Asset Class and Economic Themes

We hope we are not the only ones to feel a little confused by financial markets. Summarising the quarter, January started out with a strong equity market rally only to start falling in February; followed by a short-term banking crisis which unfolded in the first week of March but was resolved within 3 weeks. Despite the near miss, equity markets ended the quarter generally outperforming bonds.

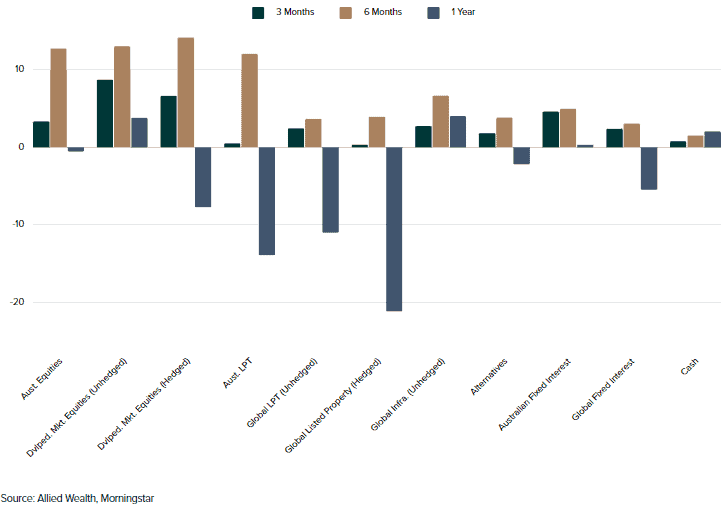

Figure 1: Asset Class Performance as at 31 March 2023 Best financial advisor Sydney

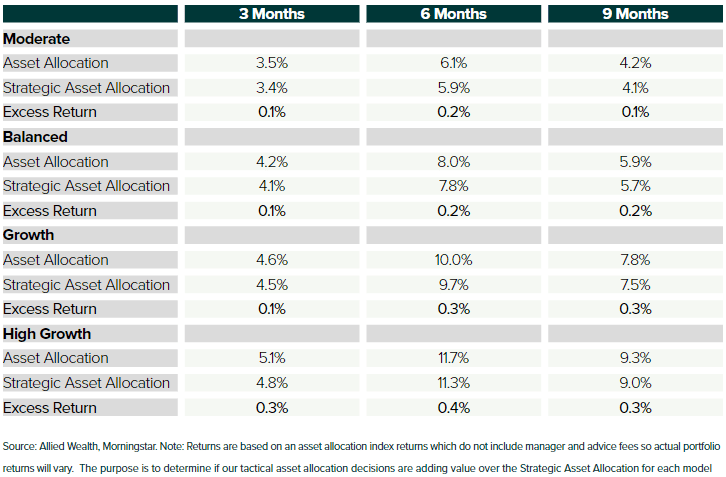

The asset allocation positions taken over the last 9 months have added value to portfolio outcomes. However, the cautious positioning has meant that excess returns relative to benchmark Strategic Asset Allocation (SAA) are marginal. Not unlike the experience over the previous quarters, all asset classes have been extremely volatile over the period – bond yields for example fell more than 1% in a day in response to the collapse of Silicon Valley Bank. Overall, we are pleased with the positive outcomes for clients.

Figure 2: Asset Allocation Performance as at 31 March 2023 Independent financial advisor

What is Our Current Investment Outlook?

In our prior quarterly newsletter, we highlighted the changing market environment and flagged an upside and a downside economic scenario tied to rising interest rates and tightening financial conditions.

Interestingly we saw a short-term banking crisis unfold in March which was met with quick action by regulators to stem the crisis. This culminated in the sale of Silicon Valley Bank in the US; and forced sale of Credit Suisse to UBS in Europe. Fast forward to today, markets have calmed down and the focus has once again shifted back to longer-term fundamentals. Despite the quick resolution, we think this is but a symptom of the broader pain the market is likely to experience going forward.

