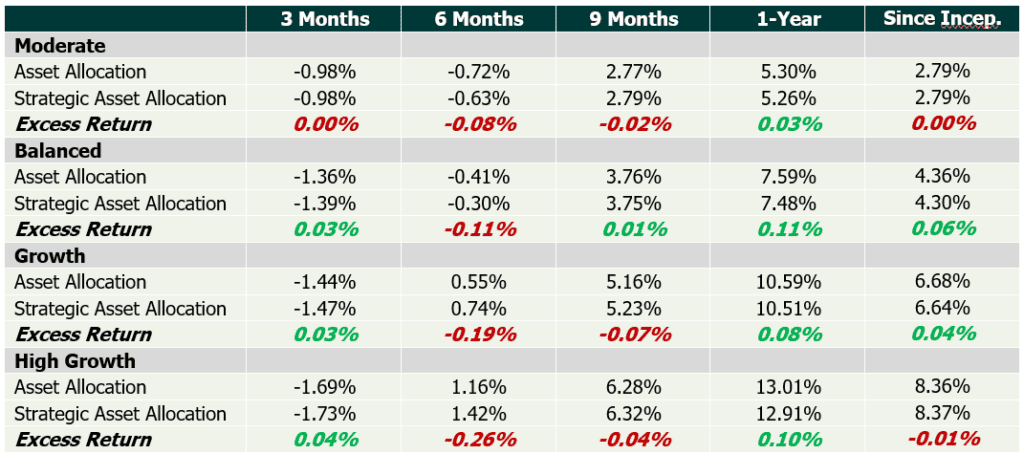

Equity markets rallied over the first half of 2023 but lost steam coming into September and October. Over the 3-months to October, all asset class performance was negative except for Alternatives and Cash. While recent market movements have vindicated the defensive positioning taken in Q2 2023, we remain cautious on both the upside and downside going forward.

Markets have remained volatile over the year and the last few weeks of quarter four have not been an exception. For us this highlights the level of disagreement embedded in the investment views held by both institutional and retail investors.

Source: Allied Wealth, Morningstar.

Please note that asset allocation performance calculations have been conducted as of September 2023.

Portfolios currently maintain a marginally defensive asset allocation stance. As was discussed in the last newsletter, the decision reflects a focus on risk management rather than profit maximisation. This position has proven prescient as growth assets have underperformed defensive assets over the quarter.

Source: Allied Wealth, Morningstar. Note: Returns are based on an asset allocation index returns which do not include manager and advice fees so actual portfolio returns will vary. The purpose is to determine if our tactical asset allocation decisions are adding value over the Strategic Asset Allocation for each model.

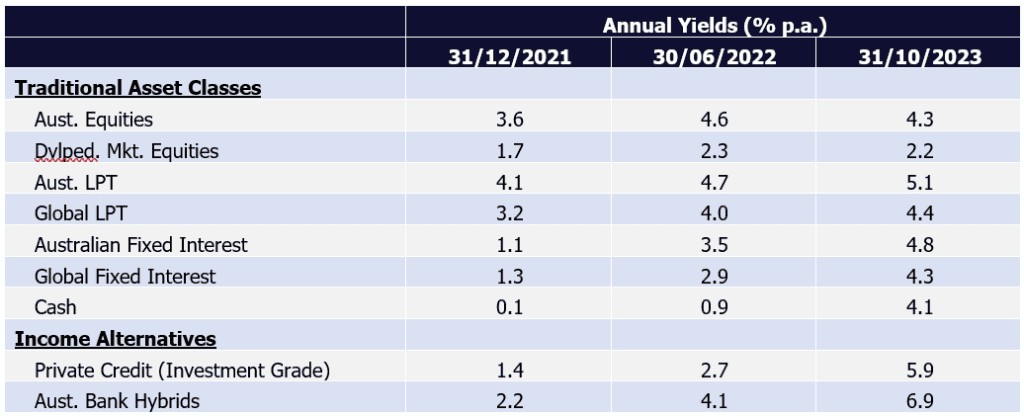

Structural Market Changes – The Returns of Income

Over the past year, rising interest rates have meant a higher income return across defensive asset classes as well as select Alternative asset classes. Where equities have (over the last 10 years) provided a higher income yield compared to bonds, the recent hiking cycle has seen income levels across multiple asset classes rise materially.

