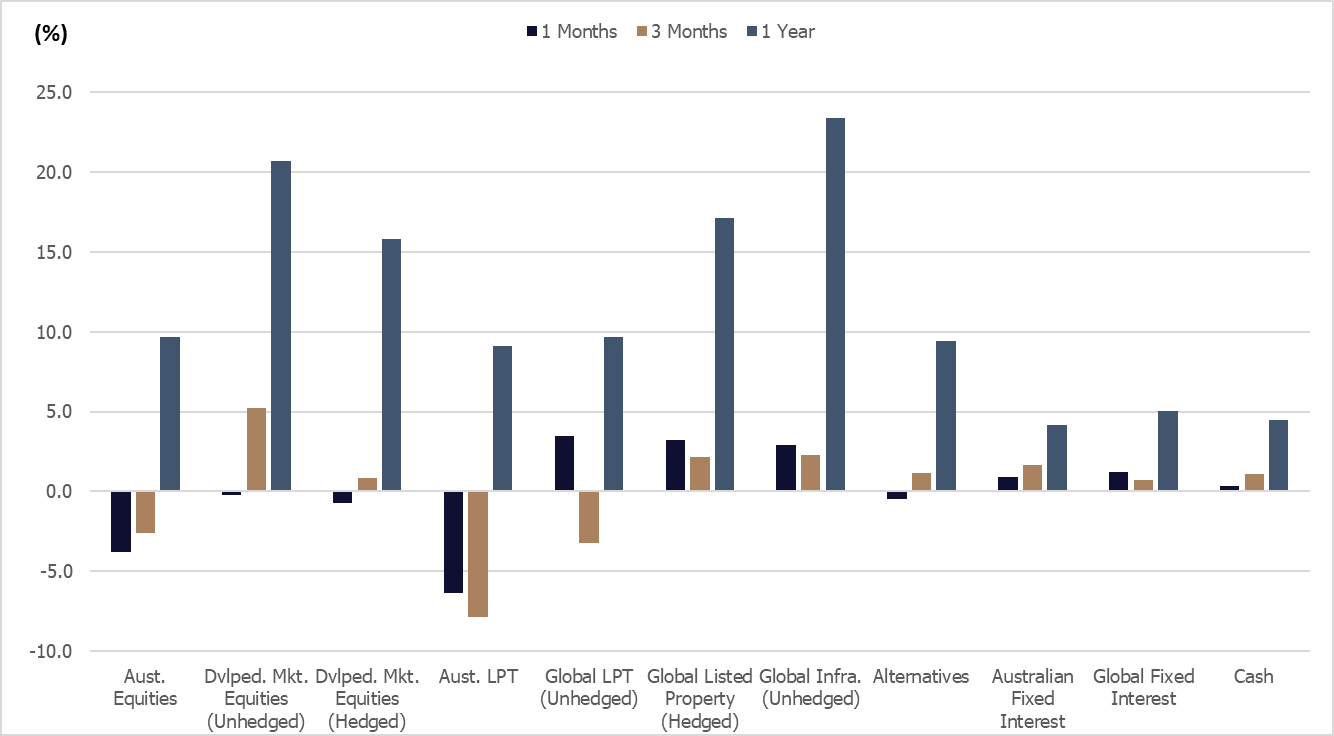

All asset class returns were positive over the 1-year period to February 2024. The Trump presidency and policy uncertainty have resulted in material market volatility over the quarter and negative returns in equities and listed property over the 1-month and 3-month period.

Source: Allied Wealth, Morningstar.

Economically, global and domestic GDP growth while moderate remain positive. Corporate earnings have remained steady but within the listed market, large companies have seen outsized earnings growth compared to smaller counterparts. Despite the Goldilocks (not to hot, not too cold) environment, the largest forces driving markets have been policy uncertainty tied to US trade and fiscal policy. Market reaction has been extreme but in-line with the persistent uncertainty.

