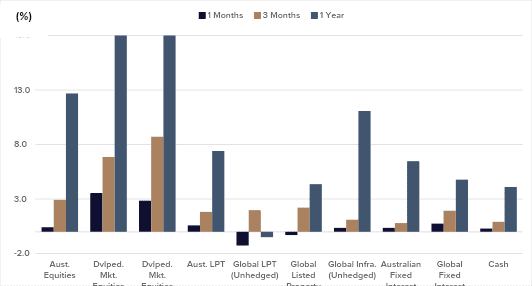

Asset class returns ended the quarter broadly positive. Despite bouts of volatility, risk assets have continued to trend higher. We remain concerned about the persistent rise in asset values given observed weakness in some underlying economic data. That said, monetary policy considerations may continue to support price appreciation even in the absence of improving fundamentals.

Source: Allied Wealth, Morningstar.

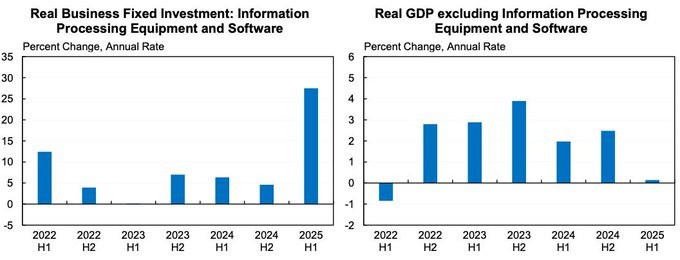

Headline real GDP growth across developed markets remains positive, though the drivers are narrow. A significant portion of growth is attributable to AI-related capital expenditure across hardware, software, and data centre infrastructure. Excluding these effects, growth appears anaemic.

Source: Jason Furman

Whilst AI-driven investment is creating near-term activity in construction and engineering, the long-term productivity gains remain untested. Early signs suggest AI may be more useful for employment consolidation rather than revenue expansion, with technologies such as SoraAI and Copilot reshaping labour demand across creative and professional sectors.

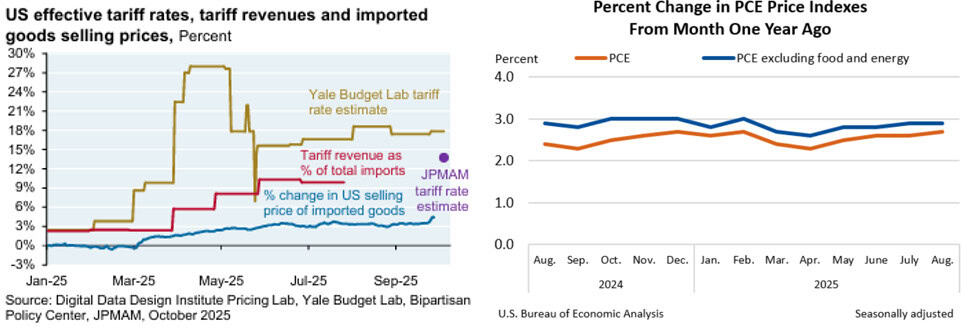

So far in 2025, the U.S. federal government has collected a record $195 billion in customs duties under the expanded tariff regime. More recently, the U.S. Trade Court ruled that the majority of tariffs enacted by President Trump under the International Emergency Economic Powers Act (IEEPA) are illegal—a decision upheld by a federal appeals court and now awaiting Supreme Court review.

Whilst tariff revenues have risen, the inflationary impact has been muted, with limited pass-through to consumer prices observed. So far, the U.S. Core PCE index (the Federal Reserve’s preferred inflation gauge) has remained stable over recent quarters.

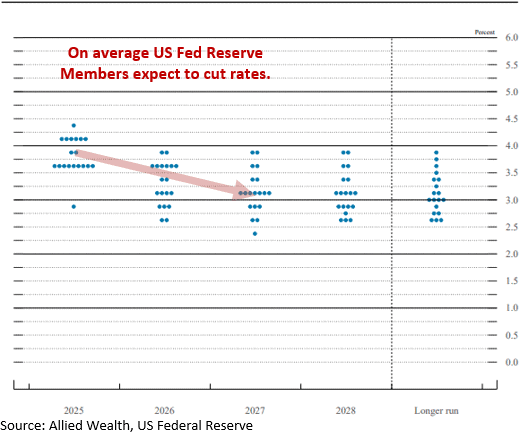

The combination of weaker underlying growth and stable inflation provides a case for further policy rate cuts by central banks. This outlook is reflected in the trajectory of rate cuts signalled by members of the U.S. Federal Reserve.

We remain cautious on equity market valuations, which continue to look elevated. Recent performance of International Equities has been disproportionately driven by unprofitable technology companies with limited fundamental justification, yet these segments have contributed materially to index-level returns.

This concentration of gains in speculative areas highlights the fragility of the rally, with sentiment rather than earnings strength dictating market outcomes. Nonetheless, a falling rate environment supporting lower financing costs and improved liquidity remains a powerful tailwind. This dynamic may continue to drive equity markets higher despite richly priced fundamentals.

Against this backdrop, market timing remains extremely challenging. In line with the current outlook, the Investment Committee has elected to retain a Neutral portfolio stance, while maintaining our overweight to hedged international equities relative to unhedged exposures. Looking to the long term, we are actively monitoring equity markets with a view to increasing allocations should valuations become more compelling.

| Asset Class | Portfolio Stance | Commentary |

|---|---|---|

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. Increasing stock concentration is skewing analysis for the asset class. Earnings have continued to remain resilient, but valuations are expensive. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have remained volatile and reactive to interest rates. |

| Fixed Interest | Neutral | We maintain a Neutral portfolio stance. Geopolitical uncertainty is contributing to some volatility in this asset class, but rates are expected to still provide downside protection in an economic downturn. In balancing both the upside and downside considerations, maintaining a neutral stance remains the prudent course of action. |

| Cash | Neutral | We have retained a Neutral cash allocation in our portfolios for buying opportunities should equity valuations reach attractive levels. |

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160