At the time of writing (April 5), equity markets have fallen 12% since the beginning of March 2025. The most significant market drawdowns experienced on the 3rd and 4th of April coincided with:

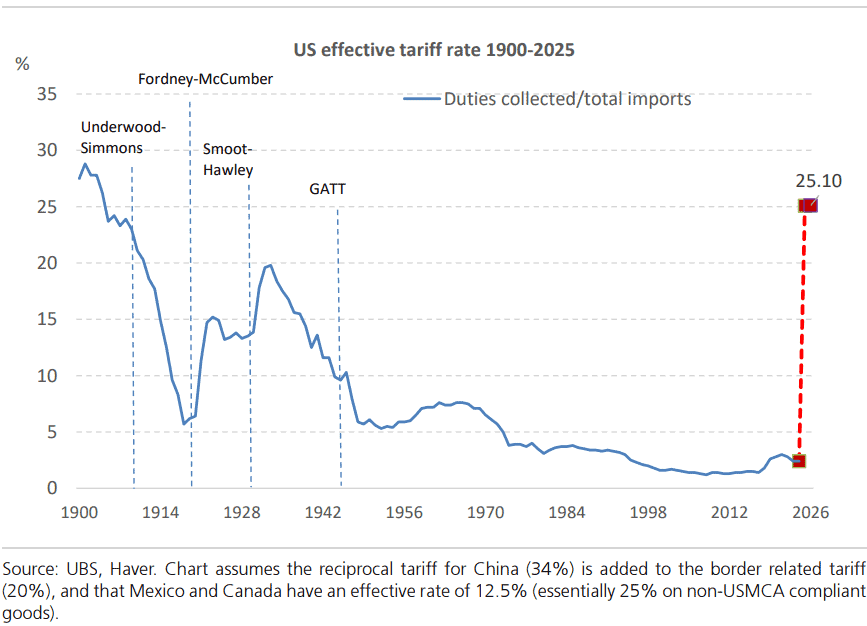

Cumulative tariffs implemented to date represent a reversal of the global trade progression over the last 100 years. Unlike 100 years ago, industrial manufacturing today is more sophisticated and interconnected than ever before. For instance, a car considered “US-made” today still relies on more than 40% non-US manufactured parts.

The magnitude of Trump’s “Liberation Day” tariffs has been far more aggressive than markets anticipated, with retaliatory tariffs by other nations still to come. Negotiations with Trump and his team have proven inconsistent at best, with the US administration abandoning its commitments in a matter of days. This persistent uncertainty in trade policy will continue to weigh on market sentiment.

You may have read multiple articles highlighting the risk of stagflation (persistently high inflation with high unemployment and low growth). We think of this risk as a tail-risk and would assign a low probability of stagflation at this time. Based on the anecdotal reaction by businesses to the tariffs, we think an economic recession over the short to medium term is more likely as businesses delay capital expenditure decisions, reduce their labour force and pass on costs to consumers – all of which will lead to a pullback in consumption and spending. The depth of the economic recession is uncertain and will be highly predicated on how the current situation evolves.