Reflecting on this discussion at our April Investment Committee, the debate this quarter centred around the possibility and probability of a hard recession. While a range of upside and downside market scenarios are possible, we think the probability of a downside scenario has increased. Simplistically we would quantify the probability of a hard economic landing as having increased from 45% to 60%.

Let us step through key thematic which has shaped our view.

The Dynamics of Inflation and Interest Rates

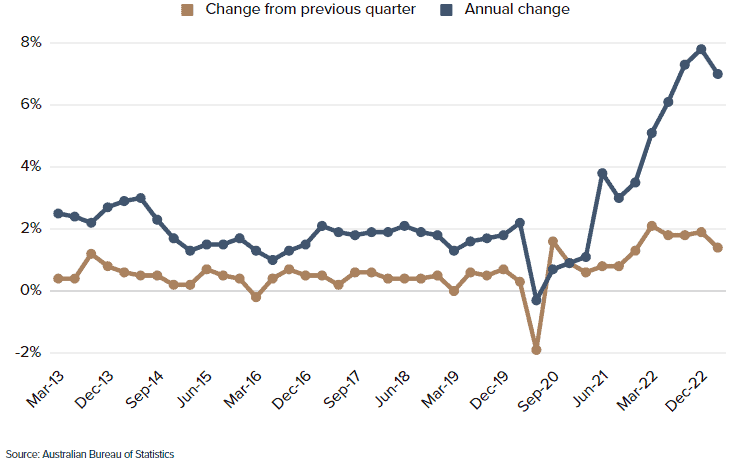

As we have seen over the 12-month period, interest rates have risen substantially. Raising interest rates is a function of central banks to try and moderate inflation and over the last 2 years, interest rates have trended materially above the desired target of 2-3% In-line with our expectations, historical data suggests that inflation in both US and Australia peaked in December 2022 but levels remain broadly elevated.

Figure 3: Australian Consumer Price Index as at 31 March 2023 Independent financial advice

Future inflation prints are likely to continue lower due to base effects. However, we are concerned that the elevated level and sticky core inflation is likely to result in further interest rate hikes before the central banks pause. Any additional interest rate hikes are likely to put more pressure on corporate balance sheets and consumers alike going forward.

Equity markets have started to show signs of stress but have continued to trade higher

We have started to see slower demand reflected in corporate revenue growth which has been declining. To preserve profit margins, companies have started to restructure their workforce and get creative with cost management. The effects across companies of different sizes and sectors have been varied.

In the case of large corporates (think large capitalisation listed equities), whilst revenue has begun to decline, profit margins have remained resilient. However, we think there is only so much that can be done before falling revenues translate directly into lower (or negative) earnings. Forward earnings expectations have started to trend downwards but despite this, equity markets have continued to trade higher.

Private equity as an asset class is facing the same headwind as it's listed counterpart but, is in our view, more susceptible in the current environment. Companies in this sector tend to be smaller, monoline businesses with limited avenues for capital raising and thus are more fragile. This compares to venture capital which is struggling in this environment.

Since 2022, we have seen a change in investor behaviour and preferences. Prior to 2022, with interest rates at 0% we saw a flood of investor capital into high growth companies with no cashflows – this bid up valuation multiples and saw some extremely expensive deals completed. Fast forward to 2023, the preference has now shifted to companies with sustainable cashflows with proven business models.

Commercial real estate particularly in private markets have been problematic. As we wrote some time ago, we saw a large discrepancy in valuations between what buyers were willing to purchase at; and what sellers were willing to sell – thus there was very limited transactional activity over 2022. Since then, the cost of debt has been steadily increasing, whilst sellers which have been hesitant to sell at large, discounts are beginning to capitulate. We have started to see property sales at 15% - 20% lower than their carrying book value. Deal numbers remain low but going forward we expect a lot more pain in the coming months.

