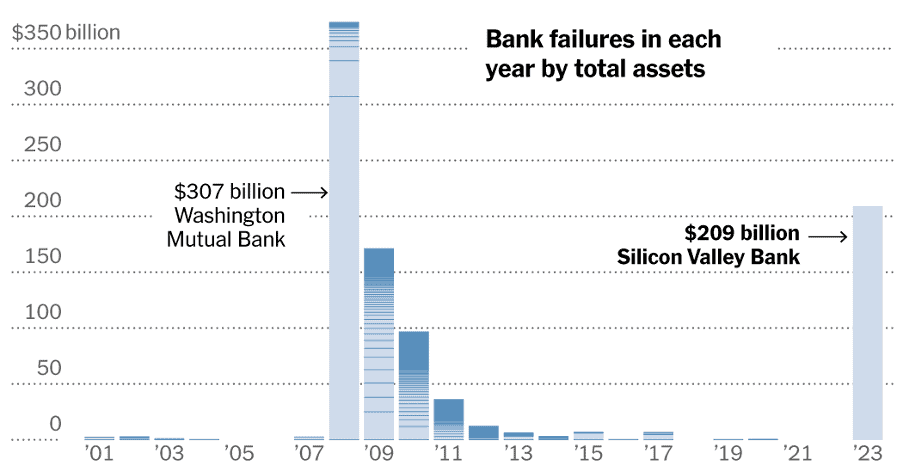

As you may have already seen in the news, US regulators moved to close Silicon Valley Bank (SVB) on the 10th of March. This was followed by the closure of Signature Bank on the 12th of March. Interestingly, the collapse of these two banks represents the 2nd and 3rd largest bank collapse in US history.

Figure 1: Comparison of Silicon Valley Bank Failure Rel. Historical Experience

Whilst these developments are specific to SVB and its circumstances, regulators are worried that this may trigger a much broader run-on banks – particularly for regional/smaller banks in the US.

To restore calm, US regulators have moved promptly to shore up depositors and guarantee all deposit balances irrespective of amount (legal maximum guarantee of $250k is legislated). Additionally, the Federal Reserve made emergency loans available to all other banks and have since seen a take-up of $1.7 Billion.

While we can argue around the moral hazard of what can be construed as a bank bail-out, what is apparent is that a broad-based bank run poses a systemic risk to both the US and global economy.

At the time of writing, we have also seen the solvency of Credit Suisse being called into question. Credit Suisse shares fell 40% prompting the Swiss Central Bank to extend a CHF 50 Billion credit line to help the bank meet any short-term funding needs.

Since the 8th of March, equity markets have seen a broad sell-off followed by a rebound two days following the announcement of emergency support measures. US banks however have fallen by -22.1% with massive intra-day volatility in share price.

Across bond markets, government bonds rallied as we saw an initial flight to safety followed by a marginal fall as markets continue to evaluate the situation. Credit spread widened on contagion risks but have since moderated.

Australian and International Equities are still lower post event at -4.3% and -2.4% respectively, while Australian and International Fixed Interest are positive at +2.1% and +1.9% respectively.

It is clear this event has spooked markets and we expect volatility to continue as investors reassess incoming news.

We have completed a look-through of our portfolios and note there are no direct holdings in SVB; However, portfolios have a marginal exposure to Signature Bank via T Rowe Price Global Equities equating to approximately 0.04% on a portfolio look-through basis.

Given the size of the exposure we are less concerned around the direct portfolio impact but are more concerned around how this changes the longer-term investment outlook.

Quite frankly like the rest of the market we are still analysing incoming data. Our base case at the time of writing remains that Central Banks and regulators globally will be successful in stemming the short-term market panic and associated risks of more bank-runs.

However, over the longer-term we believe this event represents the first of many more to come, particularly as higher interest rates start working its way through the economy. This event is likely to weigh on central banking decision making especially when considered in combination with inflation prints which have remained stubbornly high. Over time we expect credit spreads to structurally shift wider as markets incorporate higher debt cost and increased default probabilities.