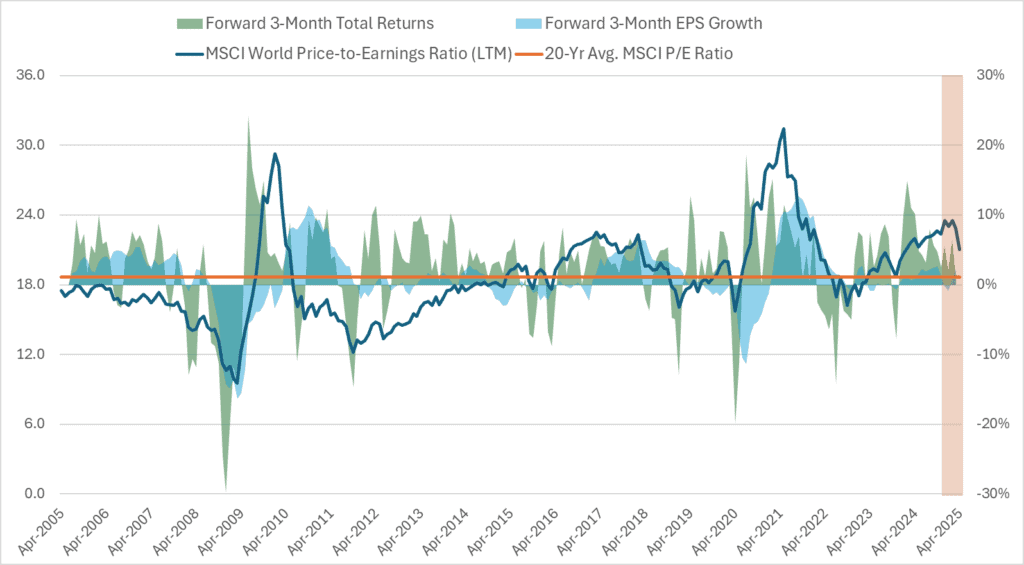

Over multiple client newsletters, we have consistently reiterated the view that markets continue to trade above fundamentals. However, the drawdown experienced to date (refer to orange bar in Figure 2) has moved International Equity valuations closer to an attractive entry point of around 18x. Should extensive drawdowns drive valuations to this desired level, we will review and assess buying opportunities.

Source: Bloomberg, Allied Wealth

While we expect a wide dispersion of outcomes over the short-term, we maintain a more bullish view over the longer-term. As noted in our previous commentary, pain for the consumer does not necessarily equate to a dire outcome for large multi-national corporations (but the adjustment will, of course, hurt!).

Much like the COVID-19 period and the interest rate rise of 2022, large corporates have maintained and grown market share through tough economic conditions at the expense of their smaller counterparts. While we do not think the current environment will be different, we think this adjustment will likely play out over a much more extended time frame. Thus, we are in no rush to increase our equity allocation (i.e., buy the dip) at the current time.

As always, the team at Allied Wealth remains committed to long-term client outcomes. Acknowledging the extremely volatile market conditions, we continue to monitor the geopolitical developments as they change from day to day.

If you have any questions or concerns, please do not hesitate to contact us.

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

Every February and August, most Australian listed companies reveal their profit results and guide how they expect their businesses to perform in the upcoming year. While we regularly meet with companies between reporting periods to gauge their business performance, the reporting season offers investors a detailed and externally audited look at the company's financials.

The February 2025 company reporting period that concluded last week highlighted how volatile earnings season can be when the market is at all-time highs. Share price volatility over the month was compounded by Trump's erratic trade policies, imposing and then reversing tariffs dented market confidence. The dominant themes of the February reporting season have been that the consumers continue to hold up, a strong US Dollar, inflation and cost management and a solid economic outlook. This week's piece looks at the key themes from the reporting season that fared last week, the best and worst results and how the Domestic Equities Portfolio performed over the month.

This February reporting season has proven to be more volatile than previous years. The average intraday share price move was 7% from the stocks that reported. Over 20 companies in the ASX 200 saw their share prices move by more than 10% on the reporting day. Small earnings misses saw significant share price moves; similarly, small earnings beats saw large share price movements. For example, A2 Milk posted a small $6 million increase in profits, which saw a $800 million increase in the company's market capitalisation on results day. Conversely, Viva Energy reported a $60 million fall in profits, and $1 billion was wiped off its value on February 25th!

In previous years, we saw prices move similarly to underlying earnings almost one-to-one, but this reporting season saw companies' share prices move over two times earnings revisions. The increased volatility has been attributed to the impact of high-frequency trading funds on setting prices on results day, with long-term holders likely to wait until after meeting management teams or even after the conclusion of reporting season in March before making significant portfolio changes. In February, Woolworths' share price saw a +2.5% gain after releasing their profit results, before falling all afternoon and finishing by -4%. Very frustrating for shareholders of the grocer.

The first dominant theme for the February reporting season was the strength of the domestic consumer. In November 2022, Westpac's economists forecasted a grim year for 2023. The much-feared fixed interest rate cliff is expected to see unemployment rise to 4.5%, an 8% fall in house prices, bad debts spike and retail sales grind to a halt.

Two years on, the February 2025 reporting season showed that consumer demand had not skipped a beat. JB Hi-Fi sales increased by 10% as consumers still demand the best technology and electronic products that will benefit from the AI rollout. Similarly, Kmart and Bunnings Warehouse owner Wesfarmers saw increased sales across its two flagship stores as consumers continued to trade down items, especially to Kmart's Anko brand.

On the negative side, consumers are unwilling to spend on large projects, including building new homes or upgrading bathrooms and hearing implants. This was seen in the results of Reece, which saw profits fall -19%, driven by lower housing starts due to high capital costs in both the United States and Australia. Cochlear surprised the market after reporting that in the USA, cost-of-living pressures have delayed some users' replacement of ageing sound processing technology due to higher out-of-pocket expenses to fund new sound processors.

