relates to labour, rent and energy prices. Profit margins so far have been retained by passing on costs to consumers, and this in turn has contributed to the above target inflation number.

Ironically, labour cost pressures faced by companies is the reason why consumers have been able to broadly absorb the increased costs of goods. Consumers domestically face increasing cost pressures which is exacerbated by a large number of low fixed rate mortgages rolling off in August (termed the mortgage cliff). Anecdotally we believe the low-income cohort of consumers are already affected. In the most recent earnings season, Woolworths and Coles reported the highest number of grocery theft experienced in recent history.

Our base case remains that inflationary pressure is likely to stay above the targeted rate. This may mean another hiking cycle at the beginning of 2024. Timing of the interest rate hikes may occur at the same time labour market softens and when the majority of consumers have drawn down their pandemic savings. This is likely to lead to lower growth going forward which will in turn weigh on equity valuations.

What is the Counter to Our Investment View?

Whilst we have an investment outlook which reflects a negative view on growth assets, discussions held at the investment committee also included scenarios which would run counter to our base investment thesis. Following our analysis, we believe there are a specific set of conditions that will need to be met for equities to grind higher.

The key condition is that inflation continues to moderate over the forward period and comes in below the 3% upper band without any additional interest rate hikes. Additionally labour markets will have to soften but with increased labour productivity (i.e. people work harder for same level of pay). These two in combination will allow corporate profit margins to grow and justify current equity market valuations.

Despite our negative outlook, we acknowledge that both regulators and central banks have done a fantastic job at steering the economy over the last 12-months. We continue to expect them to utilise all the tools at their disposal to ensure any market downside is not permanent or long lasting.

Investment Market Trends

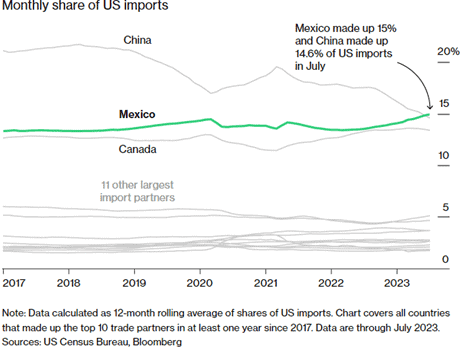

Outside of economic conditions, there have been two market themes that have captured our attention. Over the preceding quarters, we have written about how the geopolitical tension between US and China has resulted in a shift of factories and production away from China to US-friendly countries. We are finally seeing some concrete evidence to back this view. Trade data for the 12-months to July 2023 indicates that Mexico has now overtaken China as the largest exporters of goods to the US.

Figure 4: Mexican Exports to the US Finally Outpace China

Artificial Intelligence (aka. machine learning) has come a long way since its humble beginnings in 1956 when the first artificial intelligence (AI) program was presented at the Dartmouth Summer Research Project on Artificial Intelligence conference. Since then, we have seen substantial improvements to machine learning algorithms, data availability, computational power and costs of access such that machine learning models may be built and deployed by anyone with a personal computer and access to the internet. Thus, it is not surprising AI has taken over everything from creative endeavours to industrial manufacturing. Some machine learning models have even been deployed to support corporate decision making.

Even though we are very positive on the development of AI and its implications for humanity, we are concerned that AI has also become the marketing buzz word and the go-to panacea to resolve all our worldly ills. Take for example the claim that AI will solve global warming; whilst we can see how AI can help, ultimately a change in human behaviour will still be required to get there.

Selfishly, we are also getting a little tired of seeing AI slides in earning presentations promising the world. It would not be an exaggeration to say that 3 out of 4 earning presentations would include a slide dedicated to AI.

