Every February and August, most Australian listed companies reveal their profit results and guide how they expect their businesses to perform in the upcoming year. While we regularly meet with companies between reporting periods to gauge their business performance, the reporting season offers investors a detailed and externally audited look at the company's financials.

The February 2025 company reporting period that concluded last week highlighted how volatile earnings season can be when the market is at all-time highs. Share price volatility over the month was compounded by Trump's erratic trade policies, imposing and then reversing tariffs dented market confidence. The dominant themes of the February reporting season have been that the consumers continue to hold up, a strong US Dollar, inflation and cost management and a solid economic outlook. This week's piece looks at the key themes from the reporting season that fared last week, the best and worst results and how the Domestic Equities Portfolio performed over the month.

This February reporting season has proven to be more volatile than previous years. The average intraday share price move was 7% from the stocks that reported. Over 20 companies in the ASX 200 saw their share prices move by more than 10% on the reporting day. Small earnings misses saw significant share price moves; similarly, small earnings beats saw large share price movements. For example, A2 Milk posted a small $6 million increase in profits, which saw a $800 million increase in the company's market capitalisation on results day. Conversely, Viva Energy reported a $60 million fall in profits, and $1 billion was wiped off its value on February 25th!

In previous years, we saw prices move similarly to underlying earnings almost one-to-one, but this reporting season saw companies' share prices move over two times earnings revisions. The increased volatility has been attributed to the impact of high-frequency trading funds on setting prices on results day, with long-term holders likely to wait until after meeting management teams or even after the conclusion of reporting season in March before making significant portfolio changes. In February, Woolworths' share price saw a +2.5% gain after releasing their profit results, before falling all afternoon and finishing by -4%. Very frustrating for shareholders of the grocer.

The first dominant theme for the February reporting season was the strength of the domestic consumer. In November 2022, Westpac's economists forecasted a grim year for 2023. The much-feared fixed interest rate cliff is expected to see unemployment rise to 4.5%, an 8% fall in house prices, bad debts spike and retail sales grind to a halt.

Two years on, the February 2025 reporting season showed that consumer demand had not skipped a beat. JB Hi-Fi sales increased by 10% as consumers still demand the best technology and electronic products that will benefit from the AI rollout. Similarly, Kmart and Bunnings Warehouse owner Wesfarmers saw increased sales across its two flagship stores as consumers continued to trade down items, especially to Kmart's Anko brand.

On the negative side, consumers are unwilling to spend on large projects, including building new homes or upgrading bathrooms and hearing implants. This was seen in the results of Reece, which saw profits fall -19%, driven by lower housing starts due to high capital costs in both the United States and Australia. Cochlear surprised the market after reporting that in the USA, cost-of-living pressures have delayed some users' replacement of ageing sound processing technology due to higher out-of-pocket expenses to fund new sound processors.

Since these companies opened their books last August, the Australian Dollar has depreciated against most international currencies, including the US dollar. While this is a negative for those planning ski trips to Aspen or summer trips to Miami, it is a positive for companies that earn profits in the United States or Europe but pay Australian Dollar dividends. The shareholders in these companies saw a free 5% uplift in their dividends from positive currency movements. The clear winners from the weaker Australian Dollar were the commodity miners, who saw their revenue priced in US dollars while their costs largely remained in Australian dollars. Australian companies with a large US presence have also benefitted from this, including Amcor and Brambles, Woodside, CSL, ResMed and QBE Insurance.

Tariffs were frequently posed to management teams in February with a global presence or operations in the USA. However, most Australian companies selling goods or services in the USA should not have a major impact as their manufacturing facilities are generally close to their customers. For example, CSL collects plasma via its network of collection centres scattered throughout the USA, which is then converted into biotherapies at a plant in Illinois. Similarly, Amcor tend to locate their packaging plants close to their US-based customers such as Unilever, Nestle, Novartis and Pepsi, as shipping empty PET drink bottles across borders makes little economic sense.