Since these companies opened their books last August, the Australian Dollar has depreciated against most international currencies, including the US dollar. While this is a negative for those planning ski trips to Aspen or summer trips to Miami, it is a positive for companies that earn profits in the United States or Europe but pay Australian Dollar dividends. The shareholders in these companies saw a free 5% uplift in their dividends from positive currency movements. The clear winners from the weaker Australian Dollar were the commodity miners, who saw their revenue priced in US dollars while their costs largely remained in Australian dollars. Australian companies with a large US presence have also benefitted from this, including Amcor and Brambles, Woodside, CSL, ResMed and QBE Insurance.

Tariffs were frequently posed to management teams in February with a global presence or operations in the USA. However, most Australian companies selling goods or services in the USA should not have a major impact as their manufacturing facilities are generally close to their customers. For example, CSL collects plasma via its network of collection centres scattered throughout the USA, which is then converted into biotherapies at a plant in Illinois. Similarly, Amcor tend to locate their packaging plants close to their US-based customers such as Unilever, Nestle, Novartis and Pepsi, as shipping empty PET drink bottles across borders makes little economic sense.

The main loser from tariffs is likely to be Rio Tino, which will have a 25% tariff on their aluminium from Canada, acquired in their 2007 takeover of Canada's Alcan. Rio mines bauxite in Australia and Brazil, which is then refined into alumina and aluminium in Canada to take advantage of low hydroelectric power costs, and the finished aluminium is sent to customers in the USA.

Breville currently derives half of its sales from the United States, and most of its manufacturing plants are in China, which currently has a 20% tariff on its goods. Explosive manufacturer Orica has a large manufacturing plant in Canada, sourcing cheap natural gas in Alberta to service blasting customers in the USA. The company's Canadian-made ammonia nitrate will now have tariffs placed on it. Conversely, rival Dyno Nobel (Incitec Pivot) may enjoy a sales boost courtesy of Orica from their cheaper explosives produced in Wyoming and Louisiana.

Commonwealth Bank provides a good look through the economy during reporting season, with Australia's largest bank holding over 17 million customer accounts. Consequently, the banks' financial results and accompanying 172-page reporting suite give investors an insight into the health of the various sectors of the economy. CBA showed minimal bad debts and rising dividends but also that higher interest rates had differing impacts across their customer base. While discretionary spending had been cut back along with savings for customers between 20 and 54, older customers above 55 had increased spending and savings.

Insurers continue to have their best results season since the GFC as they enjoy higher premiums, lower claims inflation, lower adverse weather events, and sound investment returns. Suncorp expects gross written premiums to increase by low-mid double digits and margins from inflation moderations. Similarly, QBE expects its gross written premium to increase by mid-single digits over the coming year while benefiting from subsiding cost inflation.