Private debt markets engaging in 'Amend, Extend and Pretend' Activities

Debt markets have been directly affected by rising interest rates. For holders of floating rate bonds/loans this has resulted in higher income returns. Whilst higher yields may be good for investment outcomes, it increases the debt burden of companies, thus increasing the probability of default. In private debt markets we have seen some questionable activities – what we like to term “Amend, Extend and Pretend “. Companies who have not been able to finance (or refinance) their loans today, are engaging with their existing debt holders to either amend terms of payment or extend loan maturities. As much as possible they will need to pretend everything is ok and hope that at some point prior to debt maturity that the Central Banks once again drop interest rates making refinancing a lot less costly compared to today.

To top this off, we note that the quality of private debt markets which initially started out as investment grade has fallen over the years, driven by a reach for yield by investors when rates were zero. Today, we believe loans which fall in that sub-investment grade category to be approximately 50% of sector. Now faced with higher cost of debt and decreased investor risk appetite we think there will be a material number of defaults in the coming year.

Given the views discussed above, we believe that the probability of a downside scenario has risen. The counterbalance to the negative view is the speed in which we have seen both central banks and regulators react to market events – good example being the recent banking crisis where key decisions were made and enacted by regulators over a period of 2 weeks.

While historically, we have seen Central Banks drop interest rates to support the economy, we believe in this cycle monetary policy support is likely to be limited – especially if inflation remains higher than the bank’s inflation target of 2% to 3%.

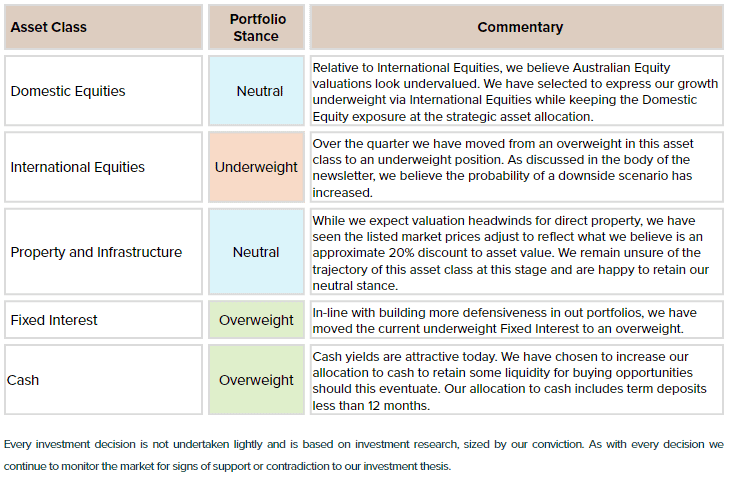

Investment Decisions and Strategy Implications Independent financial advisor Sydney

Given the confluence of events, we have made the decision to reduce portfolio risk. While there is still a probability that equity markets may fare well through this, we think this probability has shifted to the downside. Furthermore, asset allocation decisions to date have added value to client outcomes and we feel it prudent to crystalise some positive returns at this juncture.

In-line with the outlook, the Investment Committee has decided to move to an underweight growth assets in favour of an overweight to defensive assets. Specifically, we have proposed an underweight position in International Equities to be funded via an overweight position in Fixed Interest and Cash.

Other Portfolio Changes: Move from Janus Henderson Tactical to Core Fixed Interest

In-line with our defensive portfolio stance, a decision has been made to change from the Janus Henderson Tactical Fixed Interest Strategy to Core Fixed Interest for most portfolios. This investment decision represents an increase in interest rate duration and a marginal decrease in credit exposure for active portfolio.

Janus Henderson’s Australian Fixed Interest team remains a quality manager in our view, so we have retained the manager but implemented a change in strategy.