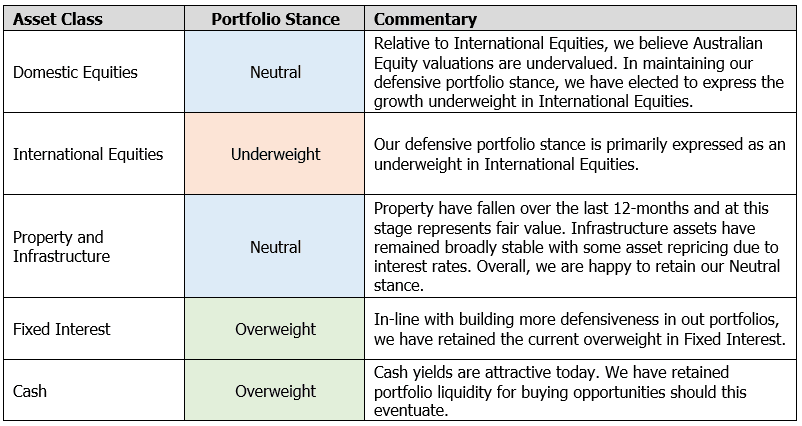

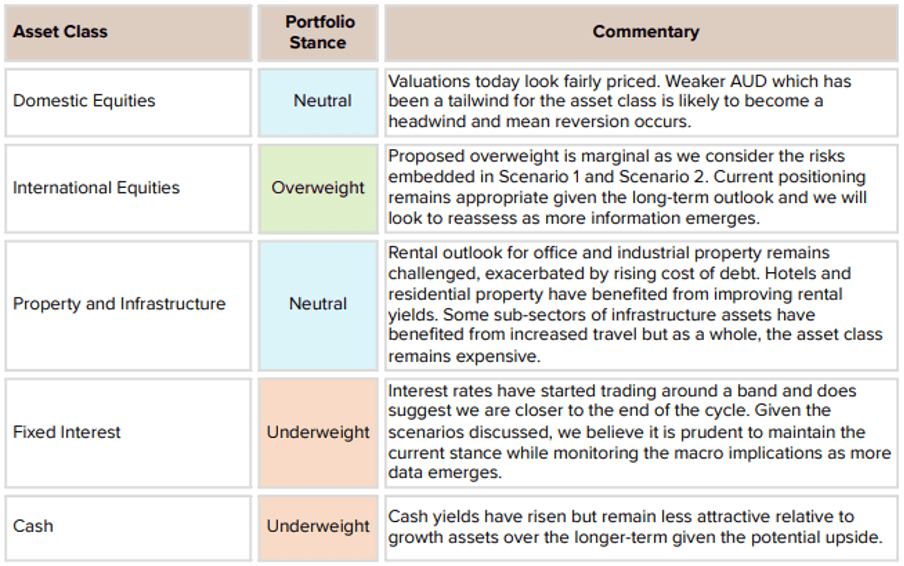

Investment Decisions and Strategy Implications

Coming back to our base investment thesis, given the confluence of events, we have made the decision to maintain a defensive stance across our portfolios. We believe there is stress building in the system despite the fantastic job done by regulators and central banks over the last 12-months. So far, the negative impact from the rise in interest rates has been broadly offset by substantial amounts of pandemic driven savings and tightness in labour markets – we do not believe this will last much longer. Despite the negative view, we are also monitoring the market for signs which are counter to our investment thesis. Emergence of a more positive macroeconomic environment may require a change in stance. From a risk management perspective, we remain comfortable with our current positions.

In-line with the outlook, the Investment Committee has decided to maintain an underweight growth assets in favour of an overweight to defensive assets. No asset allocation changes have been made.

Figure 5: Asset Class Summary and Portfolio Stance

Every investment decision is not undertaken lightly and is based on investment research, sized by our conviction. As with every decision we continue to monitor the market for signs of support or contradiction to our investment thesis.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Episode details - 22 August 2023

Greg and Brendon Vade chat about the benefits advisers have experienced from having an investment committee and outline some of the challenges they have faced throughout their journey.

Our team discuss the challenges faced in dealing with an investment committee. Greg is a highly experienced independent advisor at Allied Wealth who can offer you investment advice that is the best possible solution for you.

Asset Class and Economic Themes

We hope we are not the only ones to feel a little confused by financial markets. Summarising the quarter, January started out with a strong equity market rally only to start falling in February; followed by a short-term banking crisis which unfolded in the first week of March but was resolved within 3 weeks. Despite the near miss, equity markets ended the quarter generally outperforming bonds.

Figure 1: Asset Class Performance as at 31 March 2023 Best financial advisor Sydney

The asset allocation positions taken over the last 9 months have added value to portfolio outcomes. However, the cautious positioning has meant that excess returns relative to benchmark Strategic Asset Allocation (SAA) are marginal. Not unlike the experience over the previous quarters, all asset classes have been extremely volatile over the period – bond yields for example fell more than 1% in a day in response to the collapse of Silicon Valley Bank. Overall, we are pleased with the positive outcomes for clients.

Figure 2: Asset Allocation Performance as at 31 March 2023 Independent financial advisor

What is Our Current Investment Outlook?

In our prior quarterly newsletter, we highlighted the changing market environment and flagged an upside and a downside economic scenario tied to rising interest rates and tightening financial conditions.

Interestingly we saw a short-term banking crisis unfold in March which was met with quick action by regulators to stem the crisis. This culminated in the sale of Silicon Valley Bank in the US; and forced sale of Credit Suisse to UBS in Europe. Fast forward to today, markets have calmed down and the focus has once again shifted back to longer-term fundamentals. Despite the quick resolution, we think this is but a symptom of the broader pain the market is likely to experience going forward.