The main loser from tariffs is likely to be Rio Tino, which will have a 25% tariff on their aluminium from Canada, acquired in their 2007 takeover of Canada's Alcan. Rio mines bauxite in Australia and Brazil, which is then refined into alumina and aluminium in Canada to take advantage of low hydroelectric power costs, and the finished aluminium is sent to customers in the USA.

Breville currently derives half of its sales from the United States, and most of its manufacturing plants are in China, which currently has a 20% tariff on its goods. Explosive manufacturer Orica has a large manufacturing plant in Canada, sourcing cheap natural gas in Alberta to service blasting customers in the USA. The company's Canadian-made ammonia nitrate will now have tariffs placed on it. Conversely, rival Dyno Nobel (Incitec Pivot) may enjoy a sales boost courtesy of Orica from their cheaper explosives produced in Wyoming and Louisiana.

Commonwealth Bank provides a good look through the economy during reporting season, with Australia's largest bank holding over 17 million customer accounts. Consequently, the banks' financial results and accompanying 172-page reporting suite give investors an insight into the health of the various sectors of the economy. CBA showed minimal bad debts and rising dividends but also that higher interest rates had differing impacts across their customer base. While discretionary spending had been cut back along with savings for customers between 20 and 54, older customers above 55 had increased spending and savings.

Insurers continue to have their best results season since the GFC as they enjoy higher premiums, lower claims inflation, lower adverse weather events, and sound investment returns. Suncorp expects gross written premiums to increase by low-mid double digits and margins from inflation moderations. Similarly, QBE expects its gross written premium to increase by mid-single digits over the coming year while benefiting from subsiding cost inflation.

During reporting season, Atlas looks closely at company dividends, particularly the direction of dividends. While our investors appreciate income, the rationale for looking closely at dividends is that increasing dividends is a sign of earnings quality. Our view is that talk and guidance from management can often be cheap, and company CFOs can use accounting tricks to manipulate reported earnings. However, paying out higher dividends tends to signify that "insiders, " company directors, don't see any imminent negative issues.

