As we begin 2024, we want you to know what a privilege it is to serve as your advisor. Hopefully each quarterly newsletter gives you some insights into our thinking and its evolution as we are confronted with new information and ideas in an ever-changing financial landscape. As always, we strive to maintain a balanced approach with awareness of both upside return and downside risks.

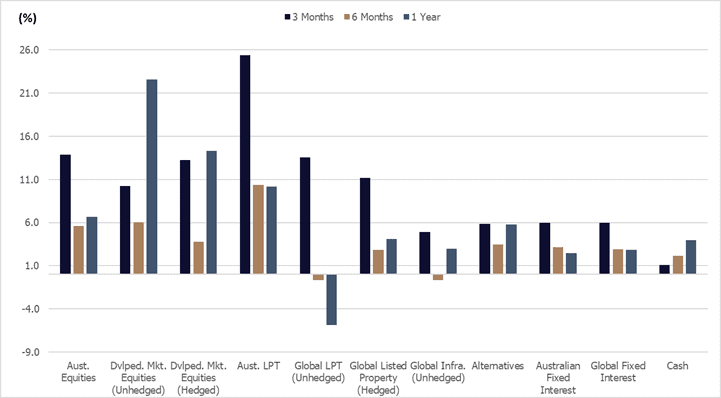

Asset class volatility has continued into 2024, with large return variations observed quarter-on-quarter. Indeed, we have seen correlated asset class performance over 2023 and we think this behaviour will likely continue over the short term. Over the 3-months to January 2024 all asset classes printed positive, driven primarily by market expectations of policy rate cuts over the first half of 2024.

Source: Allied Wealth, Morningstar.

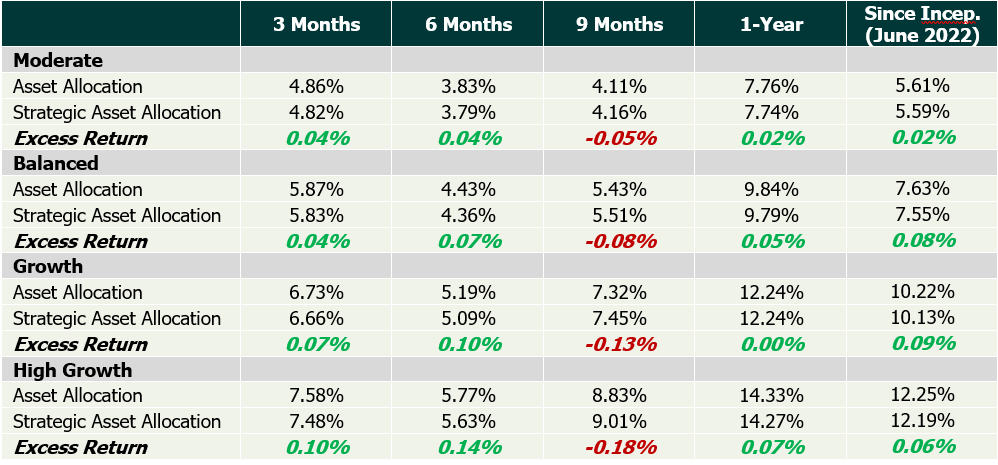

Coming into Q4 2023, we implemented an overweight allocation in hedged international equities relative to the unhedged position. This decision contributed to performance as the Australian Dollar strengthened over the period. Over the quarter, portfolios have maintained a marginal defensive bias expressed as an underweight in growth assets in favour of defensive assets – this position has marginally detracted from relative performance over the quarter. The combined asset allocation decisions are net positive and additive to long-term portfolio returns. While we are pleased with the results, we would emphasize that the asset allocations decisions have been made both from the perspective of risk mitigation as well as alpha generation.

Source: Allied Wealth, Morningstar. Note: Returns are based on an asset allocation index returns which do not include manager and advice fees so actual portfolio returns will vary. The purpose is to determine if our tactical asset allocation decisions are adding value over the Strategic Asset Allocation for each model.

Strategic Asset Allocation Review

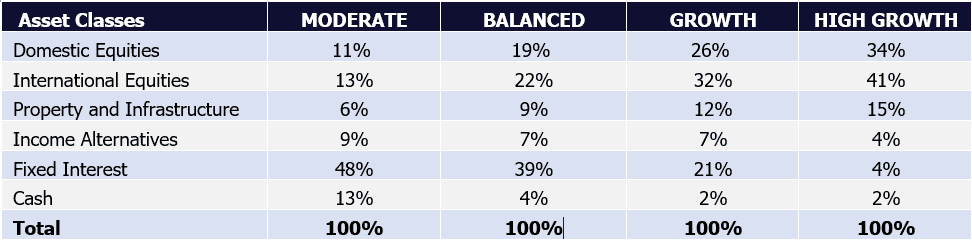

In Q4 2023, we conducted a Strategic Asset Allocation (SAA) review of client portfolios across the risk spectrum – Moderate, Balanced, Growth and High Growth. Review includes an assessment of our current Capital Market Assumptions and long-term implications for the baseline SAA.