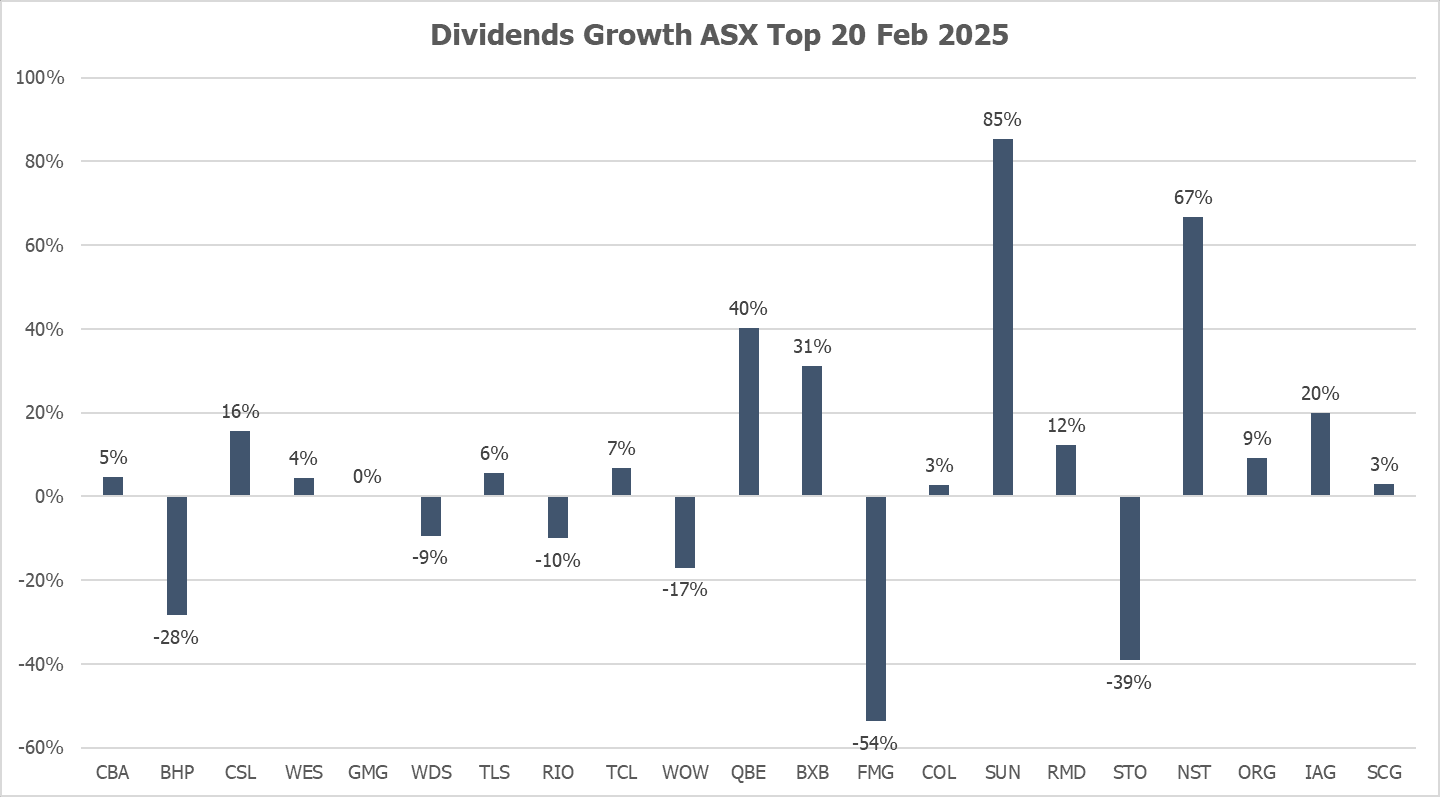

During reporting season, Atlas looks closely at company dividends, particularly the direction of dividends. While our investors appreciate income, the rationale for looking closely at dividends is that increasing dividends is a sign of earnings quality. Our view is that talk and guidance from management can often be cheap, and company CFOs can use accounting tricks to manipulate reported earnings. However, paying out higher dividends tends to signify that "insiders, " company directors, don't see any imminent negative issues.

Looking across the top 20 stocks (that reported the other banks having different financial year-ends), the weighted average dividend increase was 0%. The five companies that reduced their dividends, BHP, RIO, Woolworths, Woodside, and Santos, saw weaker commodity pricing.

On the positive side of the ledger, Suncorp, QBE, Northern Star, and Brambles offset the cuts, posting solid increases in cash flows to their shareholders. Across the wider ASX 200, dividends declined by -6% in February.

Over the month, A2 Milk, Computershare, Fletcher Building, Eagers Automotive, and NIB Insurance delivered the best results. Despite the uncertain economic environment, especially around the softening of consumers, these companies were able to grow sales and expand gross margins along with providing optimistic outlooks.

Looking on the negative side of the ledger, Mineral Resources, Viva Energy, Reece, and WiseTech reported poorly received results by the markets. The common themes amongst this group were lower commodity prices (Mineral Resources and Viva Energy) and weaker-than-expected outlooks for higher PE companies (WiseTech and Reece).

Before the February 2025 reporting season, everyone expected that the insurers would have strong financial results, benefitting from slowing claims inflation and higher investment returns on their billion-dollar investment floats. This saw record profits from QBE Insurance and Suncorp, but none better than Medibank Private's results. Medibank continues to grow profits and market share in the Australia Private Health market, which has benefitted from higher premiums, higher uptake of short-stay hospitals and claims inflation slowing. During February, the government approved an average 3.73% increase in health insurance premiums ahead of cost increases. These strong results were achieved while simultaneously returning $1.6 billion to customers through their commitment not to benefit or profit from the pandemic. This is a great outcome that will help Medibank continue growing its market share and benefit the brand and stakeholders.