Reflecting on this discussion at our April Investment Committee, the debate this quarter centred around the possibility and probability of a hard recession. While a range of upside and downside market scenarios are possible, we think the probability of a downside scenario has increased. Simplistically we would quantify the probability of a hard economic landing as having increased from 45% to 60%.

Let us step through key thematic which has shaped our view.

The Dynamics of Inflation and Interest Rates

As we have seen over the 12-month period, interest rates have risen substantially. Raising interest rates is a function of central banks to try and moderate inflation and over the last 2 years, interest rates have trended materially above the desired target of 2-3% In-line with our expectations, historical data suggests that inflation in both US and Australia peaked in December 2022 but levels remain broadly elevated.

Figure 3: Australian Consumer Price Index as at 31 March 2023 Independent financial advice

Future inflation prints are likely to continue lower due to base effects. However, we are concerned that the elevated level and sticky core inflation is likely to result in further interest rate hikes before the central banks pause. Any additional interest rate hikes are likely to put more pressure on corporate balance sheets and consumers alike going forward.

Equity markets have started to show signs of stress but have continued to trade higher

We have started to see slower demand reflected in corporate revenue growth which has been declining. To preserve profit margins, companies have started to restructure their workforce and get creative with cost management. The effects across companies of different sizes and sectors have been varied.

In the case of large corporates (think large capitalisation listed equities), whilst revenue has begun to decline, profit margins have remained resilient. However, we think there is only so much that can be done before falling revenues translate directly into lower (or negative) earnings. Forward earnings expectations have started to trend downwards but despite this, equity markets have continued to trade higher.

Private equity as an asset class is facing the same headwind as it's listed counterpart but, is in our view, more susceptible in the current environment. Companies in this sector tend to be smaller, monoline businesses with limited avenues for capital raising and thus are more fragile. This compares to venture capital which is struggling in this environment.

Since 2022, we have seen a change in investor behaviour and preferences. Prior to 2022, with interest rates at 0% we saw a flood of investor capital into high growth companies with no cashflows – this bid up valuation multiples and saw some extremely expensive deals completed. Fast forward to 2023, the preference has now shifted to companies with sustainable cashflows with proven business models.

Commercial real estate particularly in private markets have been problematic. As we wrote some time ago, we saw a large discrepancy in valuations between what buyers were willing to purchase at; and what sellers were willing to sell – thus there was very limited transactional activity over 2022. Since then, the cost of debt has been steadily increasing, whilst sellers which have been hesitant to sell at large, discounts are beginning to capitulate. We have started to see property sales at 15% - 20% lower than their carrying book value. Deal numbers remain low but going forward we expect a lot more pain in the coming months.

Private debt markets engaging in 'Amend, Extend and Pretend' Activities

Debt markets have been directly affected by rising interest rates. For holders of floating rate bonds/loans this has resulted in higher income returns. Whilst higher yields may be good for investment outcomes, it increases the debt burden of companies, thus increasing the probability of default. In private debt markets we have seen some questionable activities – what we like to term “Amend, Extend and Pretend “. Companies who have not been able to finance (or refinance) their loans today, are engaging with their existing debt holders to either amend terms of payment or extend loan maturities. As much as possible they will need to pretend everything is ok and hope that at some point prior to debt maturity that the Central Banks once again drop interest rates making refinancing a lot less costly compared to today.

To top this off, we note that the quality of private debt markets which initially started out as investment grade has fallen over the years, driven by a reach for yield by investors when rates were zero. Today, we believe loans which fall in that sub-investment grade category to be approximately 50% of sector. Now faced with higher cost of debt and decreased investor risk appetite we think there will be a material number of defaults in the coming year.

Given the views discussed above, we believe that the probability of a downside scenario has risen. The counterbalance to the negative view is the speed in which we have seen both central banks and regulators react to market events – good example being the recent banking crisis where key decisions were made and enacted by regulators over a period of 2 weeks.

While historically, we have seen Central Banks drop interest rates to support the economy, we believe in this cycle monetary policy support is likely to be limited – especially if inflation remains higher than the bank’s inflation target of 2% to 3%.

Investment Decisions and Strategy Implications Independent financial advisor Sydney

Given the confluence of events, we have made the decision to reduce portfolio risk. While there is still a probability that equity markets may fare well through this, we think this probability has shifted to the downside. Furthermore, asset allocation decisions to date have added value to client outcomes and we feel it prudent to crystalise some positive returns at this juncture.