Portfolios today are well positioned to weather the bouts of market volatility. For now, we believe the action of central banks and regulators have been quick and decisive enough to stem a broader marker panic. We will look to provide another update to the investment outlook post the March 2023 Investment Committee as the situation evolves.

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

2023 has gotten off to a roaring start. Despite a sharp equity rally in January, risks that were prevalent at the end of 2022 continue to plague the markets. I would liken the equity rally as investors cautiously stepping out across a frozen river – positive they can make it through, but knowing they could fall in at any time. Over the 3 and 6-month periods to December 2022, growth assets have outperformed defensive assets.

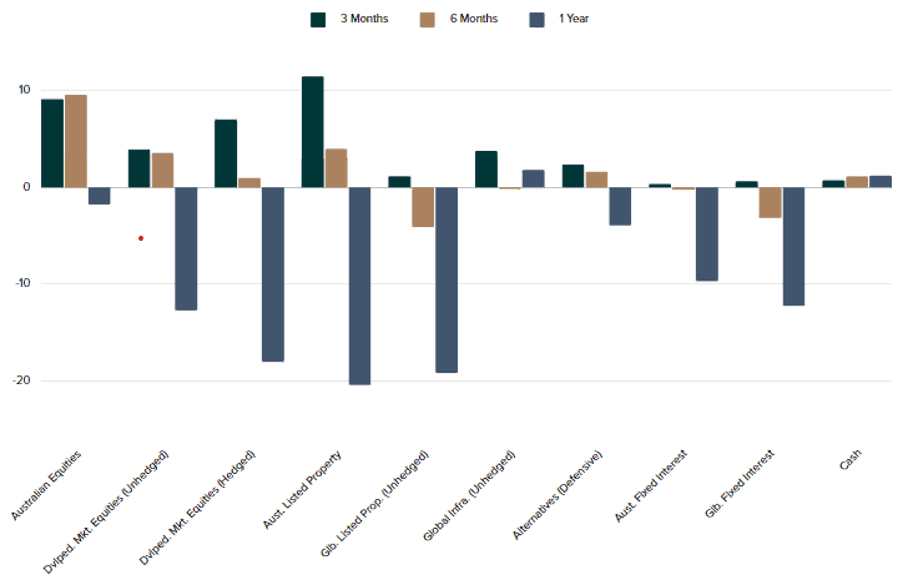

Figure 1: Asset Class Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

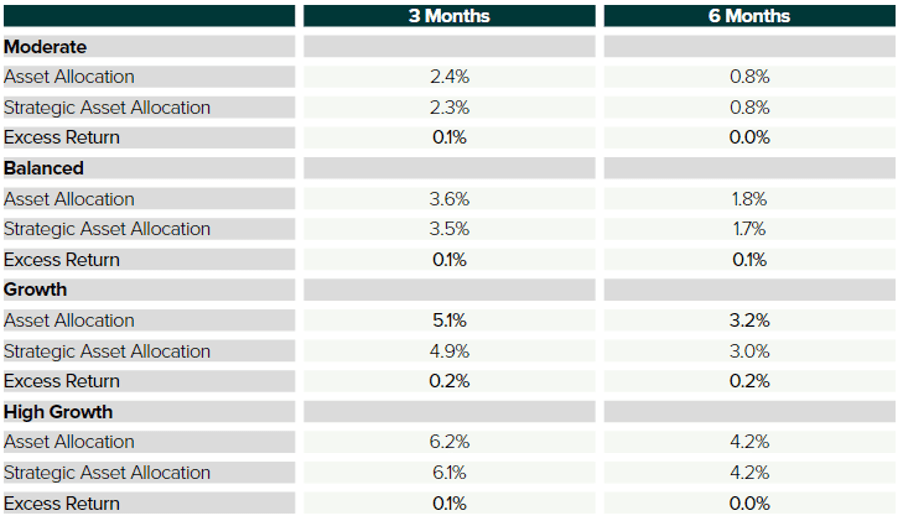

Asset allocation positions taken over the last 3 to 6 months have added value to portfolio outcomes. However the cautious positioning has meant that excess returns relative to benchmark Strategic Asset Allocation (SAA) are marginal. Peering under the hood, it has certainly been a bumpy ride through the last 2 quarters and provides us comfort that the marginal risk-on allocations we held was the right decision for portfolio and client outcomes.

