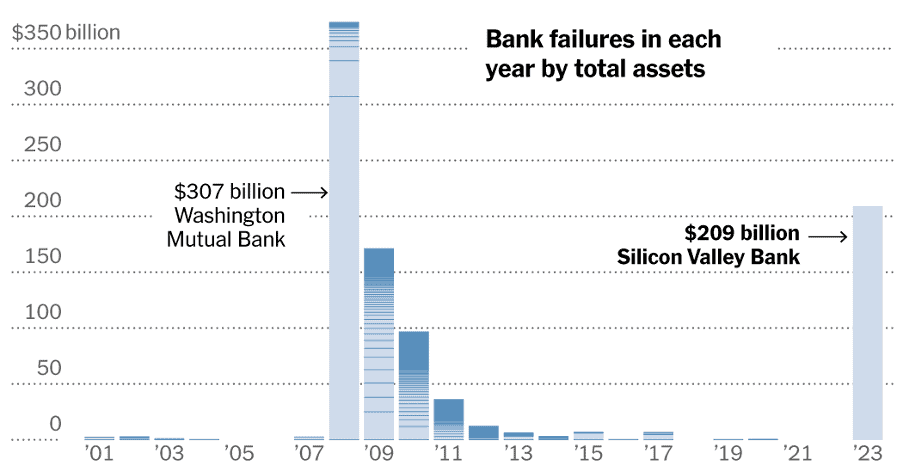

As you may have already seen in the news, US regulators moved to close Silicon Valley Bank (SVB) on the 10th of March. This was followed by the closure of Signature Bank on the 12th of March. Interestingly, the collapse of these two banks represents the 2nd and 3rd largest bank collapse in US history.

Figure 1: Comparison of Silicon Valley Bank Failure Rel. Historical Experience

Whilst these developments are specific to SVB and its circumstances, regulators are worried that this may trigger a much broader run-on banks – particularly for regional/smaller banks in the US.

To restore calm, US regulators have moved promptly to shore up depositors and guarantee all deposit balances irrespective of amount (legal maximum guarantee of $250k is legislated). Additionally, the Federal Reserve made emergency loans available to all other banks and have since seen a take-up of $1.7 Billion.

While we can argue around the moral hazard of what can be construed as a bank bail-out, what is apparent is that a broad-based bank run poses a systemic risk to both the US and global economy.

At the time of writing, we have also seen the solvency of Credit Suisse being called into question. Credit Suisse shares fell 40% prompting the Swiss Central Bank to extend a CHF 50 Billion credit line to help the bank meet any short-term funding needs.

Since the 8th of March, equity markets have seen a broad sell-off followed by a rebound two days following the announcement of emergency support measures. US banks however have fallen by -22.1% with massive intra-day volatility in share price.

Across bond markets, government bonds rallied as we saw an initial flight to safety followed by a marginal fall as markets continue to evaluate the situation. Credit spread widened on contagion risks but have since moderated.

Australian and International Equities are still lower post event at -4.3% and -2.4% respectively, while Australian and International Fixed Interest are positive at +2.1% and +1.9% respectively.

It is clear this event has spooked markets and we expect volatility to continue as investors reassess incoming news.

We have completed a look-through of our portfolios and note there are no direct holdings in SVB; However, portfolios have a marginal exposure to Signature Bank via T Rowe Price Global Equities equating to approximately 0.04% on a portfolio look-through basis.

Given the size of the exposure we are less concerned around the direct portfolio impact but are more concerned around how this changes the longer-term investment outlook.

Quite frankly like the rest of the market we are still analysing incoming data. Our base case at the time of writing remains that Central Banks and regulators globally will be successful in stemming the short-term market panic and associated risks of more bank-runs.

However, over the longer-term we believe this event represents the first of many more to come, particularly as higher interest rates start working its way through the economy. This event is likely to weigh on central banking decision making especially when considered in combination with inflation prints which have remained stubbornly high. Over time we expect credit spreads to structurally shift wider as markets incorporate higher debt cost and increased default probabilities.

Portfolios today are well positioned to weather the bouts of market volatility. For now, we believe the action of central banks and regulators have been quick and decisive enough to stem a broader marker panic. We will look to provide another update to the investment outlook post the March 2023 Investment Committee as the situation evolves.

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

2023 has gotten off to a roaring start. Despite a sharp equity rally in January, risks that were prevalent at the end of 2022 continue to plague the markets. I would liken the equity rally as investors cautiously stepping out across a frozen river – positive they can make it through, but knowing they could fall in at any time. Over the 3 and 6-month periods to December 2022, growth assets have outperformed defensive assets.

