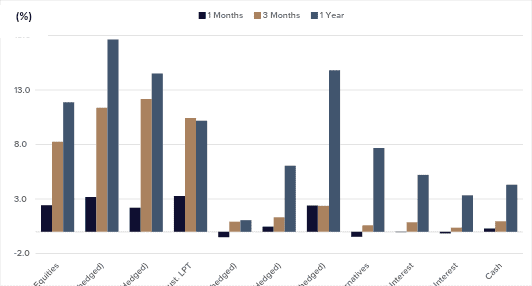

Asset class returns ended the quarter broadly positive. Incoming economic data was mixed. Despite some negative economic data prints equity, credit and rate markets have trended positive.

Source: Allied Wealth, Morningstar.

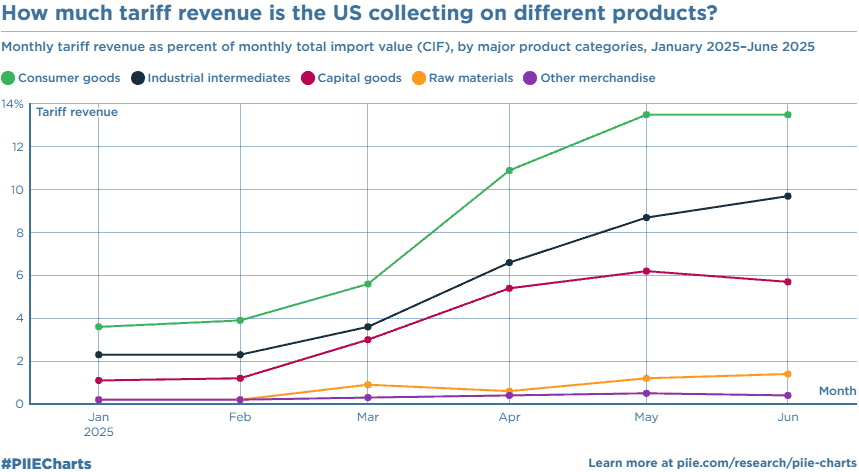

Since his inauguration earlier this year, President Trump has weaponised US trade policy and created both corporate and economic uncertainty for US consumers and global trading partners. Despite claims that multiple bilateral trade agreements have been reached, implementable details have been lacking. We are not convinced that there will be trade stability given his volatile nature and penchant for walking back on previous agreements. What is certain today are tariff are here to stay. Tariff collections have started, and at current levels is estimated to bring in approximately USD 330 Billion p.a. We have begun to see a slight uptick in US core inflation and expect this to trend upwards as the year progresses. Surveys conducted with US importers suggests that companies are planning to pass on 70% of tariffs in 2025, increasing it to 100% in 2026 and onwards.

Source: Peterson Institute

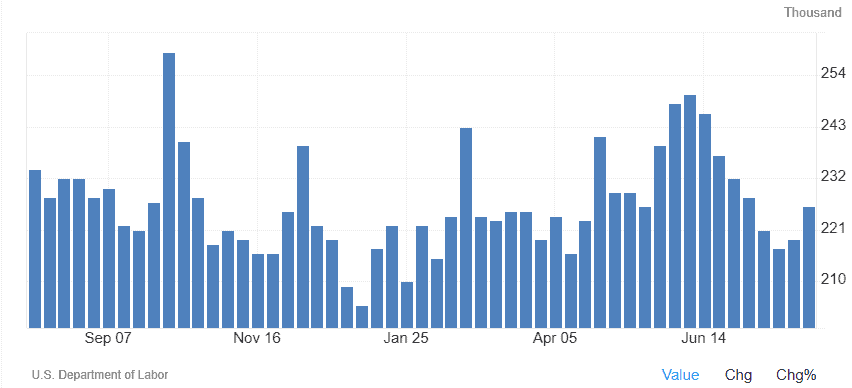

Reported corporate earning in Q2 2025 demonstrate some level of earnings resilience but the impact of companies front-running tariffs through excess importing should not be underestimated. Much like the tariff pass-through we think the consumer pain will likely only appear in the data prints sometime in the fourth quarter. Indeed, early labour market indicator such as the initial jobless claims have marginally increased in August.

Source: Trading Economics

In addition to upending trade policy, Trump has been trying to influence the outcome of monetary policy suggesting in press conferences that US policy rates should be lowered to 1%. (For context, US policy rates are currently 4.33%). Should he be successful, this would mean an end to the independence of the US Federal Reserve which have been an independent and apolitical institution since 1951.

Australia is unlikely to be immune to the impact of policy changes, but given our geographic location and economic linkages, we are likely to experience the second-order effects. At the time of writing, Australia’s GDP growth was 1.4%; with inflation hovering around 2.1%. Despite the RBA’s reticence, we think the central bank will be forced to cut rates in the coming quarter, given the weakening observed in the labour market. We expect our growth trajectory to be affected by a slowing Chinese economy.

US trade and monetary policy are key economic uncertainties. Despite headwinds, we expect corporates to continue to muddle through this environment. Tariffs will likely remain a feature of market going forward, with only the level changing.

Market timing in this environment remains extremely challenging. In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, while maintaining our overweight to hedged international equities relative to unhedged. Focusing on the long-term, we are actively monitoring equity markets with a view of increasing our allocation should market valuation become compelling.

| Asset Class | Portfolio Stance | Commentary |

|---|---|---|

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. Increasing stock concentration is skewing analysis for the asset class. Earnings have continued to remain resilient, but valuations are expensive. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have remained volatile and reactive to interest rates. Goodman Group represents almost 40% of the Australian listed property index. |

| Fixed Interest | Neutral | We maintain a Neutral portfolio stance. The evolution of trade policy, potential for economic recession and inflation have a wide set of implications for the asset class. In balancing both the upside and downside maintaining a neutral stance remains the prudent course of action. |

| Cash | Neutral | We have retained a Neutral cash allocation in our portfolios for buying opportunities should equity valuations reach attractive levels. |

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160