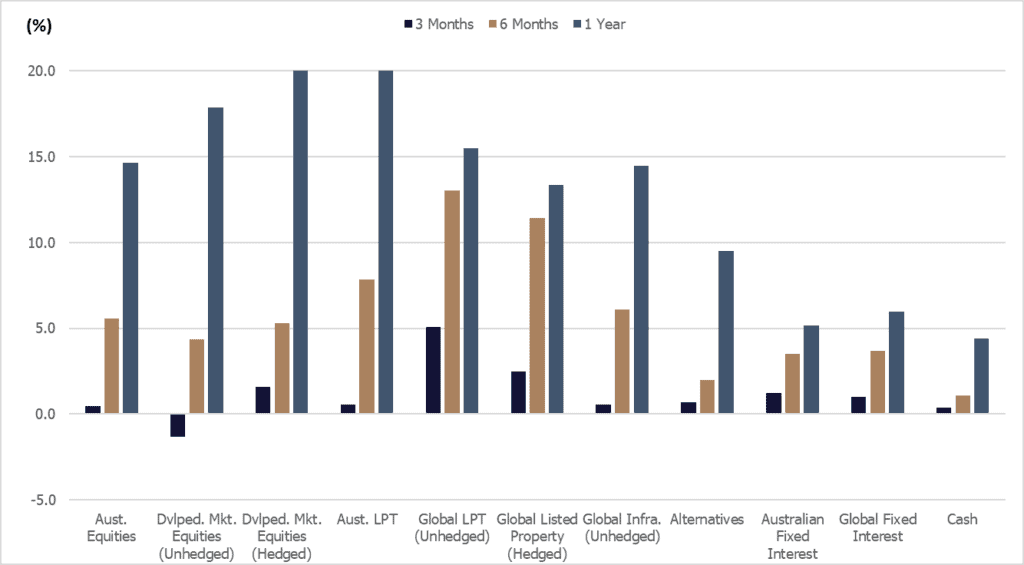

Equity markets which rallied over the first half of 2024 experienced a large drawdown in late July/early August of 2024. However, the drawdown was short-lived with a strong recovery experienced over the remainder of the month. We provide the asset class performance as at the end of August 2024 below. Of note is the impact of currency, with the strengthening of the Australian dollar more supportive of Hedged International Equities vs. Unhedged.

Source: Allied Wealth, Morningstar.

Over Q2 and into Q3 2024, portfolios continue to maintain a Neutral asset class position; but with an overweight to hedged International Equities relative to unhedged. The relative currency position has contributed positively to performance as the Australian Dollar rallied relative to US Dollars and Euros over the assessment period. Given the confluence of market events, we find it hard to take a directional view on risk assets, choosing instead to focus on relative valuation. We provide further discussion on the outlook in the section below.

Our investment outlook since the last quarter has not changed materially, but we have seen some softening in economic conditions. Labour markets have weakened as companies continue to rationalise labour costs and pass on inflation through price increases. This was observed in the recent earnings season where companies have broadly maintained their profit margins despite falling revenues.

Across developed economies only US equities have continued to demonstrate positive earnings growth, but these have been primarily tech related companies. Consumer cyclical and discretionary sectors remains broadly challenged, tied to the weakening consumer. Stock market concentration remains an ongoing issue with a small number of companies accounting for a substantial percentage of the global equity index. From a valuation perspective, equity markets today continue to trade at the higher end of its historical range.

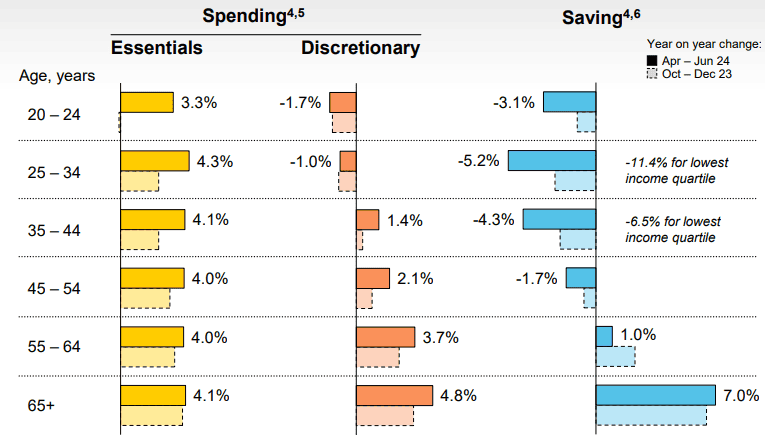

Domestically, weaker consumer dynamics is observed in the younger age groups. Most age cohorts have continued to draw down on savings to fund the increasing cost of essential goods. For the older cohorts, discretionary spending continues to grow but we attribute some of the increase to the higher cost of goods and services.