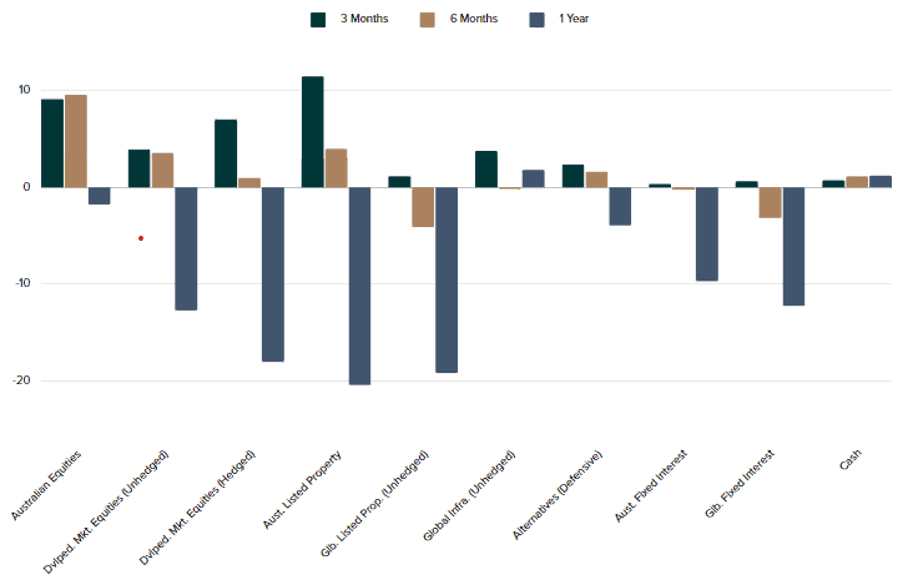

Figure 1: Asset Class Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

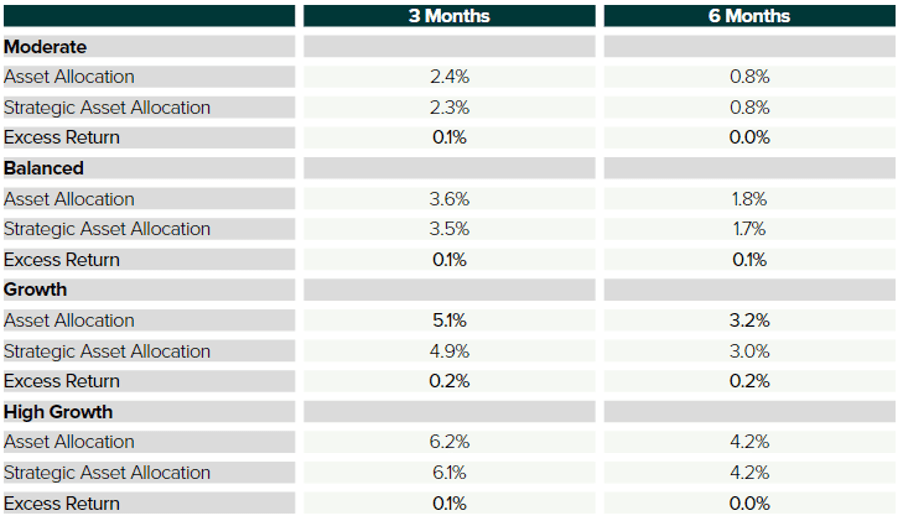

Asset allocation positions taken over the last 3 to 6 months have added value to portfolio outcomes. However the cautious positioning has meant that excess returns relative to benchmark Strategic Asset Allocation (SAA) are marginal. Peering under the hood, it has certainly been a bumpy ride through the last 2 quarters and provides us comfort that the marginal risk-on allocations we held was the right decision for portfolio and client outcomes.

Figure 2: Asset Allocation Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

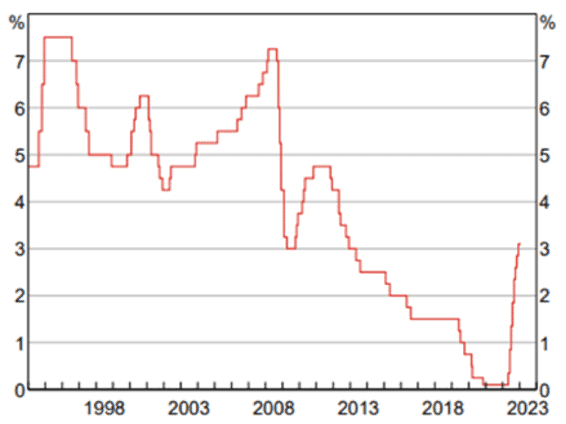

Over 2022 Australian interest rates rose by a whopping 3% (see Figure 3) and in a historical context represents one of the sharpest rises in interest rates since 1990s. Over the last 3 years, we saw the largest combined monetary and fiscal experiment in recorded history resulting in runaway inflation and central banks globally scrambling to keep it under control. This is by no means a localised event as we see the same story playing out in the US and Europe.