Figure 2: Asset Allocation Performance as at 31 December 2022

Source: Allied Wealth, Morningstar

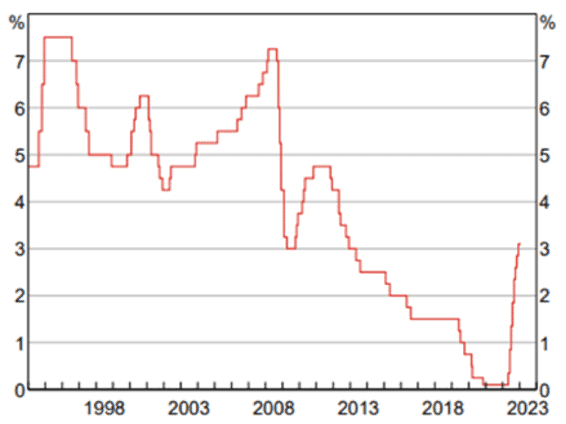

Over 2022 Australian interest rates rose by a whopping 3% (see Figure 3) and in a historical context represents one of the sharpest rises in interest rates since 1990s. Over the last 3 years, we saw the largest combined monetary and fiscal experiment in recorded history resulting in runaway inflation and central banks globally scrambling to keep it under control. This is by no means a localised event as we see the same story playing out in the US and Europe.

Figure 3: RBA Cash Rate Target

Source: Reserve Bank of Australia

We believe we are closer to the end of the hiking cycle compared to the start. We have seen moderation in economic activity; and importantly more cost-cutting activity by large corporations. Interest rates which have risen over the year have affected everything from consumer demand to the costs of borrowing. Anyone paying a variable rate mortgage would have felt its effects by now.

Consequently, slowing demand has started to affect corporate revenues and earnings. We believe that earnings going forward will decline into the first half of 2023. However, our review of equity market valuations suggests this has been somewhat incorporated into prices today.

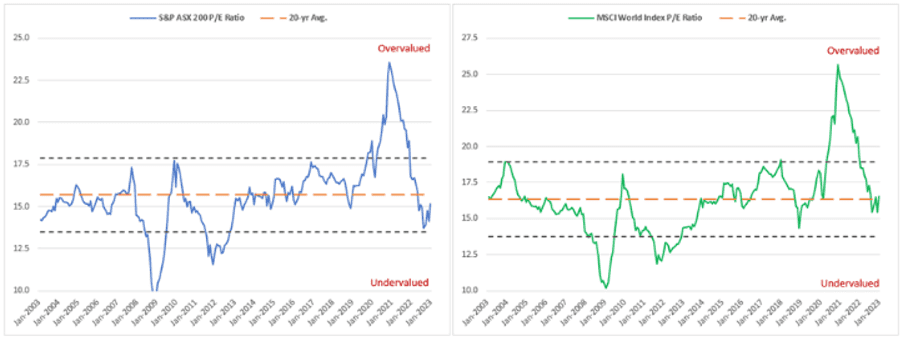

Figure 4: Australian and US Equity Market Valuations

Source: Allied Wealth, Investment Management Partners

We discuss below two likely scenarios we expect to play out over the coming year as well as our thinking.

Scenario 1 – Economic Soft Landing (Allied Wealth’s Base Case)

In this scenario Central Banks globally are mindful of the forward impact of rising interest rates, having taken notice of moderating economic indicators. Despite high historical inflation, central bankers stop raising interest rates with a view of keeping current rates steady going forward.