In-line with the outlook, the Investment Committee has decided to move to an underweight growth assets in favour of an overweight to defensive assets. Specifically, we have proposed an underweight position in International Equities to be funded via an overweight position in Fixed Interest and Cash.

Other Portfolio Changes: Move from Janus Henderson Tactical to Core Fixed Interest

In-line with our defensive portfolio stance, a decision has been made to change from the Janus Henderson Tactical Fixed Interest Strategy to Core Fixed Interest for most portfolios. This investment decision represents an increase in interest rate duration and a marginal decrease in credit exposure for active portfolio.

Janus Henderson’s Australian Fixed Interest team remains a quality manager in our view, so we have retained the manager but implemented a change in strategy.

Figure 4: Asset Class Summary and Portfolio Stance

Bottom-up market observations

What to do with the banks

The last four years have been very eventful for bank shareholders, with each year bringing a new set of worries predicted to bring the banks to their knees. 2020 saw capital raisings from NAB and Westpac missing their first dividend since the banking crisis of 1893, as experts forecasted 30% declines in house prices and 12% unemployment! Then 2021 saw the banks grappling with zero interest rates and APRA warning management teams about the systems issues they may face from zero or negative market interest rates, an issue that seems quite comical now. 2022 saw the RBA raise the cash rate from 0.10% to 3.10%, the most rapid tightening ever from Australia's central bank. Now in 2023, the concerns have switched to the impact of sharply rising interest rates on bad debts and the upcoming "fixed rate cliff".

While the banks will surely see rising bad debts over the next year, Allied view that the market is far too negative towards the banks in 2023. Indeed, the main banks are better placed to weather 2023 and 2024 than in 2007 to deal with the last rate tightening cycle.

Bad Debts will rise, but that is not bad

Rising interest rates will see declining discretionary retail spending as more income is directed towards servicing interest costs. While bad debts will increase, this should be expected. In the 2022 financial year, the major banks reported bad debt expenses between 0% and 0.2%, the lowest in history and clearly unsustainable. Excluding the property crash of 1991, bad debt charges through the cycle have averaged 0.3% of gross bank loans for the major banks, with NAB and ANZ reporting higher bad debts than Westpac and CBA due to their greater exposure to corporate lending.

Figure 5: Australian Banking Sector Bad Debts as a Percentage of the Loan Book

In predicting the trajectory of bad debts in 2024, the 1989-93 spike in bad debts should be excluded, as bank bad debts spiked due to a combination of poor lending practices and very high-interest rates. Indeed in 1991, the head office of Westpac was unaware that different arms of the bank were simultaneously lending to 1980s entrepreneurs such as Bond and Skase et al.

Additionally, during this period, borrowers saw interest rates approaching 20%, a level outside any current forecasts. Today the composition of Australian bank loan books are considerably different to what they were in the early 1990s or even 2007, with fewer corporate loans (such as to ABC Learning, Allco, MFS) and a greater focus on mortgage lending, which is secured against assets and historically has very low loan losses. Additionally, the major banks have pulled the plug on their foreign adventures, with no exposure to northern England and Asia that in 2008 saw high bad debts, often due to the making of questionable loans outside of the core market.