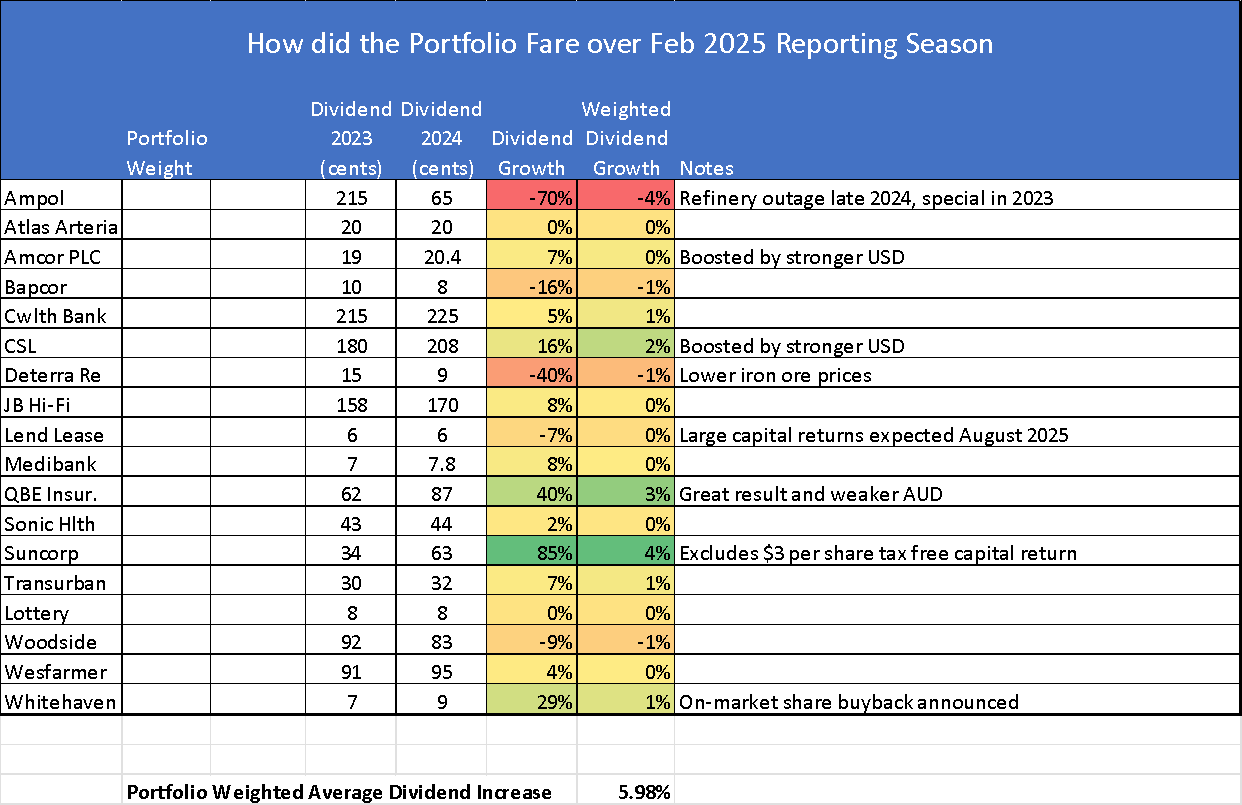

Overall, we are reasonably pleased with the results from the reporting season for the Atlas Portfolio. In general, the companies in our Portfolio were able to increase earnings and dividends, with some reporting record dividends in a more challenging economic environment.

As a long-term investor focused on delivering income to investors, we look closely at the dividends paid out by our companies and whether they are growing. After every reporting season, Atlas looks to "weigh" the dividends that our investors will receive. While share prices move every second between the hours of 10 am and 4 pm, dictated by changing market emotions, ultimately, the sole reason for buying a share is to access a share of the company's profits paid in the form of dividends.

Indeed, in the February reporting season, we saw several companies, such as NIB and Woolworths, give optimistic outlooks, while cutting dividends. This sends a mixed message to investors, and we would prefer to follow the cash rather than the words! Using a weighted average across the Portfolio, our investor's dividends will be +6% greater than the previous period in 2024, and significantly ahead of the 0% dividend growth seen in the top 20 Australian companies that reported and the -6% decline across the wider ASX.

The Portfolio's dividend increase was also ahead of inflation, which was 2.4% over the period, thus maintaining purchasing power for investors who fund their retirement off income. Based on this measure Atlas are pleased with the results from the February 2025 reporting season.