Under this scenario, expectations of earnings and margin compression have been largely baked into equity valuations and we see limited downside before an eventual recovery. Equity markets are likely to trend upwards over the forward period but with higher levels of volatility.

Scenario 2 – Economic Hard Landing from Rising Rates (Probable Scenarios but NOT Base Case)

While not the base case, we see scenario 2 as a probable outcome given how some central bankers remain glued to historical inflation numbers. Under this scenario, despite moderation in economic activity, central bankers wait for concrete proof of falling inflation (Note inflation is a lagging economic indicator by about 1-year).

Sharp and continued rise in interest rates results in a structural destruction of demand. The resultant negative corporate earnings induce large cost cutting exercises which in turn leads to a spike in unemployment. This combined with the higher interest rates imposed by central banks affect residential property prices as people fail to meet mortgage payments and defaults rises. Based on today’s equity market valuations, we expect equity downside of approximately -10% to -15% eventuate.

Given the scenarios discussed above, we believe maintaining a marginal growth overweight remains the prudent course of action. If Scenario 1 plays out, we are likely to continue to hold our marginal overweight longer as we let market digests the earnings season going into Q2 2023.

However, if Scenario 2 eventuates, we would look to materially increase our allocation to growth assets. An economic hard landing would eventually (this may take a year or so) force central banks to reduce interest rates again, albeit not to the same magnitude as we have seen. This will in turn allow equity markets to recover as confidence re-emerges and inflation starts normalising. We consider an equity market entry point at -15% lower than today’s valuations an attractive investment proposition and would look to allocate materially at this point.

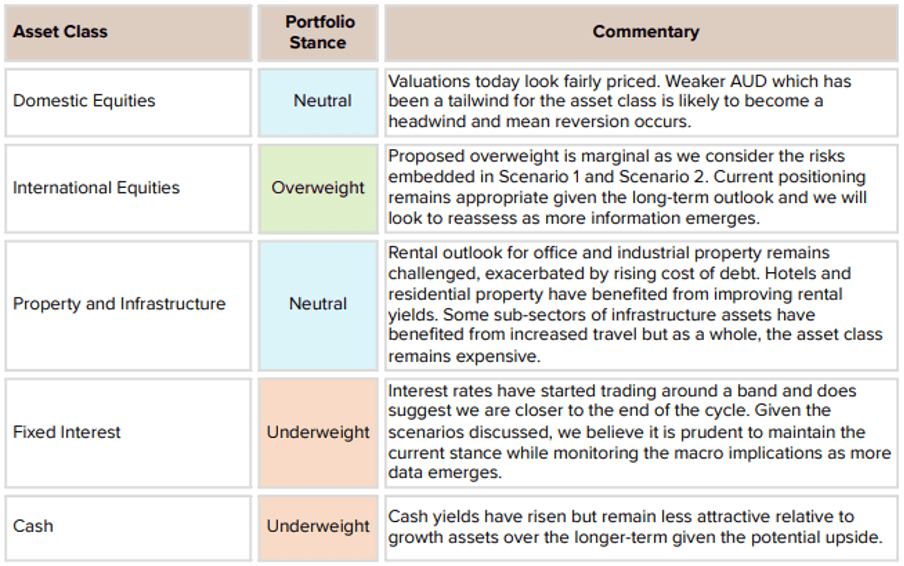

Balancing the risks discussed in Scenario 1 & 2, we retain the marginal growth bias across all risk models. Positions today remain appropriately sized given the range of expected outcomes and we are closely monitoring both economic conditions and market valuations for key catalysts discussed previously.

Figure 5: Asset Class Summary and Portfolio Stance

Australian Shares over the next decade

Over the past decade, Australian shares have underperformed global stocks, with Australian companies being viewed as boring, mature, and low growth when compared with the exciting opportunities offered by global companies, particularly the large tech FAANG[1] and now MAMAA[2] companies.