Notes:

Dividend yields have been used for equities; yield-to-maturity for bonds

For private credit and Aust. bank hybrids yield have been calculated as a spread plus cash

Comparing yields at the end of October 2023 to December 2021, we see a material increase in yields across Fixed Interest, Cash and Income Alternatives. In some cases, yields exceed dividend yields for equities. Another important point to note is that these asset classes also exhibit lower volatility of capital relative to equities which makes for an attractive investment proposition particularly for investors with lower risk tolerance. As an investment committee, we have begun discussing the implication for client portfolio and expect this to be an important consideration in the upcoming Strategic Asset Allocation review.

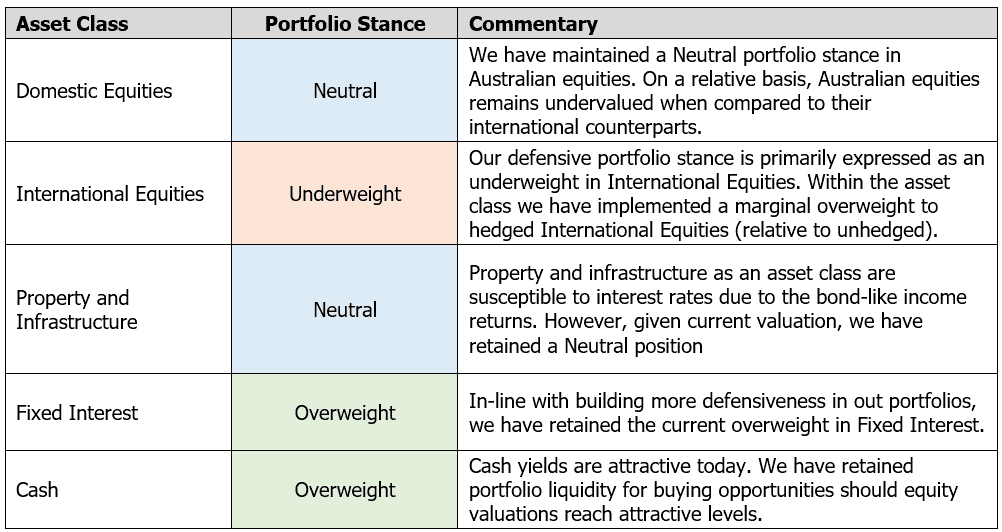

Investment Outlook & Strategy Implications

We continue to maintain a cautious asset allocation stance. We see a combination of growth headwinds in the medium-to-near term. The impact of higher interest rates is working through the economy, and we have seen signs of corporate earnings under pressure. Consumers have started to feel the pinch and have adjusted their spending accordingly.

Geopolitical conflict has been a theme well covered in all our publications as well as internal discussions. The escalation of conflict in the middle east represents a grave humanitarian crisis with implications for oil prices. However, the impact of the conflict on global GDP currently remains minimal. It remains too early to tell the secondary or third-order effects and we continue to monitor the situation as it develops.

Market movements across equities and bonds suggest market participants remain glued to central bank commentary. While any indication of a “pause” in policy rates is cheered on by investors and may lead to a short-term equity rally, we believe fundamentals are likely to deteriorate further before improving. Despite falling equity prices in the recent months, we continue to view the asset class as overvalued especially when earnings momentum and economic fundamentals are considered. Based on our current assessment, we would like to see a further 5% to 10% fall in prices before adding back to underweight positions.

Within international equities, we have made some minor allocation changes resulting in a marginal overweight to hedged international equities (relative to unhedged). Over the preceding quarters we have seen the Australian dollar materially weaken relative to the US dollar and Euros. Based on our analysis, the Australian dollar currently trades cheaply when compared to other development market currencies. Our experience with FX suggests that while mean reversion is likely, this can happen over an extended period. Current valuation provides a good entry point, and we expect to hold on to this position over the medium term.