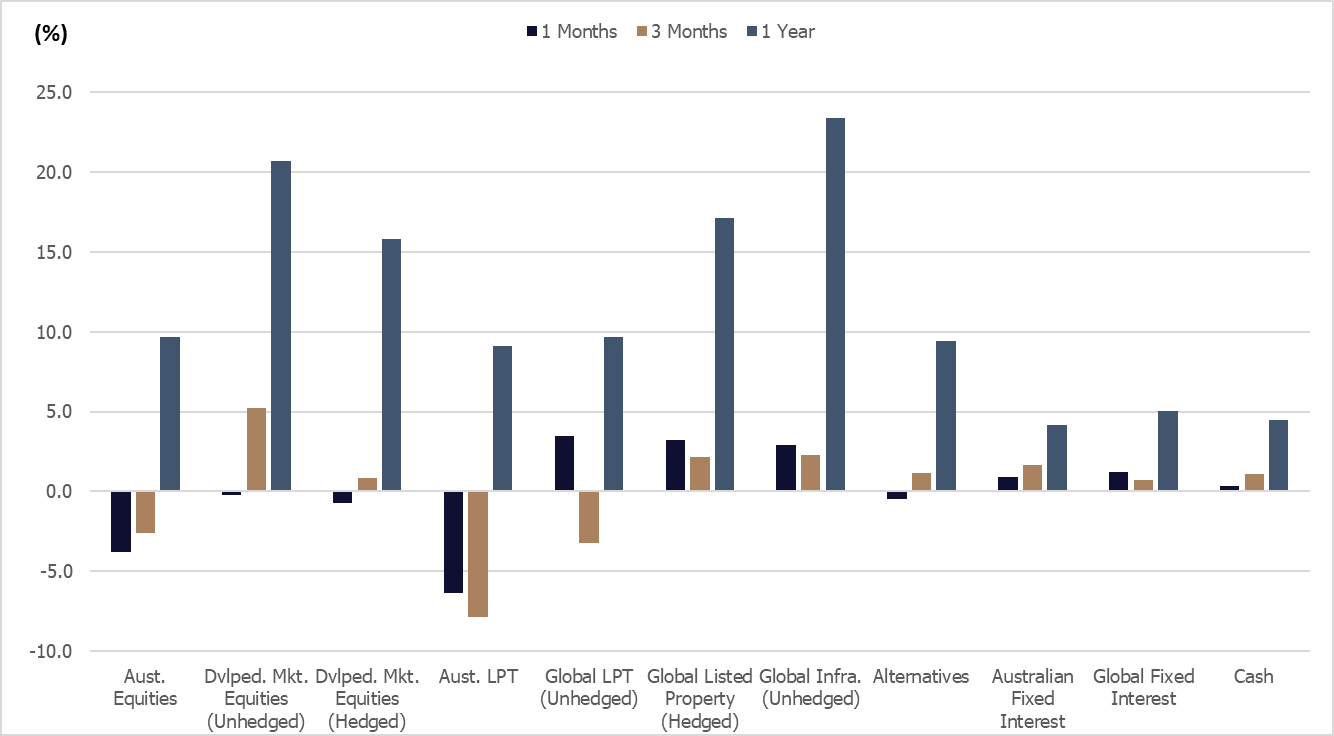

All asset class returns were positive over the 1-year period to February 2024. The Trump presidency and policy uncertainty have resulted in material market volatility over the quarter and negative returns in equities and listed property over the 1-month and 3-month period.

Source: Allied Wealth, Morningstar.

Economically, global and domestic GDP growth while moderate remain positive. Corporate earnings have remained steady but within the listed market, large companies have seen outsized earnings growth compared to smaller counterparts. Despite the Goldilocks (not to hot, not too cold) environment, the largest forces driving markets have been policy uncertainty tied to US trade and fiscal policy. Market reaction has been extreme but in-line with the persistent uncertainty.

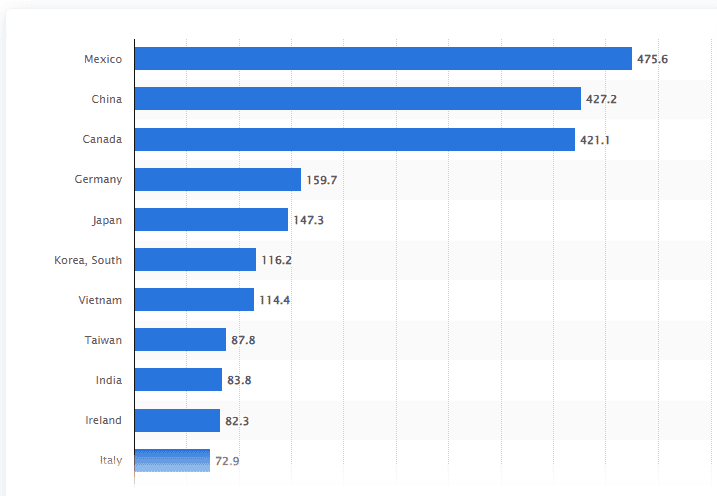

Uncertainty around US trade policy has been the largest driver of market movement over the recent period. Since the inauguration of Donald Trump on the 20th of January the administration has threatened and implemented a 25% trade tariff on Canada and Mexico; with a 20% trade tariff imposed on China. At last count, the Trump presidency has threatened trade tariffs and reversed the decision 6 times in the matter of 7 weeks in office. In our view, trade tariffs are a bad idea and represents an effective tax on the end consumer.