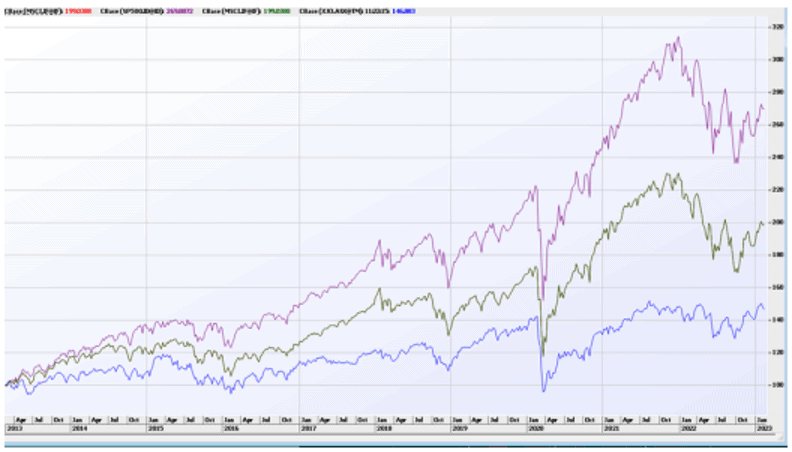

Since February 2013, Australian shares (ASX 200) have underperformed global shares (MSCI World Index) and US shares (S&P500) significantly. The below chart shows that the S&P 500 is up +170%, ahead of the 46% gain in the ASX 200. The broader global MSCI Index is up 100%, though US stocks typically comprise around 60% of the global index. However, this dynamic changed in 2022, as rising interest rates, falling tech valuations and potential recessions in the USA and Europe saw global shares fall close to -20% versus a small loss for the ASX 200. More troubled market conditions expected over the coming years will likely see Australian shares build on 2022 and be an attractive place to invest.

[1] Facebook, Amazon, Apple, Netflix and Google

[2] The 2022 version: Meta, Apple, Microsoft, Amazon, and Alphabet with accounts for Facebook and Google changing their names and adds Microsoft.

Figure 6: Comparing the S&P500, MSCI World and the ASX 200 over the past decade

From reading the financial press, one could gain the impression that stock markets are highly correlated and trade in a similar fashion. Whilst this is the case in the short term and during crises such as March 2020. Over the longer term, share market indices are made up of a collection of companies invariably operating in different industries with profits that are influenced by different factors. For example, the S&P 500 is dominated by Tech (Apple), Healthcare (United Health) and Consumer Discretionary (Amazon/Tesla) companies, with mining, energy and domestic banks a small weight. This is the exact opposite of the ASX, where mining, domestic banks and energy are the three largest sectors, with tech and consumer discretionary small sectors.

For much of the past decade, investors were rewarded for buying companies trading on a high price-to-earnings ratio (share price divided by earnings per share) as the good times were never going to end. All that mattered for companies such as Square, Tesla and Zoom was global domination and optimistic estimates of a company’s total addressable market.

In this heady environment, companies like Commonwealth Bank, BHP, Transurban and Woodside looked pretty boring, as their earnings were relatively detached from the global economic cycle. Many ASX companies typically offer goods and services to domestic consumers, earning high margins but with growth constrained by Australia’s GDP growth. In 2023 with global markets digesting potential recessions in Europe and the USA, these “boring” Australian companies are now looking quite defensive and attractive.

Conversely, investors are now more suspicious of the growth these former high-flying tech companies promised and the companies themselves aggressively laying off staff to conserve capital in a slowing economy. The February 2023 reporting season has already shown that most Australian companies will see minimal to no impact on profits from the war in Ukraine, rocketing energy prices in Europe or a recession in the USA.

Many large Australian companies operate in oligopolies that face lower levels of competition than equivalent companies in the USA and Europe, generally due to Australia’s small market and geographic isolation. This allows many Australian companies to earn significantly higher profit margins than comparable companies offshore. For example, Woolworths or Commonwealth Bank have consistently enjoyed higher profit margins than Kroger or Well Fargo.