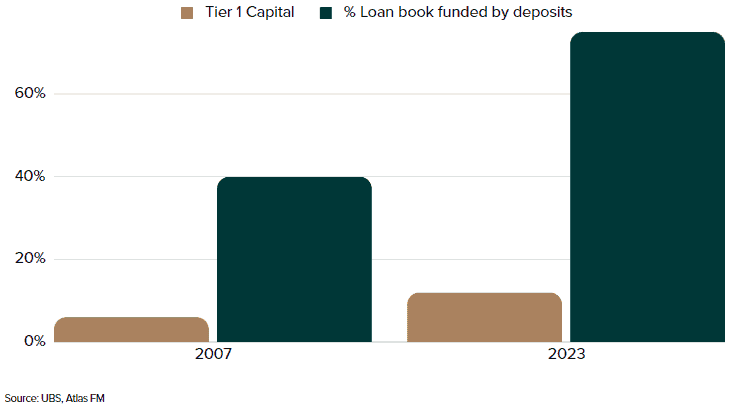

Then and Now

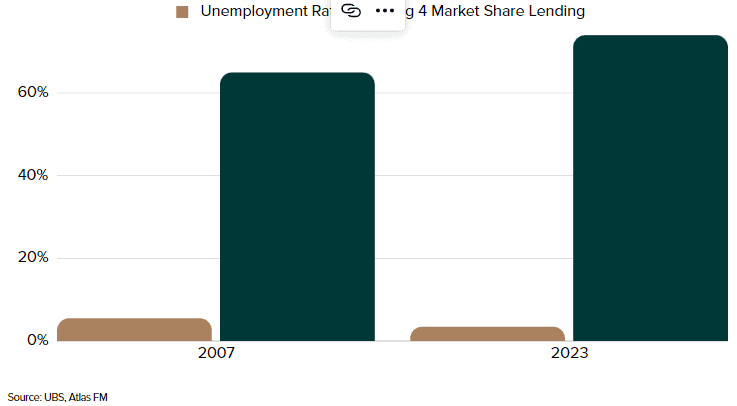

In 2023 all banks have a core Tier 1 capital ratio above the Australian Prudential Regulation Authority (APRA) 'unquestionably strong' benchmark of 10.5%. This allowed Australia's banks to enter the 2022/23 rising rate cycle with a greater ability to withstand an external shock than was present in 2007 going into the GFC, where their Tier 1 Capital ratios were around 6%. For investors, this means that the banks have more capital backing their loans. Additionally, the quality of the loan books of the major banks is higher in 2023 than in 2007 or 1991, which saw a greater weighting to corporate loans with higher loss levels than mortgages. Further, the banks' funding source is more stable today than it was 13 years ago, with an average of 75% of loan books funded internally via customer deposits. This means that the banks rely less on raising capital on the wholesale money markets (typically in the USA and Europe) to fund their lending.

Figure 6: ASX Banking Sector 2007 vs 2023

The major banks face the next few years in a far stronger position than they went into 2007. Currently, the unemployment rate is 3.5%, significantly less than it was going into the last rate tightening cycle. While rising interest rates will undoubtedly cause stress to many borrowers over the next 12 months, so long as employment remains strong, mortgage repayments will remain high and bank bad debts low. However, we expect the outlook for consumer discretionary stocks such as Flight Centre, Harvey Norman and AP Eagers to deteriorate as spending on Bali holidays, televisions and new cars are diverted to service higher mortgage payments.

Figure 7: ASX Banking Sector 2007 vs 2023

Since the GFC, the banking oligopoly in Australia has only become stronger, with foreign banks such as Citigroup exiting the market and smaller banks such as St George, Bankwest, and now Suncorp being taken over by the major banks. While our political masters bemoan the concentrated banking market structure, having a strong, well-capitalised banking sector looked to be very desirable in March with the collapse of Silicon Valley Bank in the USA and in the wake of UBS' forced takeover of Credit Suisse.

Our Take

Allied Wealth expects the upcoming May reporting season to show that Australia's banks are in good shape and face a better outlook than many sectors of the Australian market. We expect the banks to outperform in the near future, enjoying a tailwind of a rising interest rate environment and high employment levels, which will see customers make the new higher loan repayments. With an average grossed-up yield of +7.2% and lower-than-expected bad debts, bank shareholders will be rewarded for their patience and for ignoring the current market noise.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Reporting season summary from Atlas Fund Management: Allied Wealth’s preferred direct Australian equity manager

Allied Wealth is pleased to have engaged Atlas Funds Management to provide recommendations for clients who have chosen direct equities for their Australian share component of their portfolio via the Atlas Core Australian Equity Portfolio. We find their income and dividend focus suits our client’s needs well. Reading the reporting season summary from Atlas which follows will also provide an insight to the level of detail and experience that Atlas have to offer.

Key Themes from the February 2023 Reporting Season

The February 2023 company reporting period concluded on 28 February 2023, revealing the financial accounts for the six months ending 31st December 2022. Overall, this was a very mixed reporting season with a greater degree of dispersion than we have seen over the past few years. February showed record profits for several companies while shrinking profit margins, dividend cuts and pessimistic outlooks for others. This was reflected on the scoreboard with the share prices of ASX 200 companies ranging from +25% (GUD) to -33% (Dominos Pizza). This variation in share prices typically occurs every year in February after financial results are reported and contrasts with January and December, where share prices tend to move together, influenced by global macroeconomic events rather than actual corporate profits. The ASX 200 declined by -2.5% in February, mirroring the decline in global markets on fears of falling corporate profits and further rate hikes.

In this piece, we look at the key themes from reporting season, along with the best and worst results and the corporate result of the season.

Mixed Outcomes

Going into the February reporting season, the market was concerned about the impact of higher interest rates and a slowing economy and swung from pessimism in December to an optimistic view that everything would be alright in January. Reporting season showed that both statements were correct; some companies reported excellent results and record profits, showing the resilience of their business models, whereas others cut dividends and provided murky outlooks. Varying corporate profitability reminds investors that when building a portfolio, you are not buying a country or general equities; but rather a share in a collection of businesses that are not impacted by economic events in the same fashion.