Figure 3: RBA Cash Rate Target

Source: Reserve Bank of Australia

We believe we are closer to the end of the hiking cycle compared to the start. We have seen moderation in economic activity; and importantly more cost-cutting activity by large corporations. Interest rates which have risen over the year have affected everything from consumer demand to the costs of borrowing. Anyone paying a variable rate mortgage would have felt its effects by now.

Consequently, slowing demand has started to affect corporate revenues and earnings. We believe that earnings going forward will decline into the first half of 2023. However, our review of equity market valuations suggests this has been somewhat incorporated into prices today.

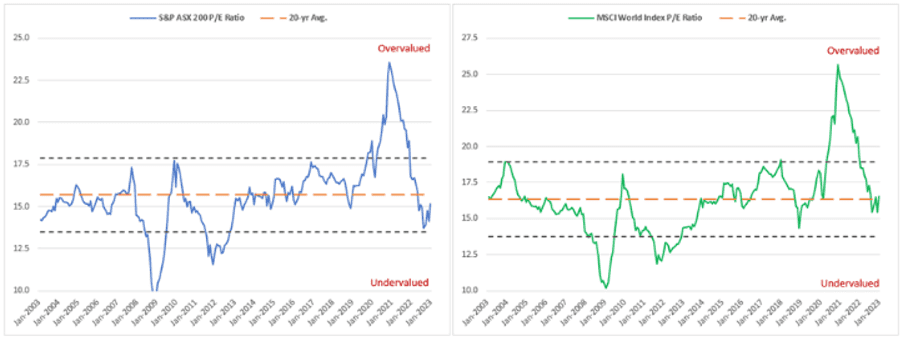

Figure 4: Australian and US Equity Market Valuations

Source: Allied Wealth, Investment Management Partners

We discuss below two likely scenarios we expect to play out over the coming year as well as our thinking.

Scenario 1 – Economic Soft Landing (Allied Wealth’s Base Case)

In this scenario Central Banks globally are mindful of the forward impact of rising interest rates, having taken notice of moderating economic indicators. Despite high historical inflation, central bankers stop raising interest rates with a view of keeping current rates steady going forward.

Under this scenario, expectations of earnings and margin compression have been largely baked into equity valuations and we see limited downside before an eventual recovery. Equity markets are likely to trend upwards over the forward period but with higher levels of volatility.

Scenario 2 – Economic Hard Landing from Rising Rates (Probable Scenarios but NOT Base Case)

While not the base case, we see scenario 2 as a probable outcome given how some central bankers remain glued to historical inflation numbers. Under this scenario, despite moderation in economic activity, central bankers wait for concrete proof of falling inflation (Note inflation is a lagging economic indicator by about 1-year).

Sharp and continued rise in interest rates results in a structural destruction of demand. The resultant negative corporate earnings induce large cost cutting exercises which in turn leads to a spike in unemployment. This combined with the higher interest rates imposed by central banks affect residential property prices as people fail to meet mortgage payments and defaults rises. Based on today’s equity market valuations, we expect equity downside of approximately -10% to -15% eventuate.

Given the scenarios discussed above, we believe maintaining a marginal growth overweight remains the prudent course of action. If Scenario 1 plays out, we are likely to continue to hold our marginal overweight longer as we let market digests the earnings season going into Q2 2023.

However, if Scenario 2 eventuates, we would look to materially increase our allocation to growth assets. An economic hard landing would eventually (this may take a year or so) force central banks to reduce interest rates again, albeit not to the same magnitude as we have seen. This will in turn allow equity markets to recover as confidence re-emerges and inflation starts normalising. We consider an equity market entry point at -15% lower than today’s valuations an attractive investment proposition and would look to allocate materially at this point.

Balancing the risks discussed in Scenario 1 & 2, we retain the marginal growth bias across all risk models. Positions today remain appropriately sized given the range of expected outcomes and we are closely monitoring both economic conditions and market valuations for key catalysts discussed previously.

