The equity market rally experienced over the March quarter stalled in April as investor sentiment moderated. Comparing forward pricing of interest rates in January vs. April 2024, we note there has been a material shift in expectations. Inflation which was on a downtrend has remained sticky around the 3%-4% mark.

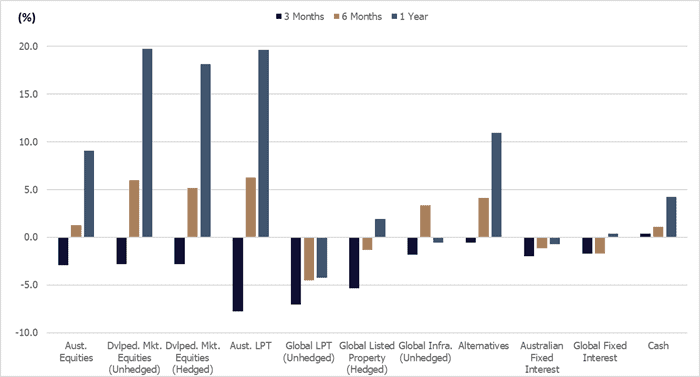

Figure 1: Asset Class Performance as at 30 April 2024

Source: Allied Wealth, Morningstar.

Coming into 2024, portfolios retained a marginal underweight risk and an overweight in hedged international equities relative to unhedged.

The underweight in risk assets detracted from the return outcome over the March 2024 quarter as stock markets experienced a narrow market rally; this compared with the overweight to hedged international equities relative to unhedged which was broadly neutral over the assessment period.

Rally in risk assets was attributable to 2 key themes, equity earnings which have proven resilient over the last 2 quarters and have continued to pick up steam at the index level, and extremely positive risk-on sentiment contributed in part by expectations of interest rates falling. The latter theme has not played out as the market expected with stickier and higher inflation for longer leading to a market sell-off in April.

We note that this market environment is very unlike a lot of history and provide further discussion on the outlook in the sections below.

The economic and geopolitical rivalry between US, Europe and China has evolved into global trade protectionism with national security increasingly cited as a reason for trade tariffs and loose fiscal policy (government spending). Over the last quarter, we have seen US and Europe provide fiscal support (via tax breaks and funding assistance) to manufacturers of semiconductors, electric vehicles, and solar panels – with the intention of bolstering local manufacturing capabilities.

Moving forward, we expect to see more protectionist measures from both US and Europe (vs China); but how this will escalate remains too early to tell. The recently implemented tariffs on Chinese goods will incentivise the build-out of local factories over the next few years, reversing decades of trade globalisation.

As stewards of your capital, we remain primarily focused on the financial market implications for your portfolios. We expect this theme to be both supportive of economic growth and inflationary. On the equity side we expect this to translate into further earnings growth, but upside participation is skewed towards tech and defence sectors.

The build-out of local manufacturing capability represents additional capital expenditure which over the short-term basis will support economic growth; but the higher labour costs associated with the production of goods is expected to be passed through to the end consumer. Thus, we continue to expect inflation to be structurally higher over the medium to long term.

Overall while there are positive implications for corporate earnings; we remain concerned that the structurally higher inflation will also mean higher borrowing costs for businesses and consumers. In balancing the upside and downside considerations based on our investment outlook, we have decided to neutralise our underweight to risk assets.

Within international equities, we continue to maintain an overweight in hedged international equities relative to unhedged. The Australian Dollar (relative to US Dollar and Euros), at current valuations still look cheap relative to history.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We have maintained a Neutral portfolio stance in Australian equities. On a price-to-earnings basis, Australian equities look marginally overvalued relative to history, however the magnitude is not large enough to warrant a change in portfolio. |

| International Equities | Neutral | We have chosen to neutralise the underweight in International Equities; but within the asset class, we have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). Across international equities, corporate earnings have proven more resilient than expected. |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have been volatile over the previous quarters. Deal volume remains low, and the asset class remains susceptible to interest rate expectations due to the bond-like nature of income returns. We continue to retain a Neutral position. |

| Fixed Interest | Neutral | In-line with changes discussed previously, we have decided to neutralise the overweight in this asset class. Whilst trajectory of interest rates remains uncertain, yields in this asset class today are attractive. |

| Cash | Neutral | Cash yields remain attractive. We have retained cash in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the outlook, the Investment Committee decided to neutralise our marginal underweight in growth assets; but have elected to maintain our overweight to hedged international equities relative to unhedged. We continue to monitor the geopolitical situation but at this juncture believe neutralising the portfolio over/underweights remains the most prudent course of action.

Yours faithfully,

Allied Wealth Investment Committee

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160