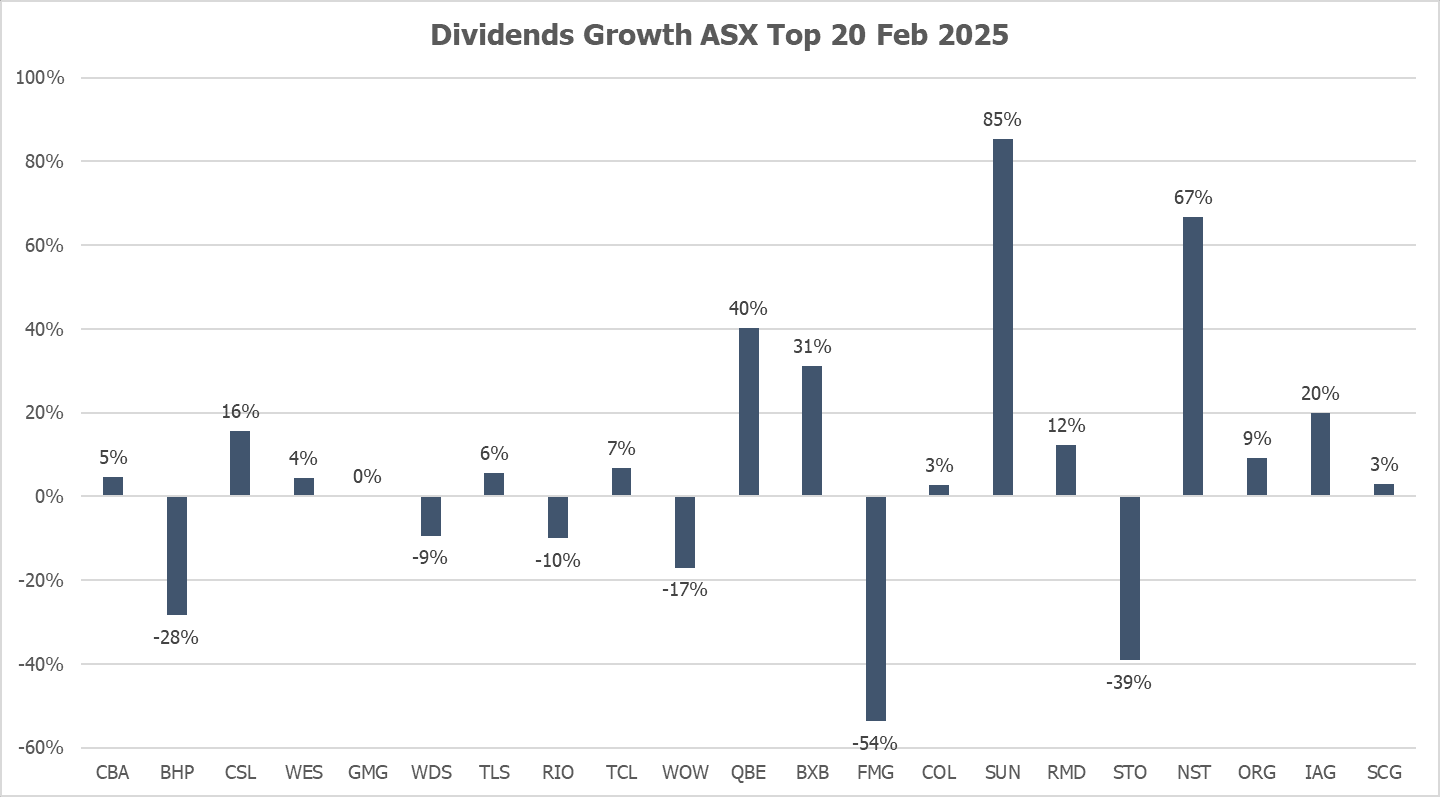

Looking across the top 20 stocks (that reported the other banks having different financial year-ends), the weighted average dividend increase was 0%. The five companies that reduced their dividends, BHP, RIO, Woolworths, Woodside, and Santos, saw weaker commodity pricing.

On the positive side of the ledger, Suncorp, QBE, Northern Star, and Brambles offset the cuts, posting solid increases in cash flows to their shareholders. Across the wider ASX 200, dividends declined by -6% in February.

Over the month, A2 Milk, Computershare, Fletcher Building, Eagers Automotive, and NIB Insurance delivered the best results. Despite the uncertain economic environment, especially around the softening of consumers, these companies were able to grow sales and expand gross margins along with providing optimistic outlooks.

Looking on the negative side of the ledger, Mineral Resources, Viva Energy, Reece, and WiseTech reported poorly received results by the markets. The common themes amongst this group were lower commodity prices (Mineral Resources and Viva Energy) and weaker-than-expected outlooks for higher PE companies (WiseTech and Reece).

Before the February 2025 reporting season, everyone expected that the insurers would have strong financial results, benefitting from slowing claims inflation and higher investment returns on their billion-dollar investment floats. This saw record profits from QBE Insurance and Suncorp, but none better than Medibank Private's results. Medibank continues to grow profits and market share in the Australia Private Health market, which has benefitted from higher premiums, higher uptake of short-stay hospitals and claims inflation slowing. During February, the government approved an average 3.73% increase in health insurance premiums ahead of cost increases. These strong results were achieved while simultaneously returning $1.6 billion to customers through their commitment not to benefit or profit from the pandemic. This is a great outcome that will help Medibank continue growing its market share and benefit the brand and stakeholders.