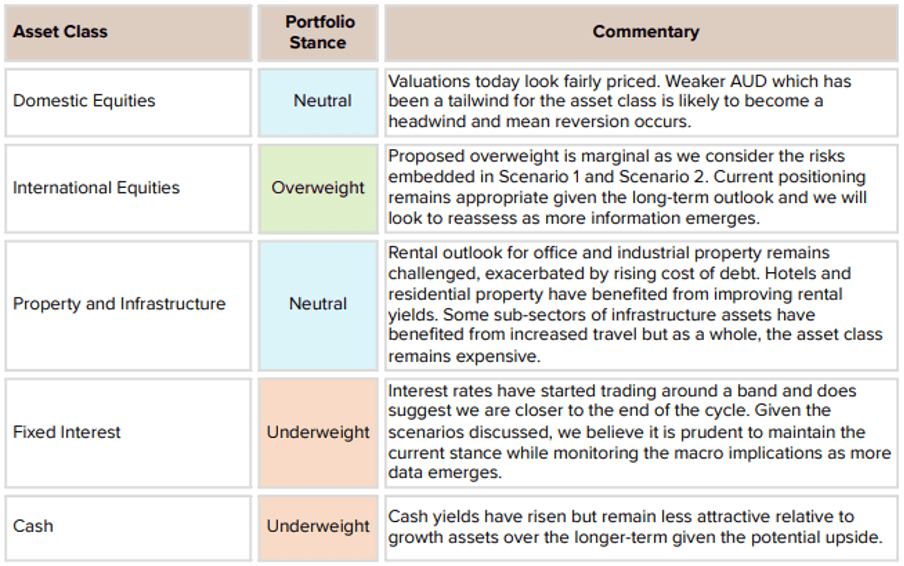

Figure 5: Asset Class Summary and Portfolio Stance

Australian Shares over the next decade

Over the past decade, Australian shares have underperformed global stocks, with Australian companies being viewed as boring, mature, and low growth when compared with the exciting opportunities offered by global companies, particularly the large tech FAANG[1] and now MAMAA[2] companies.

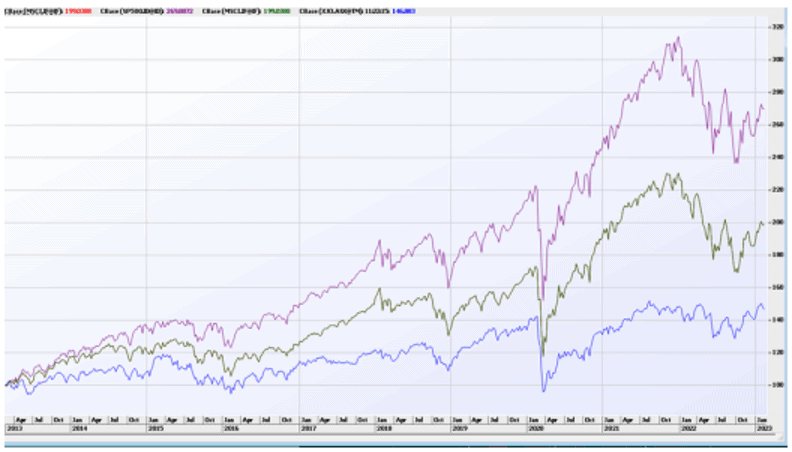

Since February 2013, Australian shares (ASX 200) have underperformed global shares (MSCI World Index) and US shares (S&P500) significantly. The below chart shows that the S&P 500 is up +170%, ahead of the 46% gain in the ASX 200. The broader global MSCI Index is up 100%, though US stocks typically comprise around 60% of the global index. However, this dynamic changed in 2022, as rising interest rates, falling tech valuations and potential recessions in the USA and Europe saw global shares fall close to -20% versus a small loss for the ASX 200. More troubled market conditions expected over the coming years will likely see Australian shares build on 2022 and be an attractive place to invest.

[1] Facebook, Amazon, Apple, Netflix and Google

[2] The 2022 version: Meta, Apple, Microsoft, Amazon, and Alphabet with accounts for Facebook and Google changing their names and adds Microsoft.

Figure 6: Comparing the S&P500, MSCI World and the ASX 200 over the past decade

From reading the financial press, one could gain the impression that stock markets are highly correlated and trade in a similar fashion. Whilst this is the case in the short term and during crises such as March 2020. Over the longer term, share market indices are made up of a collection of companies invariably operating in different industries with profits that are influenced by different factors. For example, the S&P 500 is dominated by Tech (Apple), Healthcare (United Health) and Consumer Discretionary (Amazon/Tesla) companies, with mining, energy and domestic banks a small weight. This is the exact opposite of the ASX, where mining, domestic banks and energy are the three largest sectors, with tech and consumer discretionary small sectors.

For much of the past decade, investors were rewarded for buying companies trading on a high price-to-earnings ratio (share price divided by earnings per share) as the good times were never going to end. All that mattered for companies such as Square, Tesla and Zoom was global domination and optimistic estimates of a company’s total addressable market.

In this heady environment, companies like Commonwealth Bank, BHP, Transurban and Woodside looked pretty boring, as their earnings were relatively detached from the global economic cycle. Many ASX companies typically offer goods and services to domestic consumers, earning high margins but with growth constrained by Australia’s GDP growth. In 2023 with global markets digesting potential recessions in Europe and the USA, these “boring” Australian companies are now looking quite defensive and attractive.

