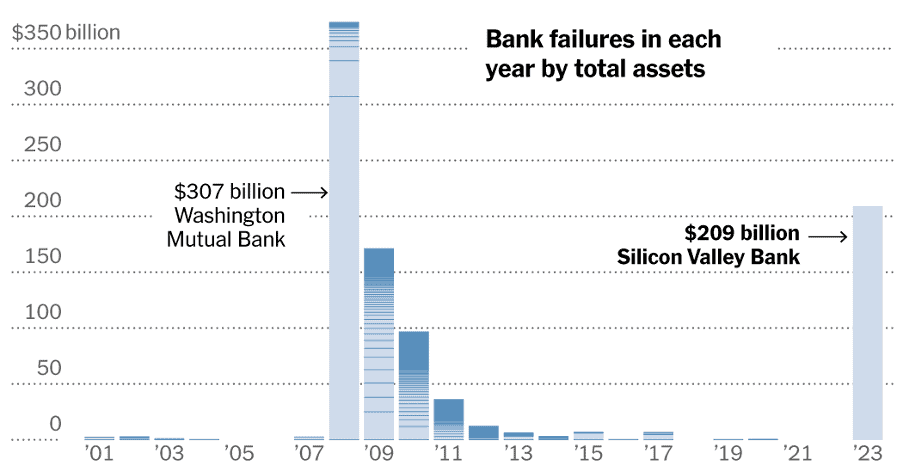

As you may have already seen in the news, US regulators moved to close Silicon Valley Bank (SVB) on the 10th of March. This was followed by the closure of Signature Bank on the 12th of March. Interestingly, the collapse of these two banks represents the 2nd and 3rd largest bank collapse in US history.

Figure 1: Comparison of Silicon Valley Bank Failure Rel. Historical Experience

Whilst these developments are specific to SVB and its circumstances, regulators are worried that this may trigger a much broader run-on banks – particularly for regional/smaller banks in the US.

To restore calm, US regulators have moved promptly to shore up depositors and guarantee all deposit balances irrespective of amount (legal maximum guarantee of $250k is legislated). Additionally, the Federal Reserve made emergency loans available to all other banks and have since seen a take-up of $1.7 Billion.

While we can argue around the moral hazard of what can be construed as a bank bail-out, what is apparent is that a broad-based bank run poses a systemic risk to both the US and global economy.

At the time of writing, we have also seen the solvency of Credit Suisse being called into question. Credit Suisse shares fell 40% prompting the Swiss Central Bank to extend a CHF 50 Billion credit line to help the bank meet any short-term funding needs.

Since the 8th of March, equity markets have seen a broad sell-off followed by a rebound two days following the announcement of emergency support measures. US banks however have fallen by -22.1% with massive intra-day volatility in share price.

Across bond markets, government bonds rallied as we saw an initial flight to safety followed by a marginal fall as markets continue to evaluate the situation. Credit spread widened on contagion risks but have since moderated.

Australian and International Equities are still lower post event at -4.3% and -2.4% respectively, while Australian and International Fixed Interest are positive at +2.1% and +1.9% respectively.

It is clear this event has spooked markets and we expect volatility to continue as investors reassess incoming news.

We have completed a look-through of our portfolios and note there are no direct holdings in SVB; However, portfolios have a marginal exposure to Signature Bank via T Rowe Price Global Equities equating to approximately 0.04% on a portfolio look-through basis.

Given the size of the exposure we are less concerned around the direct portfolio impact but are more concerned around how this changes the longer-term investment outlook.

Quite frankly like the rest of the market we are still analysing incoming data. Our base case at the time of writing remains that Central Banks and regulators globally will be successful in stemming the short-term market panic and associated risks of more bank-runs.

However, over the longer-term we believe this event represents the first of many more to come, particularly as higher interest rates start working its way through the economy. This event is likely to weigh on central banking decision making especially when considered in combination with inflation prints which have remained stubbornly high. Over time we expect credit spreads to structurally shift wider as markets incorporate higher debt cost and increased default probabilities.

Portfolios today are well positioned to weather the bouts of market volatility. For now, we believe the action of central banks and regulators have been quick and decisive enough to stem a broader marker panic. We will look to provide another update to the investment outlook post the March 2023 Investment Committee as the situation evolves.

Yours faithfully,

Allied Wealth Investment Committee

Allied Wealth's core principles

You are welcome to pass on this commentary or our contact details to anyone whom you think would benefit from our services.

Disclosure

The information provided in and made available through this document does not constitute financial product advice. The information is of general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice.

We recommend that you obtain your own professional advice before making any decision in relation to your particular requirements or circumstances.

Allied Wealth Pty Ltd is a Corporate Authorised Representative of Allied Advice Pty Ltd for financial planning services. AFS Licence No. 528160