Bottom-up market observations

Reporting Season Scorecard

The last four years have been very eventful for bank shareholders, with each year bringing a new set of worries predicted to bring the banks to their knees. 2020 saw an emergency capital raising from NAB (some of which was used to pay the dividend) and Westpac missing their first dividend since the banking crisis of 1893, as experts forecasted 30% declines in house prices and 12% unemployment! Then, 2021 saw the banks grappling with zero interest rates and APRA warning management teams about the systems issues they may face from zero or negative market interest rates expected to come in 2022. In 2022 and 2023, the concerns have switched to the impact of a 4.25% rise in the cash rate on bad debts and the looming fixed interest rate cliff that would see retail sales and house prices plummet.

In this Allied Wealth quarterly, we will look at the themes in approximately 900 pages of financial results released over the past ten days by the financial intermediaries that grease the wheels of Australian capitalism.

Low Bad Debts

From May 2022, Australia's official cash rate climbed from 0.10% to 4.35% across 13 different rate hikes. Every time we had a cash rate increase, the first question was how it would impact consumers and whether bad debts would rise sharply and house prices would collapse. What we have seen over the last year is that employment in Australia has remained remarkably robust in a tight labour marketplace. This has seen consumers being able to reallocate funds from discretionary or non-necessity spending to being able to fund their home loans. Additionally, we have seen a substantial increase in offset account balances that have risen rather than fallen, with $5 billion being added since March 2023.

Bad debts remained low in 2023, with all banks reporting negligible loan losses; ANZ and Macquarie reported the lowest level, with loan losses of 0.01%. To put this in context, since the implosion in 1991 where, banks grappled with interest rates of 18% and considerable losses to colourful entrepreneurs such as Bond, Skase et al. Since then, loan losses have averaged around 0.3% of outstanding loans, and the banks price loans assuming losses of this magnitude.

The level of loan losses is important for investors as high loan losses reduce profits and, thus, dividends and erode a bank's capital base. Conversely, the very low losses in 2023 have translated into record dividends and billion-dollar share buybacks.

Show Me The Money

While the big Australian banks are sometimes viewed as boring compared with the biotech or IT themes du jour, what is exciting is their ability to deliver profits in a range of market conditions. In 2023, the banks generated $32.7 billion in net profits after tax. This saw dividends per share increase by an average of 15% per share, with all banks except for NAB now paying out higher dividends than they did pre-Covid 19. The star among the banks was ANZ, which raised dividends per share by 19%!

Well Capitalised

Capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather the potential loan losses. The bank regulator, the Australian Prudential Regulation Authority (APRA) has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks. In 2008, US taxpayers were forced to support Citigroup, Goldman Sachs and Bank of America, and British taxpayers dipping into their pockets to stop RBS, Northern Rock and Lloyds Bank going under. The Australian banks were better placed in 2008 and did not require explicit injections of government funds; the optics of bankers in three-thousand-dollar Armani suits asking for taxpayer assistance is not good.

In 2023, the Australian banks are all very well capitalised and have seen their capital build. This allows the banks to return capital to shareholders in the form of on-market buybacks. During the bank reporting season, Macquarie announced a $2 billion dollar on-market buyback, Westpac announced a $1.5 billion share buyback, CBA announced a $1 billion share buyback, and NAB announced they had a remaining $1.2 billion share buyback. For investors, this not only supports the share price in coming months but reduces the amount of shares outstanding to divide next year's profits by!

Our View

Overall, we are happy with the financial results in November from the banks owned by the Concentrated Australian Equity Portfolio. The three main overweight positions, Commonwealth Bank, ANZ and Westpac, all increased their dividends, which is a crucial signal indicating improving prospects and board confidence in the outlook. All banks showed solid net interest margins, low bad debts and good cost control. Profit growth is likely to be tough to find on the ASX over the next few years, with earnings for resources and consumer discretionary likely to retreat; however, Australia's major banks look to be placed in a good position in current turbulent markets.

Every investment decision is not undertaken lightly and is based on investment research, sized by our conviction. In-line with the outlook, the Investment Committee has decided to maintain our underweight in growth assets in favour of an overweight to defensive assets. Apart from a marginal overweight in hedged international equities within the asset class, no other allocation changes have been made.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our independent financial advice services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160