Conversely, investors are now more suspicious of the growth these former high-flying tech companies promised and the companies themselves aggressively laying off staff to conserve capital in a slowing economy. The February 2023 reporting season has already shown that most Australian companies will see minimal to no impact on profits from the war in Ukraine, rocketing energy prices in Europe or a recession in the USA.

Many large Australian companies operate in oligopolies that face lower levels of competition than equivalent companies in the USA and Europe, generally due to Australia’s small market and geographic isolation. This allows many Australian companies to earn significantly higher profit margins than comparable companies offshore. For example, Woolworths or Commonwealth Bank have consistently enjoyed higher profit margins than Kroger or Well Fargo.

After the banks were deregulated in 1983, many foreign banks received banking licences, and the cosy environment for Australia’s banks seemed at an end. However, in the intervening years, virtually all these banks have exited the domestic banking market and retreated to their home markets. Woolworths and Coles have seen off challengers such as Germany’s Kaufland, with Costco still struggling to make much headway. The lone successful entrant into the grocery market has been Aldi which built critical mass around a decade ago, flying under the radar while Coles was in disarray and Woolworths dismissing that Australian shoppers would ever warm to the company’s quirky home brand offerings.

Over the period 2013 to 2021, interest rates in Australia and globally declined steadily until they reached close to zero in 2021, the lowest level in human history since Hammurabi capped loans on silver at the Bank of Babylon at 20% in 1750 BC. In this environment of free money, companies paying dividends were looked at askance by many investors, citing returning profits to shareholders as evidence that their management teams had run out of ideas as to where to invest in driving growth in the future.

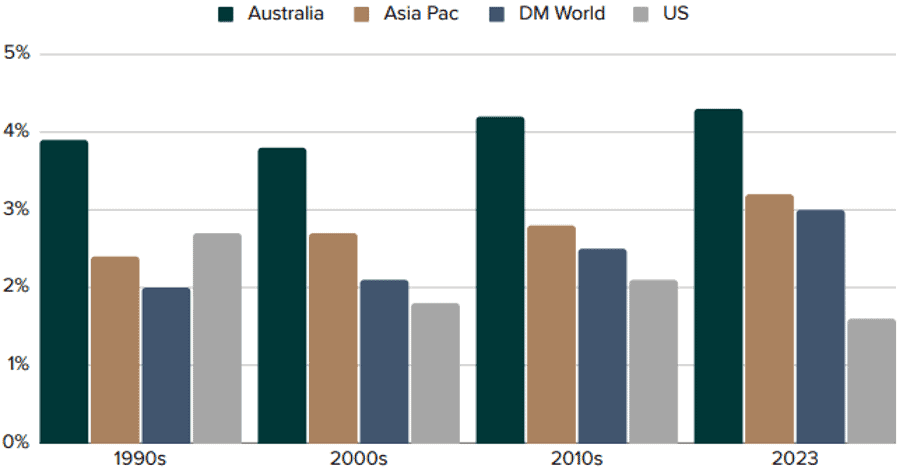

Consequently, many global investors passed on buying Australian companies. Australian companies typically pay much higher dividends than their global counterparts due to a combination of our taxation regime that encourages the payment of franked dividends and the ASX being populated by mature profitable companies operating in established markets.

Additionally, most long-term investors will recognise the frequently terrible offshore “growth acquisitions” made by companies in all sectors (probably except for healthcare) and would prefer to have excess capital returned to shareholders rather than wasted buying hardware stores in the UK, shale gas in the USA or domestic banks globally.

Figure 7: Dividend yields by decade - ASX vs offshore equities

Source: Refinitiv, UBS

However, with the normalisation of interest rates in 2022 and 2023, a profitable but boring company paying dividends today looks more attractive than companies offering minimal earnings today but promising high profits in the future. As interest rates rise, the net present value of future profits potentially earned in 10 years is discounted more heavily, making dividends paid today more attractive. Additionally, in the current growth environment investors face, income-paying companies are looking more attractive.

Over the medium term, the outlook for Australian shares looks healthier than for many other developed markets, with the share market winners of the next ten years almost certainly looking different to those of the past decade. In a low-growth world with higher interest rates, greater economic uncertainty and inflationary pressures, the conditions for Australian shares to outperform appear to be building. In particular, a portfolio of ASX companies with low levels of gearing, operating in established industries, with dividends growing ahead of inflation, is likely to both outperform and help investors sleep easier at night.

Markets have certainly kept us on our feet in 2022, and we don’t think 2023 will be any different. But for all our clients we hope you have had a fantastic start to the year and hopefully the rest of it will be less tumultuous compared to financial markets!