Source: Commonwealth Bank June 2024 Earnings Presentation

Over the quarter, we have seen the US Federal Reserve soften its stance on monetary policy; indicating a rate cut is expected in September. This is different from the Reserve Bank of Australia who is likely to maintain tight monetary policy given the stickier domestic inflation experience.

US elections are set for the 5th of November with campaigning now in full swing. We remain quite indifferent to either of Trump or Harris presidency. What remains clear is that irrespective of a Republican or Democrat win, we expect higher levels of government spending to persists. While there has been some debate around the sustainability of US federal debt, we think as long as debt serviceability is maintained this situation will likely continue.

As stewards of your capital, we remain primarily focused on the financial market implications for your portfolios. Despite elevated levels of market volatility, we are becoming more constructive on the corporate earnings outlook. However expensive valuations continue to give us pause.

Within international equities, we continue to maintain an overweight in hedged international equities relative to unhedged. The Australian Dollar (relative to US Dollar and Euro), at current valuations still look cheap relative to history.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. On a price-to-earnings basis, Aust equities looks marginally overvalued relative to history, however the magnitude is not large enough to warrant a change in portfolio stance. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have been volatile over the previous quarters. Deal volume remains low, and the asset class remains susceptible to interest rate expectations due to the bond-like nature of income returns. We continue to retain a Neutral position. |

| Fixed Interest | Neutral | In-line with changes discussed previously, we have decided to neutralise the overweight in the asset class. Whilst the trajectory of interest rates remain uncertain, yields in this asset class today are attractive. |

| Cash | Neutral | Cash yields remain attractive. We have retained cash in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, whilst maintaining our overweight to hedged international equities relative to unhedged. We continue to monitor market condition but believe current positioning remains the most prudent course of action.

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160

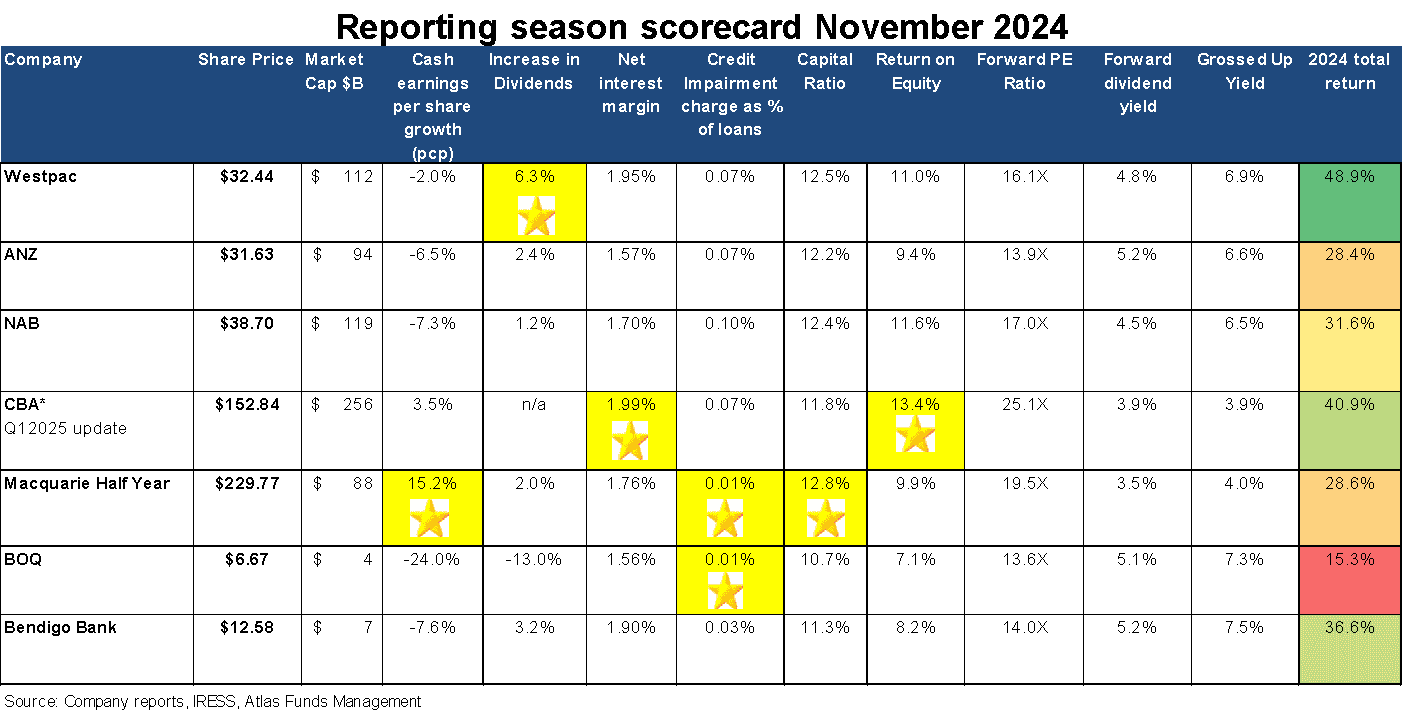

What to do with the big Australian banks is one of the major decisions for both retail and institutional investors alike, with the banks comprising over 27% of the ASX 200. Early in 2024 several major investment banks recommended that investors sell all the big four banks based on valuation concerns, declining earnings and the expectation of rising bad debts. However, on average, the big 5 Australian banks have had a stellar 2024, up 33%, significantly ahead of the ASX 200's return of 12%. Similar to their half-year results in May, Australia's banks delivered a steady reporting season, reporting solid results, steady dividends and, once again, very low bad debts.