After the banks were deregulated in 1983, many foreign banks received banking licences, and the cosy environment for Australia’s banks seemed at an end. However, in the intervening years, virtually all these banks have exited the domestic banking market and retreated to their home markets. Woolworths and Coles have seen off challengers such as Germany’s Kaufland, with Costco still struggling to make much headway. The lone successful entrant into the grocery market has been Aldi which built critical mass around a decade ago, flying under the radar while Coles was in disarray and Woolworths dismissing that Australian shoppers would ever warm to the company’s quirky home brand offerings.

Over the period 2013 to 2021, interest rates in Australia and globally declined steadily until they reached close to zero in 2021, the lowest level in human history since Hammurabi capped loans on silver at the Bank of Babylon at 20% in 1750 BC. In this environment of free money, companies paying dividends were looked at askance by many investors, citing returning profits to shareholders as evidence that their management teams had run out of ideas as to where to invest in driving growth in the future.

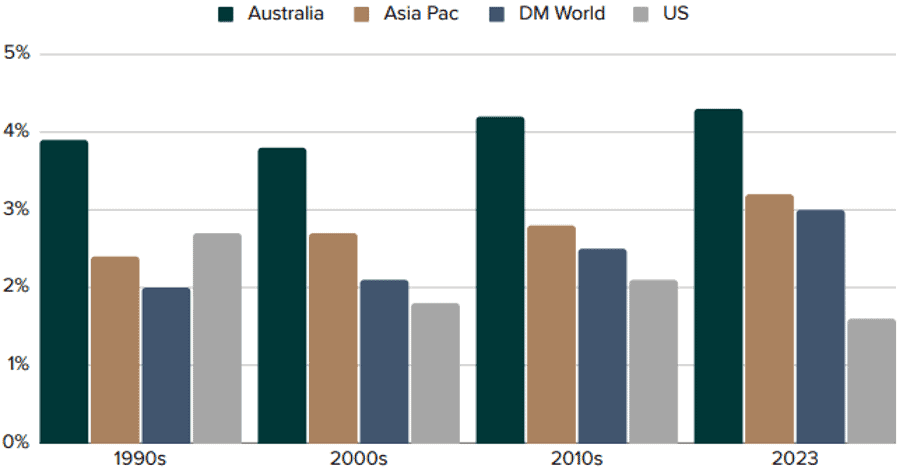

Consequently, many global investors passed on buying Australian companies. Australian companies typically pay much higher dividends than their global counterparts due to a combination of our taxation regime that encourages the payment of franked dividends and the ASX being populated by mature profitable companies operating in established markets.

Additionally, most long-term investors will recognise the frequently terrible offshore “growth acquisitions” made by companies in all sectors (probably except for healthcare) and would prefer to have excess capital returned to shareholders rather than wasted buying hardware stores in the UK, shale gas in the USA or domestic banks globally.

Figure 7: Dividend yields by decade - ASX vs offshore equities

Source: Refinitiv, UBS

However, with the normalisation of interest rates in 2022 and 2023, a profitable but boring company paying dividends today looks more attractive than companies offering minimal earnings today but promising high profits in the future. As interest rates rise, the net present value of future profits potentially earned in 10 years is discounted more heavily, making dividends paid today more attractive. Additionally, in the current growth environment investors face, income-paying companies are looking more attractive.

Over the medium term, the outlook for Australian shares looks healthier than for many other developed markets, with the share market winners of the next ten years almost certainly looking different to those of the past decade. In a low-growth world with higher interest rates, greater economic uncertainty and inflationary pressures, the conditions for Australian shares to outperform appear to be building. In particular, a portfolio of ASX companies with low levels of gearing, operating in established industries, with dividends growing ahead of inflation, is likely to both outperform and help investors sleep easier at night.

Markets have certainly kept us on our feet in 2022, and we don’t think 2023 will be any different. But for all our clients we hope you have had a fantastic start to the year and hopefully the rest of it will be less tumultuous compared to financial markets!

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160