Our analysis of asset class returns and risks suggests that while there are short-to-medium term market considerations of note, the relative attractiveness of asset classes have not changed over the long-term (20-years forward). Structurally, we see a rise in income yields across asset classes, more so in bonds and credit compared to equities. The attractive level of income has resulted in an increased allocation to Income Alternatives across Moderate, Balanced and Growth portfolios.

One of the key themes discussed at the Investment Committee was narrow market representation. Looking through the market indices we note that positive performance in international equities was primarily driven by strong performance in a small number of large-cap tech stocks (Microsoft, Google, Nvdia, Meta, Apple and Amazon). While there is an argument to be made that large-cap tech is overvalued, we have seen positive earnings growth which continues to support the lofty valuations. However, we note in most cases (exception being Nvidia) a material contribution to earnings growth have been job cuts in the second half of 2023.

The AI boom remains the gift that keeps on giving. Despite record number of lay-offs in the tech sector, companies continue to invest in AI and data processing which has led to strong demand for both software and hardware. This trend has also percolated across property and infrastructure. We have seen substantial investments in data centres and energy infrastructure, supported by new equity and debt raisings. Investors continue to be extremely bullish on these themes coming into 2024.

We believe that central banks globally are mostly at the tail-end of their hiking cycle. Tight monetary policy has led to softening of economic conditions and moderation in inflationary pressures. Inflation remains on the higher end of the target range at around 3%, and we expect this to continue over the first half of 2024.

Investor sentiment remains too bullish for our liking. At this point, equity market valuations are expensive but as history indicates, expensive valuations may persist over long-periods of time. Our analysis suggests that equity valuations today include an expectation that interest rate will fall in H1 2024 followed by earnings growth coming into H2 2024. This thesis at current valuation does not leave much room for error and thus we have remained cautious.

Geopolitical conflict continues to be an ongoing theme. With the US presidential elections in November 2024, primaries have already commenced. Polling and voting to date suggest the upcoming election will be a Trump vs Biden showdown. Irrespective of which candidate wins, we expect further escalation of trade conflict between US and China.

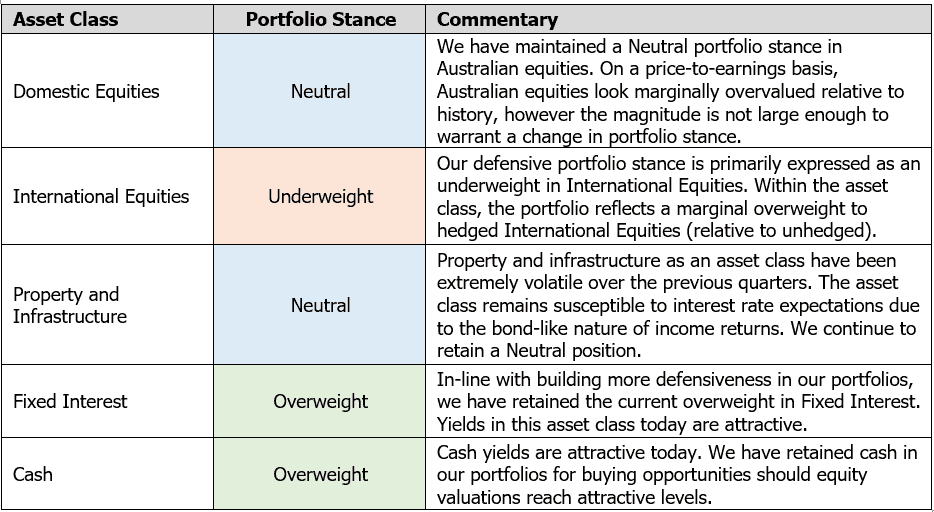

Following the investment committee discussion, members agreed to retain the current asset allocation stance which reflects 1) a marginally defensive stance overweight cash and fixed interest in favour of an underweight in international equities and 2) within international equities, an overweight in hedged international equities relative to unhedged. Despite the appreciation of the Australian Dollar (relative to US Dollar and Euros), current valuations still look cheap relative to history.

In-line with the outlook, the Investment Committee decided to maintain our marginal underweight in growth assets in favour of an overweight to defensive assets; and an overweight to hedged international equities relative to unhedged. Given the current market environment we have thought it appropriate to maintain the cautious stance but will look to reassess our position should it be warranted.

Thank you once again for your continued trust and confidence. We wish you a fruitful and prosperous 2024.

Yours faithfully,

Allied Wealth Investment Committee

What sets Allied Wealth apart

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

General advice warning

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160