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Whilst the seasons might be changing, for financial markets it was more or less the same. Themes discussed in the last newsletter remain dominant today – we sound a bit like a broken record repeating ourselves.

Central banks and their actions continue to wield an outsized influence on the direction of equity, bond, and currency markets. Over the quarter, asset allocation performance has been flat relative to the strategic asset allocation. Size of positions were small in-line with the cautiously positive overall outlook.

Figure 1: Allied Wealth Asset Allocation Performance – 3-Months to 30th September 2022

| 3-Months to 30th Sept 2022 | Moderate | Balanced | Growth | High Growth |

| Asset Allocation | -1.6 | -1.7 | -1.8 | -1.9 |

| Strategic Asset Allocation | -1.6 | -1.7 | -1.8 | -1.8 |

| Excess Return | 0.0 | 0.0 | 0.0 | -0.1 |

Source: Allied Wealth, Morningstar

Performance over the September quarter was characterised by a strong equity market rally in the first half followed by a fall in the second half. What stood out overall was the strength of the US dollar relative to most developed market currencies, which supported the relative outperformance of unhedged relative to hedged international equities.

Figure 2: Asset Class Performance as at 30th September 2022

Source: Allied Wealth, Morningstar

On the economic front, more data points have emerged to suggest that aggregate demand is softening, while higher interest rates have started to weigh on consumer and corporate spending.

Supply chain disruptions and the energy crisis, which were major themes early this year, have started to rectify themselves. Cost of shipping has fallen since the start of the year, while factory manufacturing activity has slowed. Natural gas prices have been volatile but current levels are much lower compared to previous peaks.

Figure 3: Natural Gas Prices in USD 2022 Year-to-Date

Labour conditions remain robust, but we believe it is a matter of time before the reduction in demand translates into weaker wage growth. As with all these data points, timing is the greatest uncertainty!

As the song goes – Why Can’t We Be Friends?

Putting aside economic indicators, we highlight longer-term structural trends from the evolution of the US-China relationship. So far into 2022, the US government has imposed further trade restrictions (on China), particularly as they relate to technology exports forcing a growing divide between global companies choosing to work closer with China, or with the US.

Over the quarter, we observed on-shoring or friend-shoring activity (mostly relocation of factories away from China to the US or jurisdictions friendly to the US) as companies look to build out supply chains more resilient to geopolitical risks.

Consequently, China has experienced a substantial outflow of foreign capital. Discussions with asset owners and managers indicate majority of remaining investments in China today reflect opportunistic positions rather than core long-term holdings. We are not surprised by this given the success of Xi Jin Ping in consolidating power and winning a precedent-breaking third term as party leader. The world is bracing for further escalation of geopolitical conflict.

What Does This Mean for Our Portfolios?

Developed market central banks have continued to tighten monetary policy. At the current pace we see an increased probability of a recessionary scenario as bankers have focused primarily on headline inflation. Equity market valuations look attractive on a historical basis – equity markets have generally fallen in-line with changing expectations of interest rates.

China whilst still considered a large part of the global growth engine, is expected to play a reduced role over the longer term. We expect to see other countries benefit from this and in turn should lead to a more diversified global growth profile.

Liquidity conditions have continued to tighten due to a combination of higher debt costs (reducing transaction volumes) and reticence of asset owners to deploy capital into a volatile market.

Over the long-term, we continue to expect earnings recovery as companies readjust to more challenging market conditions. Over the short-to-medium term, we see a situation where a mild recession triggered by central banks are met with static monetary policy as bankers look to retain ammunition against future systemic risk events.

In-line with this view, we retain the marginal growth bias across all risk models. Positions today remain appropriately sized given the range of expected outcomes both on the upside and downside.

Figure 4: Asset Class Summary and Portfolio Stance

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | Valuation continues to look cheap. Asset class has been supported by the slower pace of monetary policy as well as a substantially weaker AUD (relative to USD). |

| International Equities | Overweight | Proposed overweight is marginal given the distribution of near-term risk. Earnings recovery is likely over the medium to long-term. |

| Property and Infrastructure | Neutral | Rental outlook for the sector remains broadly challenged, particularly for the Retail and Office sector. Industrial property continues to trade expensively in contradiction to the reduction in demand. Infrastructure as a sector has continued to trade expensively. |

| Fixed Interest | Underweight | Interest rates have risen materially over the year-to-date in-line with global policy rates. Economic conditions have moderated further, although market uncertainty around terminal rates implies that rate volatility is likely to continue over the short-term. |

| Cash | Underweight | Cash yield have risen but remains less attractive over the medium-term compared to growth assets given the potential upside. |

Bottom-Up Market Observations

Over the next twelve months, we expect that the two key factors driving equity markets will be rising interest rates and a weaker Australian dollar, both of which will be positive for many of the companies in the Portfolio.

