At the time of writing (April 5), equity markets have fallen 12% since the beginning of March 2025. The most significant market drawdowns experienced on the 3rd and 4th of April coincided with:

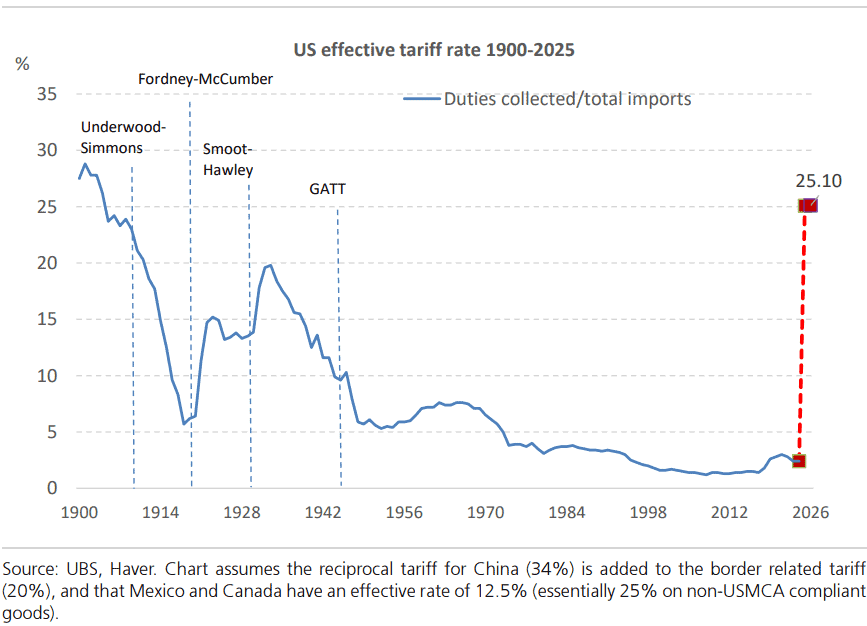

Cumulative tariffs implemented to date represent a reversal of the global trade progression over the last 100 years. Unlike 100 years ago, industrial manufacturing today is more sophisticated and interconnected than ever before. For instance, a car considered “US-made” today still relies on more than 40% non-US manufactured parts.

The magnitude of Trump’s “Liberation Day” tariffs has been far more aggressive than markets anticipated, with retaliatory tariffs by other nations still to come. Negotiations with Trump and his team have proven inconsistent at best, with the US administration abandoning its commitments in a matter of days. This persistent uncertainty in trade policy will continue to weigh on market sentiment.

You may have read multiple articles highlighting the risk of stagflation (persistently high inflation with high unemployment and low growth). We think of this risk as a tail-risk and would assign a low probability of stagflation at this time. Based on the anecdotal reaction by businesses to the tariffs, we think an economic recession over the short to medium term is more likely as businesses delay capital expenditure decisions, reduce their labour force and pass on costs to consumers – all of which will lead to a pullback in consumption and spending. The depth of the economic recession is uncertain and will be highly predicated on how the current situation evolves.

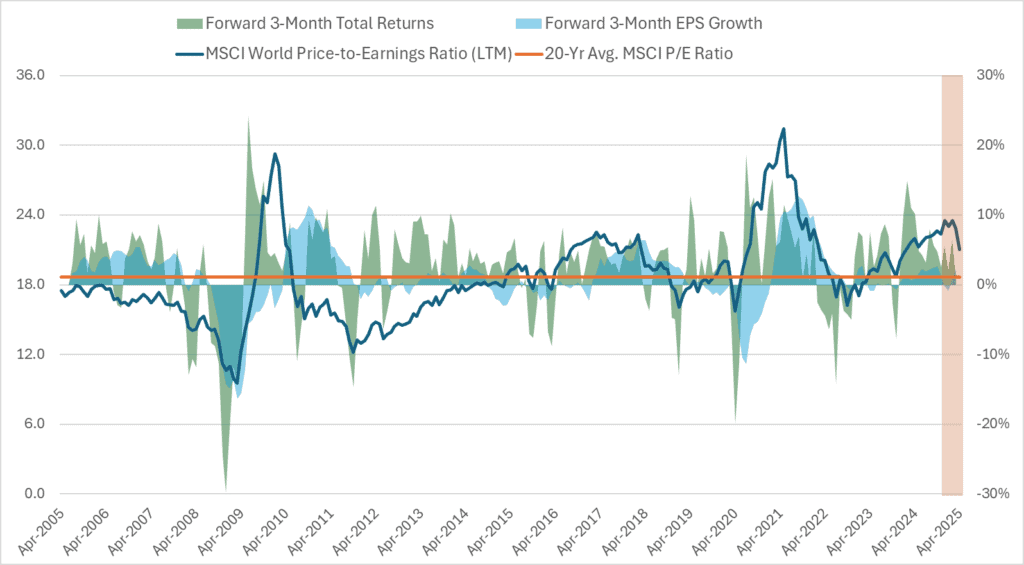

Over multiple client newsletters, we have consistently reiterated the view that markets continue to trade above fundamentals. However, the drawdown experienced to date (refer to orange bar in Figure 2) has moved International Equity valuations closer to an attractive entry point of around 18x. Should extensive drawdowns drive valuations to this desired level, we will review and assess buying opportunities.

Source: Bloomberg, Allied Wealth

While we expect a wide dispersion of outcomes over the short-term, we maintain a more bullish view over the longer-term. As noted in our previous commentary, pain for the consumer does not necessarily equate to a dire outcome for large multi-national corporations (but the adjustment will, of course, hurt!).

Much like the COVID-19 period and the interest rate rise of 2022, large corporates have maintained and grown market share through tough economic conditions at the expense of their smaller counterparts. While we do not think the current environment will be different, we think this adjustment will likely play out over a much more extended time frame. Thus, we are in no rush to increase our equity allocation (i.e., buy the dip) at the current time.

As always, the team at Allied Wealth remains committed to long-term client outcomes. Acknowledging the extremely volatile market conditions, we continue to monitor the geopolitical developments as they change from day to day.

If you have any questions or concerns, please do not hesitate to contact us.

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not consider your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160