Liberalisation of trade over the last 100 years combined with technological specialisations have resulted in an interconnected global supply chain – e.g. assembly of cars today rely on multiple parts manufactured globally across different countries. Thus, any tariffs affecting the flow of good across borders results in more expensive production costs which is then passed on to consumers by companies looking to maintain their profit margins.

We believe the motivations for tariffs are driven by Trump’s desire to implement a broad range of tax cuts while keeping the US fiscal budget balanced. In Trump’s view, the implementation of tariffs is expected to raise massive amounts of government revenue to offset losses from reduced tax.

Source: Statista

However, Trump has likely underestimated the detrimental effects to US consumers including the impact of trade retaliation from Mexico, Canada and China. These are the three largest US trading partners, and we expect its effects to be felt far and wide.

Other avenues of budget reduction have been staff cuts by DOGE run by Elon Musk. We estimate to date DOGE has been able to reduce the government budget by US$ 400 billion which is a far cry from the US$ 2 trillion in cuts promised. More than 70% of the annual federal budget is represented by social security payments, Medicare and Medicaid. Any cuts to these programs directly affect the lowest income cohorts within the community. Excluding the large items, other material components of the budgets are defence spending and interest payments. Unless there are material cuts to any of these categories, it is unlikely that DOGE will be able to meet its stated objective.

We believe that the Trump administration will go ahead with the tax cuts which will further increase the federal costs. This will in turn result in an increase in government debt and translate into increased annual interest payments.

More concerning is the impact of the trade tariffs. Even under the best-case scenario where implemented tariffs are withdrawn, we believe the trade policy uncertainty will persist. We have seen evidence of companies delaying investment and hiring decisions. This will continue to weigh on growth over the medium term.

In the worst-case scenario of escalating trade tariffs, including retaliation by Canada, Mexico, China and the European union, we believe the impact to the global economy will be large. There are no winners in a trade war. In this scenario, we expect a short-term rise in inflation reflecting the passed-on costs of tariffs, followed by a large drop in output and consumption (effectively an economic recession).

Comparing the range of scenarios, we believe there is a wide dispersion of outcomes. Additionally, there is an added complexity of timing. The short-term economic pain for consumer does not necessarily mean a dire outcome for large multi-national companies who are likely to be more resilient. However, the evolution of trade policy (both US and trading counterparties) at this time is unknown and thus we prefer to maintain our market exposure within the portfolio.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. Post the drawdown experienced in February and March, valuation for the asset class has started to look attractive, even adjusting for the potential earnings degradation. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). We believe the currency has moved too far and looks cheap from a valuation perspective. |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have remained volatile and reactive to interest rates. Australian listed property remains a more concentrated market compared to global listed property. |

| Fixed Interest | Neutral | We maintain a Neutral portfolio stance. The evolution of trade policy, potential for economic recession and inflation have a wide set of implications for the asset class. In balancing both the upside and downside maintaining a neutral stance remains the prudent course of action. |

| Cash | Neutral | We have retained a Neutral cash allocation in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, while maintaining our overweight to hedged international equities relative to unhedged. Focusing on the long-term, we are actively monitoring the equity market drawdown playing out today with a view of increasing our equity allocation should market valuation become compelling.

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

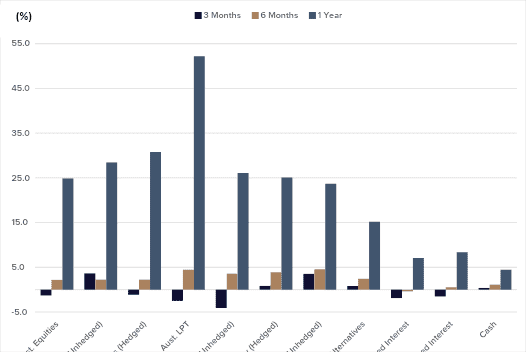

All asset class returns were positive over the 1-year period to October 2024; despite the marginal market drawdown experience in the month of October. Strong performance of Australian Listed Property over the year was primarily driven by the performance of Goodman Group which has an outsized allocation within the index.