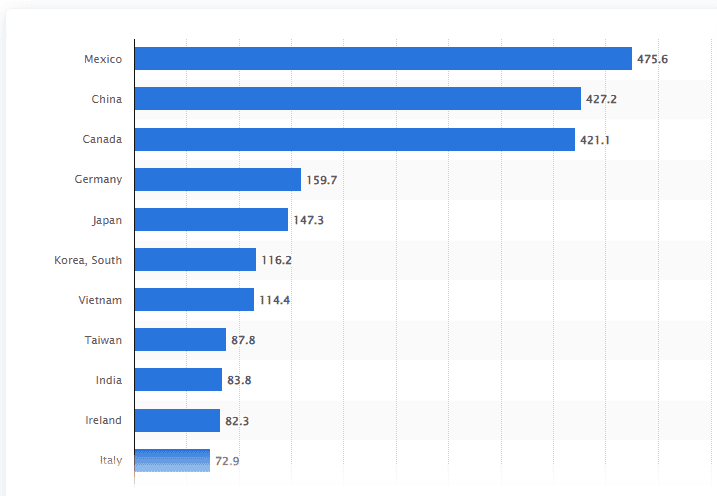

Uncertainty around US trade policy has been the largest driver of market movement over the recent period. Since the inauguration of Donald Trump on the 20th of January the administration has threatened and implemented a 25% trade tariff on Canada and Mexico; with a 20% trade tariff imposed on China. At last count, the Trump presidency has threatened trade tariffs and reversed the decision 6 times in the matter of 7 weeks in office. In our view, trade tariffs are a bad idea and represents an effective tax on the end consumer.

Liberalisation of trade over the last 100 years combined with technological specialisations have resulted in an interconnected global supply chain – e.g. assembly of cars today rely on multiple parts manufactured globally across different countries. Thus, any tariffs affecting the flow of good across borders results in more expensive production costs which is then passed on to consumers by companies looking to maintain their profit margins.

We believe the motivations for tariffs are driven by Trump’s desire to implement a broad range of tax cuts while keeping the US fiscal budget balanced. In Trump’s view, the implementation of tariffs is expected to raise massive amounts of government revenue to offset losses from reduced tax.

Source: Statista

However, Trump has likely underestimated the detrimental effects to US consumers including the impact of trade retaliation from Mexico, Canada and China. These are the three largest US trading partners, and we expect its effects to be felt far and wide.

Other avenues of budget reduction have been staff cuts by DOGE run by Elon Musk. We estimate to date DOGE has been able to reduce the government budget by US$ 400 billion which is a far cry from the US$ 2 trillion in cuts promised. More than 70% of the annual federal budget is represented by social security payments, Medicare and Medicaid. Any cuts to these programs directly affect the lowest income cohorts within the community. Excluding the large items, other material components of the budgets are defence spending and interest payments. Unless there are material cuts to any of these categories, it is unlikely that DOGE will be able to meet its stated objective.

We believe that the Trump administration will go ahead with the tax cuts which will further increase the federal costs. This will in turn result in an increase in government debt and translate into increased annual interest payments.

More concerning is the impact of the trade tariffs. Even under the best-case scenario where implemented tariffs are withdrawn, we believe the trade policy uncertainty will persist. We have seen evidence of companies delaying investment and hiring decisions. This will continue to weigh on growth over the medium term.

In the worst-case scenario of escalating trade tariffs, including retaliation by Canada, Mexico, China and the European union, we believe the impact to the global economy will be large. There are no winners in a trade war. In this scenario, we expect a short-term rise in inflation reflecting the passed-on costs of tariffs, followed by a large drop in output and consumption (effectively an economic recession).

Comparing the range of scenarios, we believe there is a wide dispersion of outcomes. Additionally, there is an added complexity of timing. The short-term economic pain for consumer does not necessarily mean a dire outcome for large multi-national companies who are likely to be more resilient. However, the evolution of trade policy (both US and trading counterparties) at this time is unknown and thus we prefer to maintain our market exposure within the portfolio.

| Asset Class | Portfolio Stance | Commentary |

| Domestic Equities | Neutral | We maintain a Neutral portfolio stance in Australian equities. Post the drawdown experienced in February and March, valuation for the asset class has started to look attractive, even adjusting for the potential earnings degradation. |

| International Equities | Neutral | We have maintained a Neutral position in International Equities; but within the asset class, have selected to maintain the marginal overweight to hedged International Equities (relative to unhedged). We believe the currency has moved too far and looks cheap from a valuation perspective. |

| Property and Infrastructure | Neutral | Property and infrastructure as an asset class have remained volatile and reactive to interest rates. Australian listed property remains a more concentrated market compared to global listed property. |

| Fixed Interest | Neutral | We maintain a Neutral portfolio stance. The evolution of trade policy, potential for economic recession and inflation have a wide set of implications for the asset class. In balancing both the upside and downside maintaining a neutral stance remains the prudent course of action. |

| Cash | Neutral | We have retained a Neutral cash allocation in our portfolios for buying opportunities should equity valuations reach attractive levels. |

In-line with the current outlook, the Investment Committee has elected to retain the Neutral portfolio stance, while maintaining our overweight to hedged international equities relative to unhedged. Focusing on the long-term, we are actively monitoring the equity market drawdown playing out today with a view of increasing our equity allocation should market valuation become compelling.

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160