While rising interest rates are very negative for highly indebted companies with minimal pricing power, rising rates benefit insurance companies earning investment returns on their insurance float or banks repricing their loan book. Similarly, companies where labour is a high component of the production costs, such as Coles and Woolworths, saw profit margin pressure. In contrast, other companies like Woodside saw minimal impact from rising wages due to the low component labour plays in extracting natural gas from offshore fields.

Higher Costs and Inflation

In February, questions around cost control and the impact of inflation dominated the analyst calls with management. The miners all reported weaker headline results courtesy of the twin issues of falling commodity prices and higher costs. BHP and RIO discussed record diesel prices, high ammonia nitrate prices (explosives), and labour shortages, pointing to higher costs in 2023. Dominos Pizza's share price was under pressure after reporting falling orders in response to raising prices for pizzas and adding a 7% delivery fee.

However, inflation did not impact all companies uniformly in the February reporting season. Packaging company Amcor increased profits and maintained margins after successfully passing on US$1 billion in extra costs to customers from increased resin, plastic films and aluminium prices. Inflation is not much of an issue for toll road owner Transurban. With the bulk of the company's tolls automatically increasing with inflation with a few strokes of a keyboard and the company's debt primarily fixed for the next seven years, rising inflation results in higher profits over the short to medium term.

Woodside saw sharply expanding profit margins in February, with profits up 223%, benefiting from stable production costs (US$8.10 per barrel of oil), highly profitable assets acquired from BHP and rising revenues. A feature of offshore LNG plants is the eye-watering upfront construction costs in the billions but a low ongoing marginal cost of production requiring minimal inputs and labour, giving the company an 85% cash profit margin.

Show me some money, but less than before

One of the starkest themes of reporting season was declining dividends, with the average ASX 200 company reducing dividends by -7%, though as with earnings, the story was mixed with some companies delivering record dividends to their shareholders. The major miners (BHP, RIO and Fortescue) cut their dividends significantly by between 13% and 50% due to falling commodity prices, uncertain outlook, higher future capex and upcoming takeovers. Conversely, February 2023 saw significant dividend increases from Woodside, Newcrest, Commonwealth Bank, Ampol and Whitehaven Coal. However, some Whitehaven investors were disappointed with the +245% increase in the coal company's dividend, citing the low 36% payout ratio. Whitehaven's directors were clearly keen to retain capital after a precipitous fall in the thermal coal price over the past six months. Additionally, coal companies are unwilling to take on bank debt due to concerns that this funding source could be removed in the future.

Unlike the last two reporting seasons, shareholders were not showered with new share buybacks, with only Commonwealth Bank, Qantas, Aristocrat and Amcor announcing significant buybacks.

What lies ahead?

When economies are going through transition periods like what we are currently experiencing, moving from near-zero interest rates and no inflation to rising interest rates, the financial statements from a reporting season can provide a misleading picture of future company profits and dividends. While some companies can pass on rising costs and maintain profit margins, others will see sharp falls in earnings and nervous calls from their bankers. The February 2023 reporting season detailed company profits for the last six months of 2022, which saw both low unemployment and the RBA raise rates from 0.85% to 3.1% in December (currently 3.6%). Due to the rather blunt nature of monetary policy, the full impact of this rate-tightening cycle has yet to be seen on the Australian economy. Retail sales were surprisingly strong, with JB Hi-Fi reporting +9% sales growth over the half, with sales increasing in January 2023. Similarly, Wesfarmers saw 17% sales growth at Kmart, perhaps capturing more price-conscious consumers, and AP Eagers showed continuing demand for new cars.

Best and Worst

Over the month, the best results were delivered by Woodside, Ampol, QBE, Medibank Private, AP Eagers and Flight Centre. The key themes were either very strong profit growth from businesses firing on all cylinders from the first three or companies that outperformed low market expectations in the case of the final three.

Looking at the negative side of the ledger, Downer, Star Entertainment, AMP, Aurizon, and Dominos Pizza fell over the month after reporting earnings below market expectations. The common theme among these was companies having difficulties passing through rising consumer costs. However, in the case of Downer and Star Entertainment, these issues were increased by accounting irregularities and regulatory issues, respectively.

Result of the Season

The most impressive result from the February reporting season came from long-term cellar dweller QBE Insurance. Over the past decade, QBE has provided many surprises on results day, mostly unpleasant, as successive management teams have struggled to manage a very diverse book of global insurance, acquired in an acquisition spree in the first decade of this century.

These acquisitions frequently surprised the market with large losses due to mispriced risk in businesses such as Argentinian worker's compensation, a business line that even close observers of the company were unaware the company had significant exposure to. Over the past few years, the company has consistently divested the problematic parts of the QBE empire.