In this piece, we look at the major themes that have played out over the November 2024 bank reporting season in the 700 pages of financial results released, including the regional banks awarding gold stars based on their performance over the last six months and how Allied Wealth’s picks fared.

Australia has a concentrated banking system with the top 5 having a market share of 73% and looks rather similar to Canada which has 5 large banks. Since the GFC, the banking oligopoly in Australia has only become stronger, with foreign banks such as Citigroup exiting the market and smaller banks such as St George, Bankwest, and now Suncorp being taken over by the major banks.

This contrasts with the USA which has 4,500 banks, while this sounds great for competition, it reflects regulations that since the Civil War prohibited banks chartered in one state from opening a branch or subsidiary in another state, thus protecting local banks from interstate competition. This makes comparisons between the US and European banks on valuation terms somewhat simplistic, with the Australian banks deserving a valuation premium as they are safer (lower loan losses) and more profitable (higher margins and ROE).

Additionally, unlike the US banks the Australian banks benefit from recourse-lending on mortgages and don’t have to offer 30-year fixed term mortgages. Homeowners can’t easily walk away from a house and mail the keys back to Westpac if they find themselves in a negative equity position!

While our political masters bemoan the concentrated banking market structure, having a strong, well-capitalised banking sector looked to be very desirable in 2023 with the collapse of Silicon Valley Bank & Signature Bank in the USA and in the wake of UBS' forced takeover of Credit Suisse.

In November, bad debts were one of the first items investors looked at in the bank reporting packs, checking whether the bank was successfully negotiating the "fixed rate cliff" and the uptick in corporate insolvencies. In November, ASIC reported a 39% increase in corporate insolvencies over the 2024 financial year, with 42% concentrated in construction, restaurants and cafes.

Bad debts have remained low in 2024, with all the banks reporting extremely low loan losses. Macquarie Bank reported the lowest bad debts, 0.01% of gross loans, reflecting their focus on mortgages to higher-earning borrowers, with Bank of Queensland at the same level.

The level of loan losses is important for investors as high loan losses reduce profits, and this dividend erodes a bank's capital base. This reporting season has seen low bad debts translated into better-than-expected profits and, thus, higher dividends.

Net interest margins are always a major topic during the banks' reporting season, with most investors going straight to the slide on margin movements in the immense Investor Discussion Packs. Generally, bank net interest margins have recovered from the lows seen in 2022, as when the prevailing cash rate is 5%, it is much easier for a bank to maintain a profit margin of 2% than when the cash rate is 0.1%.

Small changes in the net interest margin significantly impact bank profitability due to the size of a bank's loan book and guide future profitability. For example, Westpac's net interest margin increased by 0.03% in the second half of 2024. Whilst this sounds very insignificant, Westpac's income increased by $214 million over the second half when applied over a loan book of $807 billion!

Typically, Westpac and Commonwealth Bank enjoy a higher net interest margin than ANZ and NAB due to their higher weighting to mortgages, which enjoy a higher net interest margin than corporations that can canvass banks in Japan or Europe for borrowing needs. In the second half of 2024, NAB saw a slight margin decrease, with ANZ and Westpac posting small increases.

The November 2024 season saw smaller increases in dividends than we have seen in recent periods, though unlike cash earnings, which declined, the banks posted higher dividends in aggregate. This was achieved due to a combination of higher dividend payout ratios and a falling share count as a result of the billions in bank shares that have been bought back and cancelled by all banks. For example, since November 2021, Westpac has reduced its share count by 6% after buying back $7 billion in shares, with other banks making similar moves. The winner of the star was Westpac, with a dividend increase of 6%.

Overall, we are happy with the financial results from the banks owned by the Australian Equity Portfolio in November. The three main overweight positions, Macquarie, ANZ and Westpac, increased their dividends, and all three have significant on-market share buybacks, which will support share prices. In the last quarter we have been slowly reducing our exposure to CBA on valuation grounds and are likely to continue to do so with Australia’s largest bank trading on 25 times earnings with a market capitalization of $256 billion.

Throughout 2024, many analysts have called investors to sell all their bank stocks, pointing to stretched valuations and high house prices. Australia's major banks continue to surprise the market positively with how they have navigated turbulent market conditions. In 2024, the banks all have cleaner loan books, no offshore distractions, minimal operations in adjacent industries such as insurance and funds management and offer a more significant margin of safety than they have had at other times in their history.