This year we saw the end of near-zero interest rates, unprecedented over the past five thousand years of human commercial transactions, below previous low points of 4% in Ancient Rome in 1 AD and 1.12% from the Republic of Genoa in 1619! Rising or, more accurately, normalizing of interest rates will present a challenge for many newly listed tech companies. Often these companies have business models that require low-interest rates, accommodating bankers and equity markets willing to finance losses.

This year has been a tough for high-priced tech stocks with minimal to no earnings today and only the promise of large profits in the distant future. In an environment of close to zero interest rates, investors are willing to pay very high prices for large distant future profits, which have a present high value when discounted using a rate close to zero.

Rising rates make the “boring” profits and dividends of companies such as Amcor, Ampol and Transurban look more attractive than a tech company promising large “blue sky” cash flow in 20 years. This occurs as the present value of profits delivered today or next year are worth more than profits that may be generated in 10 of 15 years.

Additionally, the Portfolio is constructed to be well hedged against rising interest rates due to either earnings being linked to increasing rates or the company having pricing power to pass on higher costs to their customers. Our positions in insurance companies, toll roads and banks will benefit from rising interest rates.

One factor that is currently being ignored by the market is the impact of a falling Australian Dollar. Over the past year, the AUD has declined by 16% against the USD to sit at US 64 cents. The last time that the AUD was consistently at this level was in early 2009. While this is bad news for those planning ski holidays in Colorado at Christmas, it is good news for many companies in the Portfolio that either have significant operations outside of Australia, or export goods that are sold in USD with costs incurred in AUD. For example, chemical company Incitec Pivot benefits from a falling AUD in two ways. Firstly, the profits Incitec earns in the USA from selling ammonia and explosives are now worth more when translated into Australian Dollars. Secondly, the fertilizer that Incitec manufactures in Australia is priced to compete with imports. A falling AUD makes imported fertilizer more expensive, thus allowing the company to increase their prices and expand their profit margins.

Currently, around 44% of profits generated in the Portfolio will see a positive impact from a falling AUD, with the bulk of these profits earning in USD. Suppose the current weakness in the AUD is maintained. In that case, Atlas expects a significant increase in AUD-reported profits and AUD dividends for the companies held in the Portfolio in the February 2023 reporting season. This occurs because one US dollar of earnings has increased by 16% for Australian-domiciled investors.

May the odds be ever in your favour! It’s been an exciting Melbourne Cup week and the race has left us with great memories but lighter pockets!

Yours faithfully,

Allied Wealth Investment Committee

As we prepare this commentary, it is a wet and cold Sydney morning like many we’ve had to bear this year. Days like these serve as a reminder that sunshine is not a guarantee and every now and then we must endure periods of rain and gloom. Like financial markets, we seem to be going through a wet patch and as much as it makes our portfolio dark and deary, we know sooner or later the sun will shine again.

What a year 2022 has been. Just as we emerge out of lock down and learn to live with the pandemic, we are confronted with the Russian invasion of Ukraine, causing more supply-side issues and pushing inflation higher. When we talk to statisticians, they term COVID19 and the Ukraine invasion as a 1 in 100-year event…and yet, we have had two of these events in the last three years.

For the first time in a long time, we saw a positive correlation between equities and bonds as both growth and defensive assets fell. What we found most interesting was that through this period, GDP growth remained positive and labour markets are now stronger than they have ever been compared to the last 15 years.

Figure 1: Asset Class Performance Over 3 Months and 1-Year to June 2022

Source: Allied Wealth, Morningstar

Analysing data points and market themes, what stands out today is the outsized impact central banks have on financial markets. Whilst media pundits would point to inflation or animal spirits, our considered view remains that central banks, more specifically the reaction of central bankers to economic conditions, have been the primary drivers of market performance during 2022.

Alongside quantitative easing, central banks have one other significant tool in their kit which is the ability to adjust cash rates (referred to as Monetary Policy), and this in turn affects everything from borrowing costs to corporate behaviour. Unfortunately, this very blunt instrument is being used to solve a myriad of complex market problems.

Much like an axe, monetary policy is much better used to chop down the tree of aggregate demand than it is to kill the flies of inflation, especially when recent prints have been largely driven by supply-side issues. Whilst a fly swatter may be better, the only tool central bankers have is an axe, so markets are justifiably concerned about the precision of policy makers.

The blunt nature of monetary policy has resulted in an increase in market uncertainty for both equity and bond investors leading to the broader sell off. Equity investors are unclear what the net flow-through impact may be on company earnings whilst bond investors have seen their portfolios reprice lower as interest rates rose (the value of the bond inversely relates with higher interest rates – therefore meaning lower bond valuation).