In February, QBE delivered a clean result with profit up +5.2% to US$847 million, with all segments (Americas, Europe and Asia Pac) benefiting from higher premiums, disciplined underwriting and rising interest rates. Typically, with QBE, investors don't see all three factors simultaneously offering a positive contribution. Conditions are building for a strong 2023 month for the global insurer, as the current tailwinds are likely to persist, particularly higher interest rates.

Our Take

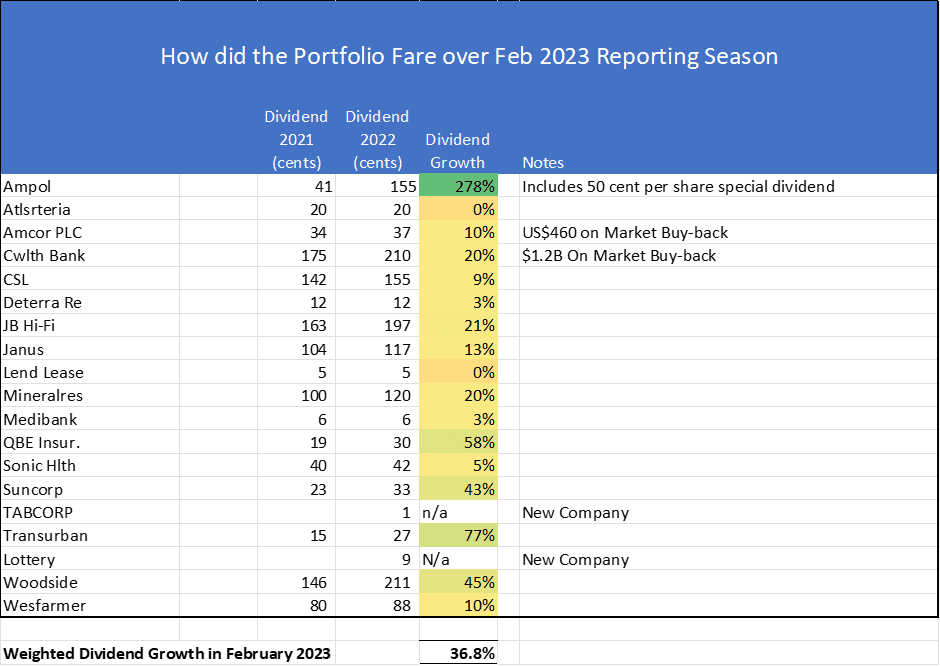

Overall, we were reasonably pleased with the results from this reporting season for the Atlas Core Australian Equity Portfolio. In general, the companies that we own reported improving profits, and indeed, for several companies in the portfolio, February 2023 saw record profits, dividends and new share buyback plans.

As long-term investors focused on delivering income to investors, we look closely at the dividends paid by the companies we own and, in particular, whether they are growing. After every reporting season, Atlas looks to "weigh" the dividends that our investors will receive from company profits. While share prices move every second between the hours of 10 am and 4 pm, dictated by changing market emotions, ultimately, the sole reason for buying a share is to access a share of that company's profits paid in the form of dividends.

Our view is that talk and guidance from management are often cheap. Also, company CFOs can use accounting tricks to manipulate earnings reported on the Profit and Loss Statement, as Downer EDI's shareholders found out in February. Actually, paying out higher dividends is a far better indicator that a business is performing well and that directors are not concerned about the future.

Using a weighted average across the portfolio, our investors' dividends will be +37% greater than the last six months of 2021. Every company held was profitable and paid a dividend. This result compares very favourably with the broader ASX 200, which saw average dividends fall by -8% in February 2023, led by the large iron ore miners. On this key measure, we are pleased with how the season went.

