Key Themes

During February and August every year, most Australian listed companies reveal their profit results, and most guide how they expect their businesses to perform in the upcoming year. Whilst we regularly meet with companies between reporting periods to gauge how their businesses are performing, companies open up their books during reporting season to allow investors a detailed look at the company's financials. As company management has been on "blackout" (and prevented from speaking with investors) since mid-June, share prices in the six weeks leading up to the result are often influenced by rumours, theories, and macroeconomic fears rather than actual financials.

The August 2023 company reporting period that concluded last week displayed stronger-than-expected results in a higher inflationary and interest rate environment. The dominant themes of the August reporting season have been higher interest repayments, higher input costs and a weaker Australian dollar. Many companies were able to weather these headwinds and deliver some strong results, and others got caught in the headwinds. In this week's piece, we look at the key themes from the reporting season that finished last week, along with the best and worst results and the corporate result of the season.

Better than expected

Going into the August reporting season, the market expected the profits to fall sharply due to the combination of cost inflation, higher interest costs and slowing retail sales from domestic consumers under pressure from higher mortgage rates. However, the reporting season showed that many companies were able to manage the current economic environment better than expected, with earnings beating expectations outnumbering companies missing expectations by a ratio of 5:3. Looking through the ASX companies that exceeded expectations were in the telco, IT, consumer discretionary and financial sectors. Conversely, disappointments were clustered in the consumer staples and healthcare sectors.

Higher interest rates - Good and bad

One of the main themes over this reporting season was how each company would be able to handle a rising interest rate environment. Since 2008, companies globally have enjoyed declining interest rates, which have seen the interest cost line on the Profit and Loss statement decline, thus boosting earnings. However, since April 2022, the cash rate has increased from 0.1% to 4.1%. August 2023 was going to be the first reporting season, with sharp increases in financing costs taking a bite out of company profits.

Aurizon (nee Queensland Rail), Australia's largest rail freight operator, underwent a large acquisition last year, adding close to $2 billion in additional debt. When combined with an increase in interest rates, the rail company saw its interest expense explode by 84%, dragging earnings down. Similarly, we have seen financing costs increase for the more highly geared listed property trusts such as Charter Hall Long WALE REIT, which saw financing costs increase by 56%. Retailer Harvey Norman is another company that has seen a large increase in financing costs of 76% due to having to take on more debt to fund more capital expenditures.

Conversely, the insurers all reported strong earnings results courtesy of finally earning an income return above zero on their "insurance float". In addition to profits made via underwriting insurance, insurance companies receive premiums upfront and pay claims later, which gives the company a cost-free pool of money that can generate investment profits for the benefit of shareholders. This pool constantly has inflows from premiums and outflows from claims, but the aggregate amount tends to remain constant. For the last several years, with rates close to 0%, insurers were earning close to nothing for their multi-billion-dollar investment floats. However, with rising interest rates, QBE Insurance earned US$662 million on its US$27 billion float in the first half of 2023. Conversely, the company made only US$382 million in all of 2021.

Input cost inflation

Over the past year, wages have risen across many sectors in Australia due to a combination of maintaining real wages in the face of higher inflation and a tight labour market with unemployment the lowest since the early 1970s. In August, cost inflation was seen very clearly in the profit results of the big miners. BHP reported higher production costs for FY2023 with diesel, explosives, machinery, and labour increasing costs by 10% over the year and expects higher costs to remain in FY2024.

Retailers Coles and Woolworths both saw higher costs of doing business in FY2023 due to higher minimum wage awards and cost inflation. Additionally, Coles lost $60 million in "shrinkage" (theft) during the second half, which alarmed investors and saw the company's share price fall. To combat this, Coles plans to add additional personnel in 2024 to watch self-checkouts, which will add to the cost of doing business.

Building products company Boral noted that input materials inflation surged over the past year, with higher transport, energy and labour costs. Despite these input cost increases, Boral increased profits by passing these on to customers, increasing the price of concrete and cement by 12 and 8 per cent, respectively.

Inflation is negative for consumers as it erodes their purchasing power, but it benefits those with existing assets with revenues linked to inflation. The best examples of companies with this characteristic are the toll road operators Transurban and Atlas Arteria, which saw strong increases in revenue from both inflation-linked tolls and higher traffic volumes. Their largest cost of interest repayments barely increased as these companies fixed their interest costs during periods of low-interest rates for a long duration.

Weaker Australian dollar

While the falling Australian dollar is a negative for Australians looking for a winter holiday in the south of France or Qantas buying jet fuel in US dollars on the world market, it is positive for Australian companies earning profits offshore. Over the past year, we have seen the Australian dollar trend downwards compared to most large currencies but most significantly against the USD. The weakening Australian dollar has provided a tailwind for companies that earn revenues in foreign currencies. Once earnings and dividends are translated into weaker Australian dollars, local investors enjoy elevated earnings per share and dividend per share growth. Some companies that benefitted from this tailwind in August were CSL, which saw dividends increase by +18%, and Amcor, where dividends rose by +13% once converted into Australian dollars.

