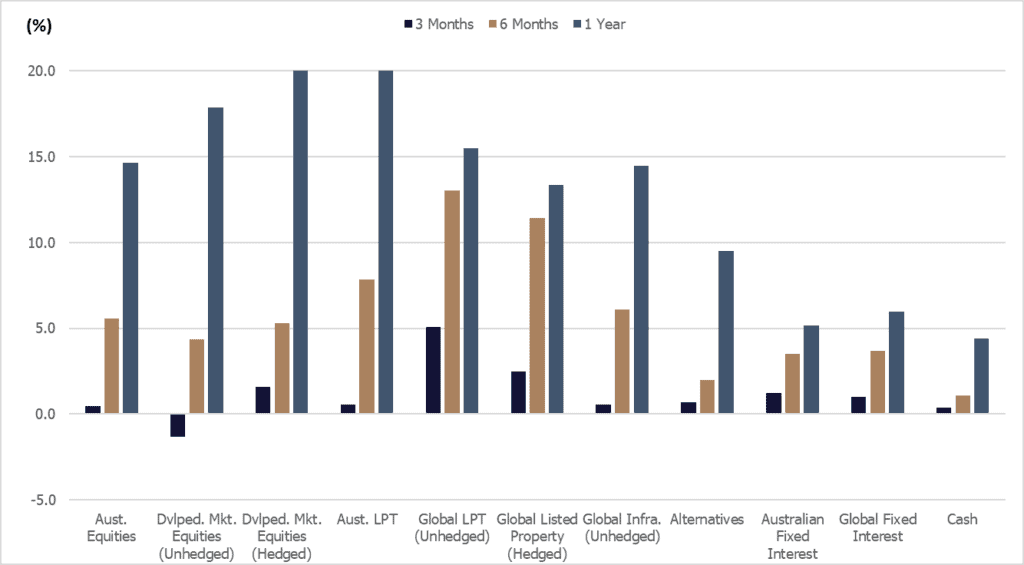

Equity markets which rallied over the first half of 2024 experienced a large drawdown in late July/early August of 2024. However, the drawdown was short-lived with a strong recovery experienced over the remainder of the month. We provide the asset class performance as at the end of August 2024 below. Of note is the impact of currency, with the strengthening of the Australian dollar more supportive of Hedged International Equities vs. Unhedged.

Source: Allied Wealth, Morningstar.

Over Q2 and into Q3 2024, portfolios continue to maintain a Neutral asset class position; but with an overweight to hedged International Equities relative to unhedged. The relative currency position has contributed positively to performance as the Australian Dollar rallied relative to US Dollars and Euros over the assessment period. Given the confluence of market events, we find it hard to take a directional view on risk assets, choosing instead to focus on relative valuation. We provide further discussion on the outlook in the section below.

Our investment outlook since the last quarter has not changed materially, but we have seen some softening in economic conditions. Labour markets have weakened as companies continue to rationalise labour costs and pass on inflation through price increases. This was observed in the recent earnings season where companies have broadly maintained their profit margins despite falling revenues.

Across developed economies only US equities have continued to demonstrate positive earnings growth, but these have been primarily tech related companies. Consumer cyclical and discretionary sectors remains broadly challenged, tied to the weakening consumer. Stock market concentration remains an ongoing issue with a small number of companies accounting for a substantial percentage of the global equity index. From a valuation perspective, equity markets today continue to trade at the higher end of its historical range.

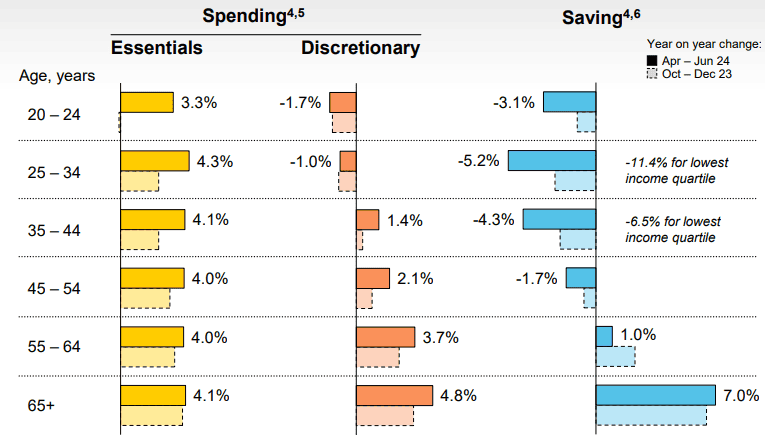

Domestically, weaker consumer dynamics is observed in the younger age groups. Most age cohorts have continued to draw down on savings to fund the increasing cost of essential goods. For the older cohorts, discretionary spending continues to grow but we attribute some of the increase to the higher cost of goods and services.

Source: Commonwealth Bank June 2024 Earnings Presentation

Over the quarter, we have seen the US Federal Reserve soften its stance on monetary policy; indicating a rate cut is expected in September. This is different from the Reserve Bank of Australia who is likely to maintain tight monetary policy given the stickier domestic inflation experience.

US elections are set for the 5th of November with campaigning now in full swing. We remain quite indifferent to either of Trump or Harris presidency. What remains clear is that irrespective of a Republican or Democrat win, we expect higher levels of government spending to persists. While there has been some debate around the sustainability of US federal debt, we think as long as debt serviceability is maintained this situation will likely continue.

As stewards of your capital, we remain primarily focused on the financial market implications for your portfolios. Despite elevated levels of market volatility, we are becoming more constructive on the corporate earnings outlook. However expensive valuations continue to give us pause.

Within international equities, we continue to maintain an overweight in hedged international equities relative to unhedged. The Australian Dollar (relative to US Dollar and Euro), at current valuations still look cheap relative to history.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. On a price-to-earnings basis, Aust equities looks marginally overvalued relative to history, however the magnitude is not large enough to warrant a change in portfolio stance. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have been volatile over the previous quarters. Deal volume remains low, and the asset class remains susceptible to interest rate expectations due to the bond-like nature of income returns. We continue to retain a Neutral position. |

| Fixed Interest | Neutral | In-line with changes discussed previously, we have decided to neutralise the overweight in the asset class. Whilst the trajectory of interest rates remain uncertain, yields in this asset class today are attractive. |

| Cash | Neutral | Cash yields remain attractive. We have retained cash in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, whilst maintaining our overweight to hedged international equities relative to unhedged. We continue to monitor market condition but believe current positioning remains the most prudent course of action.

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160