Figure 4: Asset Class Summary and Portfolio Stance

Bottom-up market observations

What to do with the banks

The last four years have been very eventful for bank shareholders, with each year bringing a new set of worries predicted to bring the banks to their knees. 2020 saw capital raisings from NAB and Westpac missing their first dividend since the banking crisis of 1893, as experts forecasted 30% declines in house prices and 12% unemployment! Then 2021 saw the banks grappling with zero interest rates and APRA warning management teams about the systems issues they may face from zero or negative market interest rates, an issue that seems quite comical now. 2022 saw the RBA raise the cash rate from 0.10% to 3.10%, the most rapid tightening ever from Australia's central bank. Now in 2023, the concerns have switched to the impact of sharply rising interest rates on bad debts and the upcoming "fixed rate cliff".

While the banks will surely see rising bad debts over the next year, Allied view that the market is far too negative towards the banks in 2023. Indeed, the main banks are better placed to weather 2023 and 2024 than in 2007 to deal with the last rate tightening cycle.

Bad Debts will rise, but that is not bad

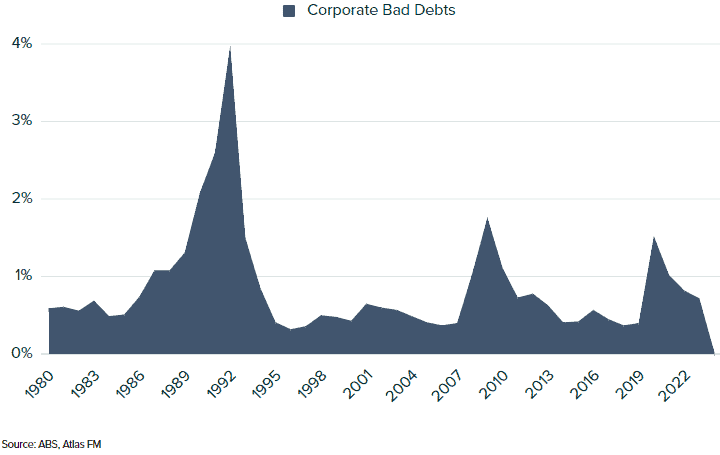

Rising interest rates will see declining discretionary retail spending as more income is directed towards servicing interest costs. While bad debts will increase, this should be expected. In the 2022 financial year, the major banks reported bad debt expenses between 0% and 0.2%, the lowest in history and clearly unsustainable. Excluding the property crash of 1991, bad debt charges through the cycle have averaged 0.3% of gross bank loans for the major banks, with NAB and ANZ reporting higher bad debts than Westpac and CBA due to their greater exposure to corporate lending.

Figure 5: Australian Banking Sector Bad Debts as a Percentage of the Loan Book

In predicting the trajectory of bad debts in 2024, the 1989-93 spike in bad debts should be excluded, as bank bad debts spiked due to a combination of poor lending practices and very high-interest rates. Indeed in 1991, the head office of Westpac was unaware that different arms of the bank were simultaneously lending to 1980s entrepreneurs such as Bond and Skase et al.

Additionally, during this period, borrowers saw interest rates approaching 20%, a level outside any current forecasts. Today the composition of Australian bank loan books are considerably different to what they were in the early 1990s or even 2007, with fewer corporate loans (such as to ABC Learning, Allco, MFS) and a greater focus on mortgage lending, which is secured against assets and historically has very low loan losses. Additionally, the major banks have pulled the plug on their foreign adventures, with no exposure to northern England and Asia that in 2008 saw high bad debts, often due to the making of questionable loans outside of the core market.