Show me the money

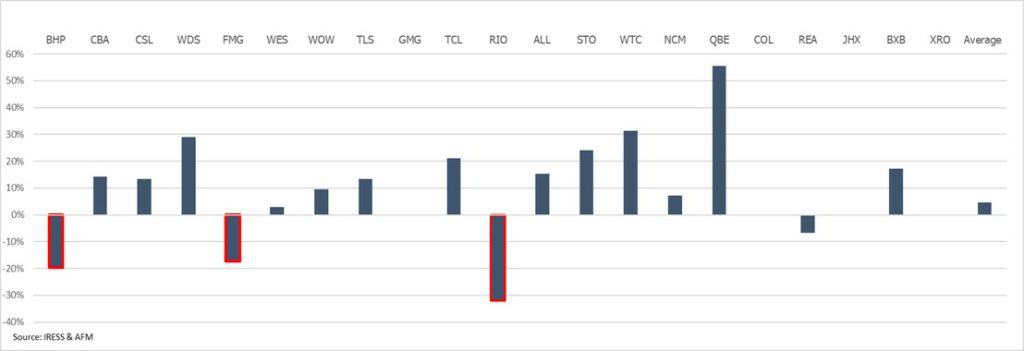

Unlike the previous few reporting seasons, August 2023 saw companies cut dividends, and share buy-backs were not a feature outside of Commonwealth Bank, Qantas and Computershare. Across the ASX Top 25 stocks (that reported - the other banks have a different financial year-end), the weighted average increase in dividends was 4%. The three miners, BHP, RIO and Fortescue, cut their dividends on weaker profits, higher costs and an uncertain outlook, with Xero not paying a dividend and James Hardie replacing their dividend with a buy-back. On the positive side of the ledger, QBE, Transurban and Woodside offset the cuts, posting strong increases in cash flows to their shareholders.

Figure 1: Dividend growth per share – ASX Top 25 August 2023

Best and worst

Over the month, Altium Limited, Inghams Group, GUD Holdings, Johns Lyng Group, Life 360 and Wesfarmers delivered the best results over the month. Despite the uncertain economic environment, especially around higher interest rates, these companies were able to combat these costs by lowering their gearing and leverage ratios whilst still being able to grow the business, in some cases lower losses, along with optimistic outlooks for 2024.

Looking at the negative side of the ledger, Chalice Mining, Core Lithium, Alumina Limited, Fletcher Building, Costa Group Holdings reported poorly received results by the markets. The common themes amongst this group are a delay or cancellation of dividends due to a potential takeover (Costa Group) or due to a lower earnings environment (Alumina) combined with lower profit guidance moving forward. Additionally, high price-to-earnings (PE) companies such ResMed, WiseTech and Ramsay that delivered profits below expectations or gave weak guidance saw their share prices sell off.

Result of the season

Before the August 2023 reporting season, conglomerate Wesfarmers would not have been many investors pick (including ours despite holding it in our portfolio) for the result of the season. Many in the market expected Wesfarmers’ earnings to contract based on a weaker domestic consumer, however the company grew profits on a strong rebound in Kmart, as well as growth in Bunnings, Officeworks and chemicals. Record Kmart earnings indicates consumers switching to the company’s low-price offer. Additionally, management provided upbeat guidance for 2024 which will see the first earnings from the Mt Holland lithium mine with the share price rallying by +11% in August.

Our Take:

Overall, we were reasonably pleased with the results from the reporting season with most of our portfolio companies able to increase earnings and dividends with some reporting record profits in a tougher economic environment.

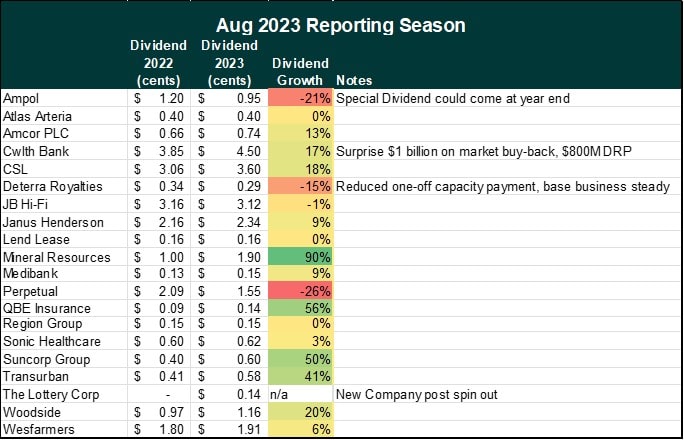

Figure 2: How did the portfolio fare?

As a long-term investor focused on delivering income to investors, we look closely at the dividends paid out by the companies that we own and whether they are growing. After every reporting season, we look to "weigh" the dividends that our investors will receive. Our view is that talk and guidance from management are often cheap, and that company CFOs can use accounting tricks to manipulate earnings, but actually paying out higher dividends is a far better indicator that a business is performing well. Additionally, global macroeconomic events and market emotions can temporarily cause the share prices of companies performing well to fall.

Using a weighted average across the portfolio, our investors' dividends will be +15% greater than for the previous period in 2022, and every company held in the portfolio was both profitable and paid a dividend.

On this measure, we are pleased with the results of the August 2023 reporting season.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160