Source: Allied Wealth, Morningstar.

Portfolios continue to maintain a Neutral asset class position; but with an overweight to hedged International Equities relative to unhedged. The relative currency position has been a strong return contributor over the September quarter; but has been volatile over the month of October. Outcomes of the US elections have implications for long-term monetary policy which make it difficult to take a directional view. Equity market valuations are expensive but can continue to rally further despite deteriorating consumer conditions. We provide further discussion on the outlook in the section below.

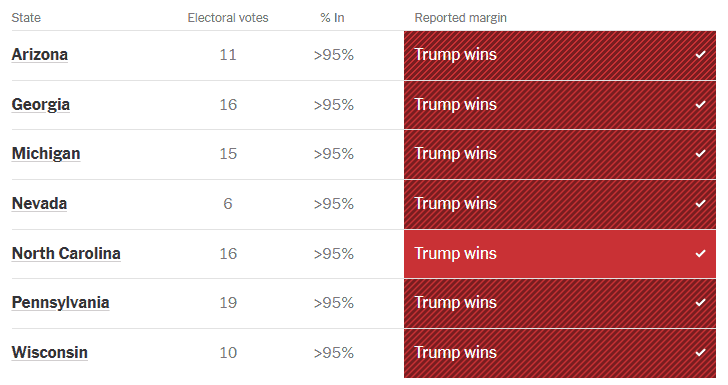

The US Elections concluded with a Republican win, and Donald Trump back in the presidential office for another 5-years. More importantly, apart from winning in all US swing states the Republican party won the majority across the US House of Representatives and Senate.

Source: NYTimes

Whilst the selection of key staff remains ongoing, President Trump has already indicated the key areas of focus are expected to be trade tariffs, tax cuts, government spending, immigration and border security – the first 3 have broad financial market implications. We provide some discussion points below.

We expect trade tariffs to be imposed on China at first, but will also be extended to Europe, Asia and Emerging Markets over time, with the primary goal of driving manufacturing back into the United States. However, implementation is expected to be disorganised given Trump’s temperament. The uncertainty is likely to weigh on corporate capital expenditure globally except for companies planning to relocate production back to the United States. Over the short-term, we do expect this to be beneficial for US growth but may result in materially higher inflation and interest rates over the longer term.

On the campaign trail, President Trump has floated several policy ideas including extending the Tax Cuts and Jobs Act, reducing corporate tax rates and exempting various income from income tax; all of which are stimulatory in nature. While the equity and equality of the proposed tax policy is debatable, the economic effects are stimulatory.

Proposed spending plans on the campaign trail has indicated that the US budget deficit is likely to increase by an estimated US$ 7.8 trillion under the Trump regime. However, the establishment of the Department of Government Efficiency (or DOGE for short) led by Elon Musk and Vivek Ramaswamy has promised more than US$ 2 trillion of savings via restructuring of government agencies, slashing regulations and dismantling government bureaucracy. It remains to be seen how this will shape out over the course of the next 5 years.

Despite the conclusion of the US election, we think there remains policy uncertainty. Over the short-term apart from tariffs on Chinese goods, we believe the economic impact from the election is minimal. Trajectory of US monetary policy in response to moderation in US (and global) inflation will likely be the key market driver over the short-term. We note across both developed and emerging markets, policy rates have been lowered and this is broadly positive for risk assets, incentivising more M&A activity.

Over the longer-term, the combination of extensive trade tariffs and government spending may have large inflationary implications in the US. This situation could be grim particularly if developed market central banks are forced to raise interest rates and trigger a rolling recession to battle runaway inflation.

For now, we have chosen to retain a broadly Neutral stance with an overweight in hedged international equities relative to unhedged. The Australian Dollar (relative to US Dollar and Euro), at current valuations still look cheap relative to history.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. On a price-to-earnings basis, Australian equities look marginally overvalued relative to history, however the magnitude is not large enough to warrant a change in portfolio stance. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have remained volatile and reactive to interest rates. Australian listed property remains a more concentrated market compared to global listed property. |

| Fixed Interest | Neutral | We maintain a Neutral portfolio stance. The outcome of the US election is likely to have longer-term implications for the asset class. However, over the short-term, we expect more moderation in interest rates. |

| Cash | Neutral | We have retained a Neutral cash allocation in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, whilst maintaining our overweight to hedged international equities relative to unhedged. We continue to monitor market condition but believe current positioning remains the most prudent course of action.

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160