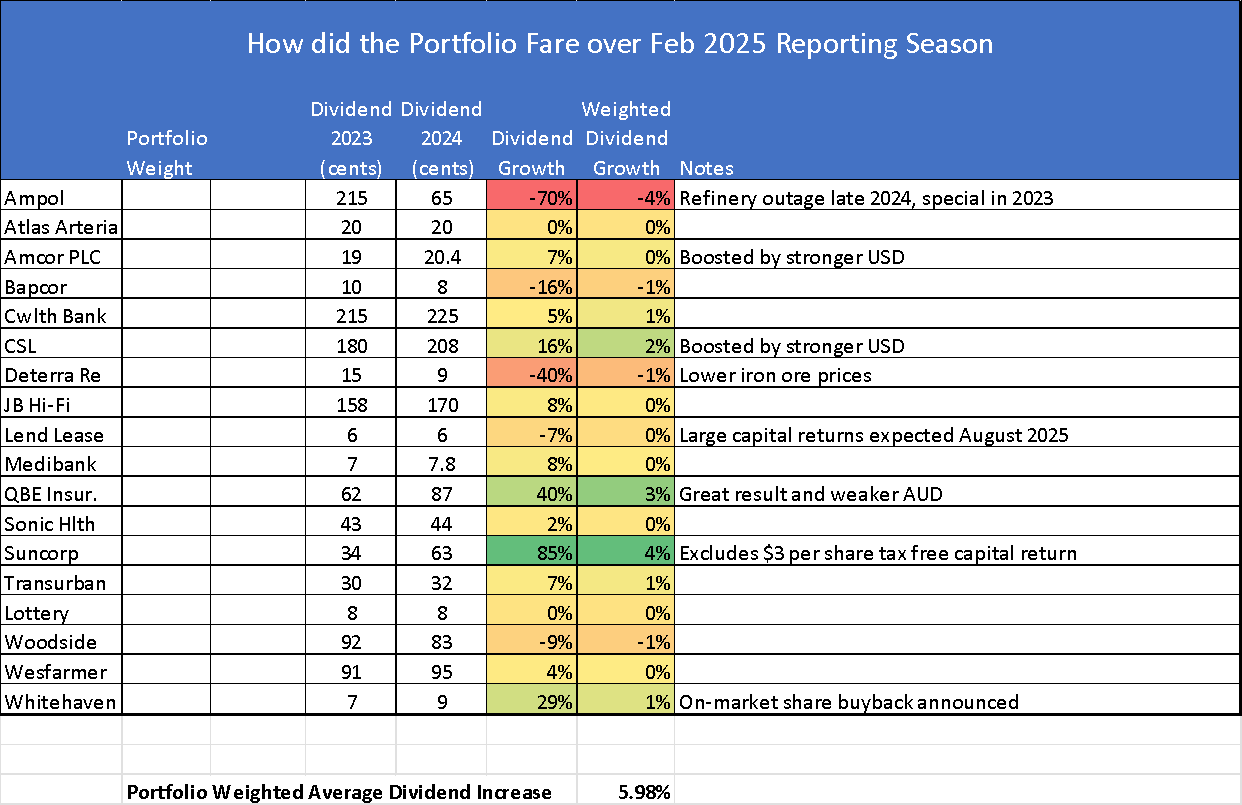

Overall, we are reasonably pleased with the results from the reporting season for the Atlas Portfolio. In general, the companies in our Portfolio were able to increase earnings and dividends, with some reporting record dividends in a more challenging economic environment.

As a long-term investor focused on delivering income to investors, we look closely at the dividends paid out by our companies and whether they are growing. After every reporting season, Atlas looks to "weigh" the dividends that our investors will receive. While share prices move every second between the hours of 10 am and 4 pm, dictated by changing market emotions, ultimately, the sole reason for buying a share is to access a share of the company's profits paid in the form of dividends.

Indeed, in the February reporting season, we saw several companies, such as NIB and Woolworths, give optimistic outlooks, while cutting dividends. This sends a mixed message to investors, and we would prefer to follow the cash rather than the words! Using a weighted average across the Portfolio, our investor's dividends will be +6% greater than the previous period in 2024, and significantly ahead of the 0% dividend growth seen in the top 20 Australian companies that reported and the -6% decline across the wider ASX.

The Portfolio's dividend increase was also ahead of inflation, which was 2.4% over the period, thus maintaining purchasing power for investors who fund their retirement off income. Based on this measure Atlas are pleased with the results from the February 2025 reporting season.