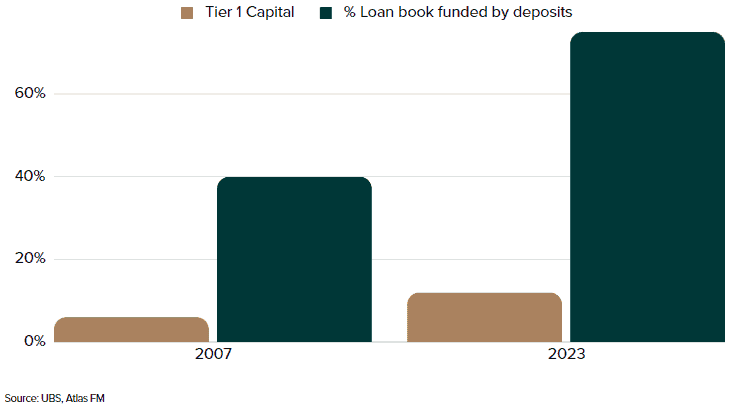

Then and Now

In 2023 all banks have a core Tier 1 capital ratio above the Australian Prudential Regulation Authority (APRA) 'unquestionably strong' benchmark of 10.5%. This allowed Australia's banks to enter the 2022/23 rising rate cycle with a greater ability to withstand an external shock than was present in 2007 going into the GFC, where their Tier 1 Capital ratios were around 6%. For investors, this means that the banks have more capital backing their loans. Additionally, the quality of the loan books of the major banks is higher in 2023 than in 2007 or 1991, which saw a greater weighting to corporate loans with higher loss levels than mortgages. Further, the banks' funding source is more stable today than it was 13 years ago, with an average of 75% of loan books funded internally via customer deposits. This means that the banks rely less on raising capital on the wholesale money markets (typically in the USA and Europe) to fund their lending.

Figure 6: ASX Banking Sector 2007 vs 2023

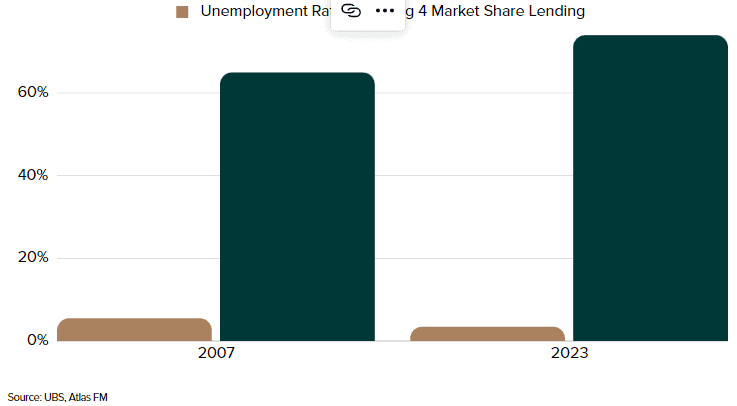

The major banks face the next few years in a far stronger position than they went into 2007. Currently, the unemployment rate is 3.5%, significantly less than it was going into the last rate tightening cycle. While rising interest rates will undoubtedly cause stress to many borrowers over the next 12 months, so long as employment remains strong, mortgage repayments will remain high and bank bad debts low. However, we expect the outlook for consumer discretionary stocks such as Flight Centre, Harvey Norman and AP Eagers to deteriorate as spending on Bali holidays, televisions and new cars are diverted to service higher mortgage payments.

Figure 7: ASX Banking Sector 2007 vs 2023

Since the GFC, the banking oligopoly in Australia has only become stronger, with foreign banks such as Citigroup exiting the market and smaller banks such as St George, Bankwest, and now Suncorp being taken over by the major banks. While our political masters bemoan the concentrated banking market structure, having a strong, well-capitalised banking sector looked to be very desirable in March with the collapse of Silicon Valley Bank in the USA and in the wake of UBS' forced takeover of Credit Suisse.

Our Take

Allied Wealth expects the upcoming May reporting season to show that Australia's banks are in good shape and face a better outlook than many sectors of the Australian market. We expect the banks to outperform in the near future, enjoying a tailwind of a rising interest rate environment and high employment levels, which will see customers make the new higher loan repayments. With an average grossed-up yield of +7.2% and lower-than-expected bad debts, bank shareholders will be rewarded for their patience and for ignoring the current market noise.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160