More recent economic data points show that economic growth is moderating, but it remains too early to tell. There are also signs that supply chains have begun to recover for the second time, but timeframes vary greatly from industry to industry. At this point we could keep going on about the broad range of expected outcomes, possibilities and probabilities. However, as much as this may be an interesting thought exercise, the key question remains: where to from here?

What Can We Say More Definitively?

Based on a broad range of outcomes, taking a position on a short-term basis is a fool’s game as there does not seem to be sufficient information to form a short-term investment conviction. It is more likely that contradictory economic data will emerge leading to wild swings in asset prices a.k.a. market volatility.

Rather than a short horizon, a longer-term focus remains the smarter choice.

From a long-term perspective:

What Does This Mean for Our Portfolios?

Given where equity valuations sit relative to the long-term expected growth, we feel the probability and magnitude of return upside is much larger than the downside. Despite the lower probability, downside concerns have tempered the sizing of our risk-on allocation. Thus, we have proposed and implemented a marginal growth bias across all risk models. We will be looking to increase this risk-on position as more supportive economic data emerges.

Figure 2: Asset Class Summary and Portfolio Stance

Note: Summary has been provided on an asset class basis. Please discuss actual asset allocations with your adviser as they may vary from model to model based on portfolio construction.

Rising inflation, the expectation of central bank rate hikes and the ongoing war in the Ukraine saw investors globally become more risk adverse during 2022. However, the companies that fell the most were typically expensive high price to earnings (PE) companies, anything related to crypto, tech companies or loss-making companies with unproven business models. All types of companies avoided by the Allied Portfolio’s Australian Equity investment process.

Additionally, 2022 has been a tough period for high priced tech stocks that generally have minimal to no earnings today, but the promise of large profits in the distant future. However, this always assumes that management’s grand plans are not disrupted. In an environment of close to zero interest rates, investors are willing to pay very high prices for large distant future profits, which have a present high value when discounted using a rate close to zero.

Rising rates make ‘boring’ profits and dividends of companies such as Amcor, Ampol and Transurban look more attractive than a tech company promising large ‘blue sky’ cash flow in 20 years’ time. This occurs as the present value of profits delivered today or next year are worth more than profits that may be generated in 10 of 15 years’ time.

Historically rising interest rates have diverted household expenditure from non-discretionary areas such as restaurants, travel and purchases of consumer goods to servicing mortgages. However, the tightening cycle in 2022 will look different to previous tightening cycles due to the potential bigger influence of fixed mortgages.

Companies that are adversely affected by rising rates are those in the consumer discretionary area, such as Myer, Flight Centre and Wesfarmers. Supermarkets and liquor retailers such as Coles, Endeavour and Woolworths tend to see a bounce from increases in dining at home & food inflation. Gambling stocks such as Tabcorp and the Lottery Company theoretically should see falling earnings, though historically that has not been the case, which says something about the foibles of Australians.

On the positive side, financials such as banks and insurance companies tend to do well in rising interest rate markets which sees higher profit margins. Banks will benefit from rising rates due to expanding net interest margins, less obvious beneficiaries are the insurance companies. For example, QBE holds an insurance float of US$29 billion. This ‘float’ incurs premiums paid upfront with claims paid out years later, with this bucket of cash being constantly replenished. Insurance companies are required to mostly hold their investments in high-quality government and corporate bonds as well as short term money market instruments, generally in the geographic area of insurance.

This has seen QBE's shareholders receive a minuscule return on this float for the past decade, with 1% earned in 2021 as interest rates were at historic lows in the USA, Europe and Australia. Rising interest rates combined with a hardening insurance market will see a significant expansion in investment earnings for QBE along with all insurers.

Less intuitive are utilities like Transurban, which you would think would do poorly in a rising rate environment due to their high level of interest costs. However due to long term hedged cost debt with a maturity close to 8 years and toll escalators linked to inflation; Transurban will see an estimated $50M per annum benefit over the next 4 years from every 1% increase in inflation.

The Allied Wealth Investment Committee are pleased with how the Portfolio is positioned, every company is profitable, sensibly geared or in several cases has no debt and every company pays a dividend. During times of market stress and rising interest rates, companies that pay a steady dividend that is growing ahead of inflation provide an airbag not enjoyed by loss-making companies and 'concept stocks' promising vast profits in the distant future.

Finally, this winter has shaped up to be one of the least enjoyable ones for some years. This sentiment is further compounded by a particularly bad flu season and virulent COVID19 strains. I hope everyone keeps well through this season.

We look forward to speaking to you again soon. In the meantime, if you have any questions about this commentary or your portfolio your adviser will be very happy to help.

Yours faithfully,

Allied Wealth Investment Committee