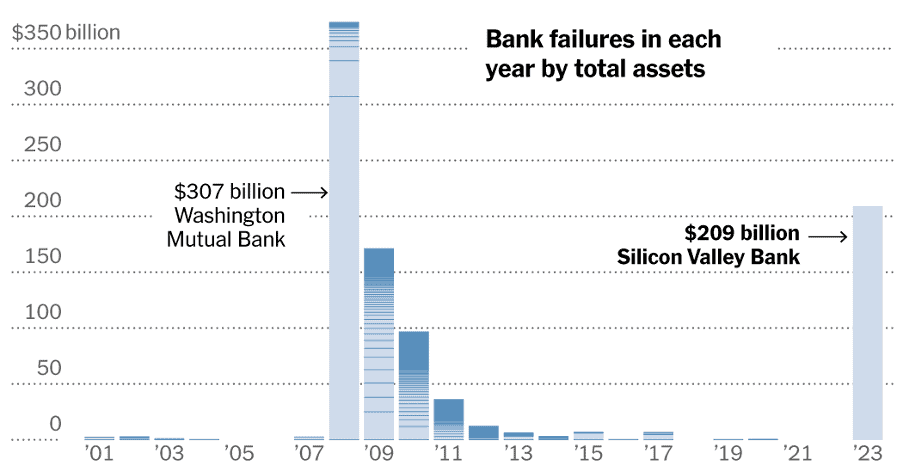

As you may have already seen in the news, US regulators moved to close Silicon Valley Bank (SVB) on the 10th of March. This was followed by the closure of Signature Bank on the 12th of March. Interestingly, the collapse of these two banks represents the 2nd and 3rd largest bank collapse in US history.

Figure 1: Comparison of Silicon Valley Bank Failure Rel. Historical Experience

Whilst these developments are specific to SVB and its circumstances, regulators are worried that this may trigger a much broader run-on banks – particularly for regional/smaller banks in the US.

To restore calm, US regulators have moved promptly to shore up depositors and guarantee all deposit balances irrespective of amount (legal maximum guarantee of $250k is legislated). Additionally, the Federal Reserve made emergency loans available to all other banks and have since seen a take-up of $1.7 Billion.

While we can argue around the moral hazard of what can be construed as a bank bail-out, what is apparent is that a broad-based bank run poses a systemic risk to both the US and global economy.

At the time of writing, we have also seen the solvency of Credit Suisse being called into question. Credit Suisse shares fell 40% prompting the Swiss Central Bank to extend a CHF 50 Billion credit line to help the bank meet any short-term funding needs.

Since the 8th of March, equity markets have seen a broad sell-off followed by a rebound two days following the announcement of emergency support measures. US banks however have fallen by -22.1% with massive intra-day volatility in share price.

Across bond markets, government bonds rallied as we saw an initial flight to safety followed by a marginal fall as markets continue to evaluate the situation. Credit spread widened on contagion risks but have since moderated.

Australian and International Equities are still lower post event at -4.3% and -2.4% respectively, while Australian and International Fixed Interest are positive at +2.1% and +1.9% respectively.

It is clear this event has spooked markets and we expect volatility to continue as investors reassess incoming news.

We have completed a look-through of our portfolios and note there are no direct holdings in SVB; However, portfolios have a marginal exposure to Signature Bank via T Rowe Price Global Equities equating to approximately 0.04% on a portfolio look-through basis.

Given the size of the exposure we are less concerned around the direct portfolio impact but are more concerned around how this changes the longer-term investment outlook.

Quite frankly like the rest of the market we are still analysing incoming data. Our base case at the time of writing remains that Central Banks and regulators globally will be successful in stemming the short-term market panic and associated risks of more bank-runs.

However, over the longer-term we believe this event represents the first of many more to come, particularly as higher interest rates start working its way through the economy. This event is likely to weigh on central banking decision making especially when considered in combination with inflation prints which have remained stubbornly high. Over time we expect credit spreads to structurally shift wider as markets incorporate higher debt cost and increased default probabilities.

Portfolios today are well positioned to weather the bouts of market volatility. For now, we believe the action of central banks and regulators have been quick and decisive enough to stem a broader marker panic. We will look to provide another update to the investment outlook post the March 2023 Investment Committee as the situation evolves.

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

2023 has gotten off to a roaring start. Despite a sharp equity rally in January, risks that were prevalent at the end of 2022 continue to plague the markets. I would liken the equity rally as investors cautiously stepping out across a frozen river – positive they can make it through, but knowing they could fall in at any time. Over the 3 and 6-month periods to December 2022, growth assets have outperformed defensive assets.

Figure 1: Asset Class Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

Asset allocation positions taken over the last 3 to 6 months have added value to portfolio outcomes. However the cautious positioning has meant that excess returns relative to benchmark Strategic Asset Allocation (SAA) are marginal. Peering under the hood, it has certainly been a bumpy ride through the last 2 quarters and provides us comfort that the marginal risk-on allocations we held was the right decision for portfolio and client outcomes.

Figure 2: Asset Allocation Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

Over 2022 Australian interest rates rose by a whopping 3% (see Figure 3) and in a historical context represents one of the sharpest rises in interest rates since 1990s. Over the last 3 years, we saw the largest combined monetary and fiscal experiment in recorded history resulting in runaway inflation and central banks globally scrambling to keep it under control. This is by no means a localised event as we see the same story playing out in the US and Europe.

Figure 3: RBA Cash Rate Target

Source: Reserve Bank of Australia